In evaluating the public tax records of Compact for America (CFA), FOAVC will provide copies of all public tax records available. FOAVC will discuss claims made by CFA in those tax records by comparing those statements with federal tax law and other resources as appropriate. In some instances concerns FOAVC has regarding the tax form in question may be so obvious that no resources are required to justify the inquiry. In raising questions FOAVC does not suggest any violation of federal tax law by Compact for America or any of its officers or members has occurred. The absence of a particular tax form, for example, may be easily explained by the fact federal tax law does not require release of that information to the public. The answer may therefore be the particular organization in question filed the proper information with the IRS but chose not to release that fact to the public.

If, as a consequence of failure to provide complete public information however, conclusions are drawn or questions raised about the financial information of Compact for America, FOAVC believes the blame must attach to CFA. If this organization does not wish questions raised by the public about their finances it is their responsibility to provide complete answers. If the complete answers are not provided by Compact for America the American people have the right to draw such conclusions as the incomplete information dictates. This is particularly true in the case of Compact for America which purports its officers "serve as public officials" at the "direction" of the Compact for a Balanced Budget Commission" which it asserts is a "governmental body."

The American public have the right to question the actions of public officials and to examine expenditures of governmental funds by a "governmental body." Public officials are even more accountable to the public than tax-exempt organizations. If, as a consequence of Compact for America stating the Commission is a "governmental body," CFA opens the door to a higher level of scrutiny by the public in regards to its finances and other activities as they relate to federal tax law or other law relating governmental bodies then this is the choice of Compact for America and it is they that must bear the responsibility for that choice.

FOAVC Concerns Regarding CFA Income Tax Returns and other Information

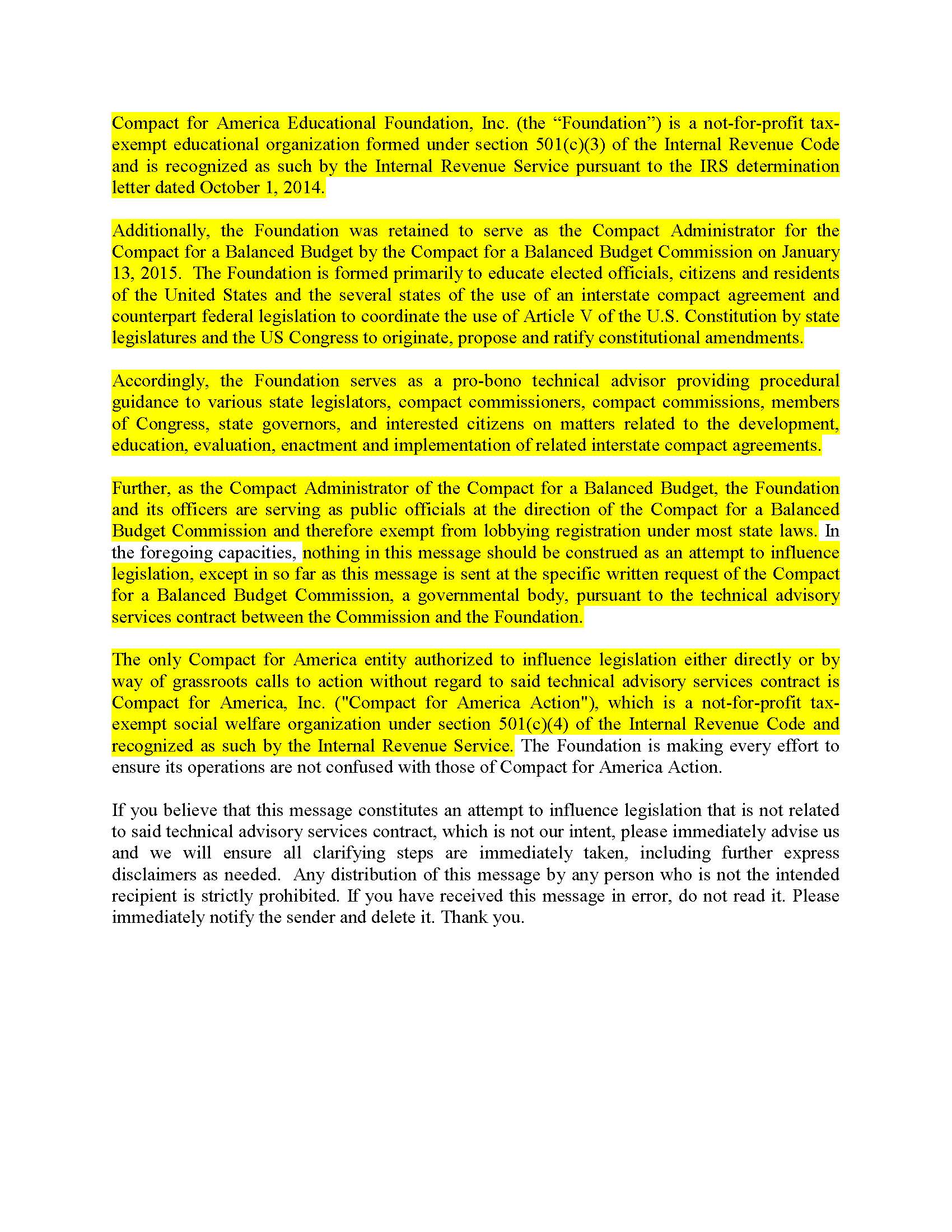

In the case of Compact for America, FOAVC has concerns related

to statements made by the organization that their officers serve as

"public officials" and that the Compact for America Education Founders,

Inc. (referred to by CFA as the "Foundation") serves as a "pro-bono

technical advisor" retained by the "Compact Administrator for the

Compact for a Balanced Budget by the Compact for a Balanced Budget

Commission." These statements are contained in the email response by

Chip DeMoss III of Compact for America and appear to be part of the

format of the email meaning that the statement is sent with every email

transmitted by Mr. DeMoss. FOAVC has copied the statement from the

email and presents it unedited except for breaking it into more

readable paragraphs (click image left to enlarge).

In the case of Compact for America, FOAVC has concerns related

to statements made by the organization that their officers serve as

"public officials" and that the Compact for America Education Founders,

Inc. (referred to by CFA as the "Foundation") serves as a "pro-bono

technical advisor" retained by the "Compact Administrator for the

Compact for a Balanced Budget by the Compact for a Balanced Budget

Commission." These statements are contained in the email response by

Chip DeMoss III of Compact for America and appear to be part of the

format of the email meaning that the statement is sent with every email

transmitted by Mr. DeMoss. FOAVC has copied the statement from the

email and presents it unedited except for breaking it into more

readable paragraphs (click image left to enlarge).FOAVC has questions regarding tax filings by CFA which, based on the available public record from CFA, when compared to federal tax law requirements simply do not add up. Primarily our questions concern the fact certain public records regarding Compact For America appear not to exist when by law they should. FOAVC cautions asking questions does not imply wrongdoing on the part of Compact for America. Information not available for public inspection in the form of letters from the IRS, for example, provisions of the tax law, or other similar circumstances may easily explain the questions raised by FOAVC.

FOAVC has questions regarding the organization known as "Compact for America, Inc." which filed tax-exempt tax returns for the tax years 2012, 2013 and 2014. CFA provides no information regarding the organization known as Compact for America Inc. Yet the tax records that are available establish a direct link between that organization and members of the "Foundation." The title of Compact for America Inc. indicates it is a corporation. However without public certification or incorporation paperwork it is impossible to state if Compact for America Inc., is an actual corporation as no public record of its incorporation have been located.

CFA(Action) Lacks Required Paperwork

According to a statement published on its website Compact for America Inc., appears to have been renamed "Compact for America--Action." CFA states Compact for America--Action is a 501(c)(4) tax exempt organization incorporated in the state of Texas. FOAVC has been unable to locate the public records proving incorporation and they are not provided on the CFA website. Unlike the Compact for America Education Foundation Inc., Compact for America has not been as forthcoming with the public tax records required by law to be available for inspection regarding Compact for America Inc,(Action).

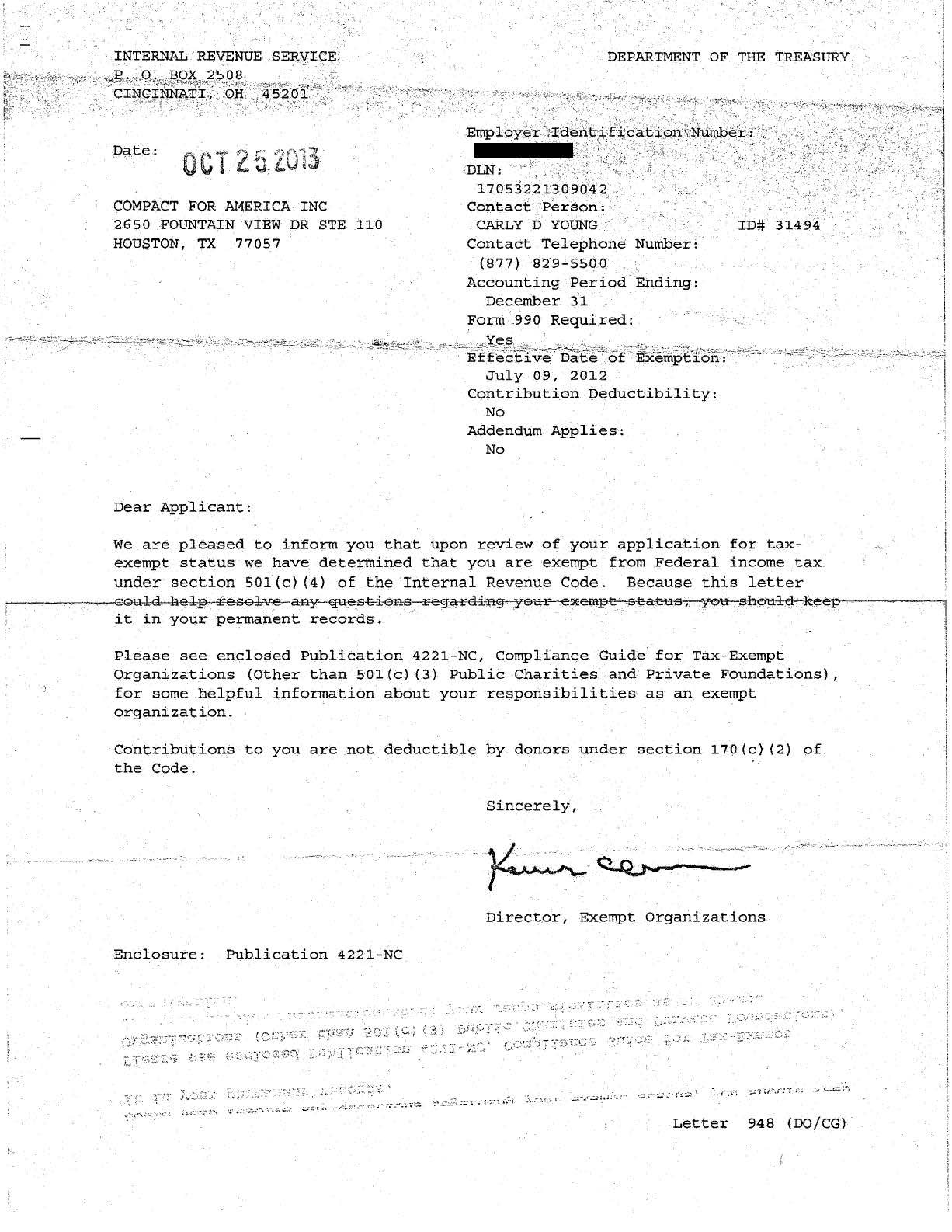

CFA

has published an approval letter from the IRS dated October 25, 2013

proving the 501(c)(4) status but to date has not published other

required tax forms regarding CFA(Action) (click image right to enlarge).

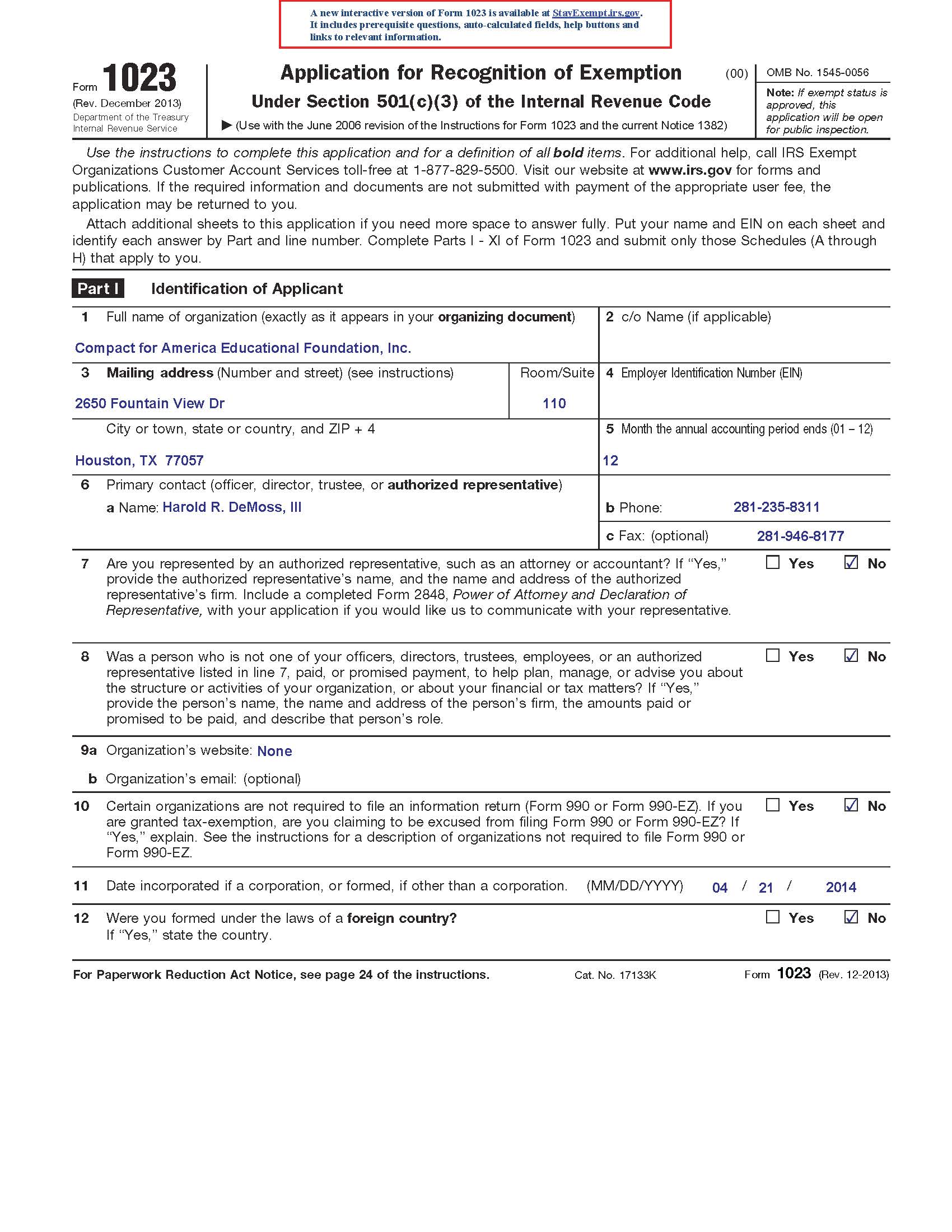

Under federal tax law an organization is required to undergo

an entirely different application process in order to receive 501(c)(4)

exemption starting with the filing of a completely different form (1024)

instead of the form (Form 1023) used

to determine 501(c)(3) status. Under

federal law, Form 1023 and Form 1024 becomes public record upon

approval of 501(c)(4) status by the Internal Revenue Service. The 1024

form for Compact for America(Action) has not been published by CFA on

its website and was not furnished to FOAVC when it requested Compact

for America provide "all" public tax records of Compact for America.

Other than publishing the IRS letter of approval CFA has provided no

other tax records required by law to be available for public

inspection. The IRS imposes penalties on organizations which fail to

provide public inspection tax records on request.

CFA

has published an approval letter from the IRS dated October 25, 2013

proving the 501(c)(4) status but to date has not published other

required tax forms regarding CFA(Action) (click image right to enlarge).

Under federal tax law an organization is required to undergo

an entirely different application process in order to receive 501(c)(4)

exemption starting with the filing of a completely different form (1024)

instead of the form (Form 1023) used

to determine 501(c)(3) status. Under

federal law, Form 1023 and Form 1024 becomes public record upon

approval of 501(c)(4) status by the Internal Revenue Service. The 1024

form for Compact for America(Action) has not been published by CFA on

its website and was not furnished to FOAVC when it requested Compact

for America provide "all" public tax records of Compact for America.

Other than publishing the IRS letter of approval CFA has provided no

other tax records required by law to be available for public

inspection. The IRS imposes penalties on organizations which fail to

provide public inspection tax records on request.FOAVC asks: Where are the other tax forms regarding CFA (Action) required to be available for public inspection?

A statement on the Compact for America Action page reads as follows: "Compact for America Education Foundation, Inc. (the "Educational Foundation" is a not-for-profit tax-exempt educational organization formed under section 501(c)(3) of the Internal Revenue Code and is recognized as such by the Internal Revenue Service pursuant to the IRS determination letter dated October 1, 2014. Additionally, the Educational Foundation was retained to serve as the Compact Administrator for the Compact for a Balanced Budget by the Compact for a Balanced Budget Commission on January 13, 2015 pursuant to a technical services agreement. The only Compact for America entity authorized to influence legislation either directly or by way of grassroots calls to action without regard to said technical advisory services contract is Compact for America, Inc. ("Compact for America Action"), which is a not-for-profit tax-exempt social welfare organization under section 501(c)(4) of the Internal Revenue Code and recognized as such by the Internal Revenue Service. [Emphasis Added]. The Educational Foundation is making every effort to ensure its operations are not confused with those of Compact for America Action."

CFA Education and CFA Action--Same Address

While

CitizenAudit.org (a website dedicated to making all public tax records

available for public inspection) lists Compact for

America Inc.,(Action),

there are no records of tax filings and other public records are routinely published on that site about

similar tax-exempt organizations (click image left to enlarge). CitizenAudit.org therefore provides

no proof of

public record that Compact for America(Action) while existing,

is actually a viable organization. Further there was no record, as far as FOAVC could determine, showing

Compact for America Inc.(Action) as being listed on the IRS website

showing tax exempt organizations despite the publication of an IRS approval letter on the CFA website.

While

CitizenAudit.org (a website dedicated to making all public tax records

available for public inspection) lists Compact for

America Inc.,(Action),

there are no records of tax filings and other public records are routinely published on that site about

similar tax-exempt organizations (click image left to enlarge). CitizenAudit.org therefore provides

no proof of

public record that Compact for America(Action) while existing,

is actually a viable organization. Further there was no record, as far as FOAVC could determine, showing

Compact for America Inc.(Action) as being listed on the IRS website

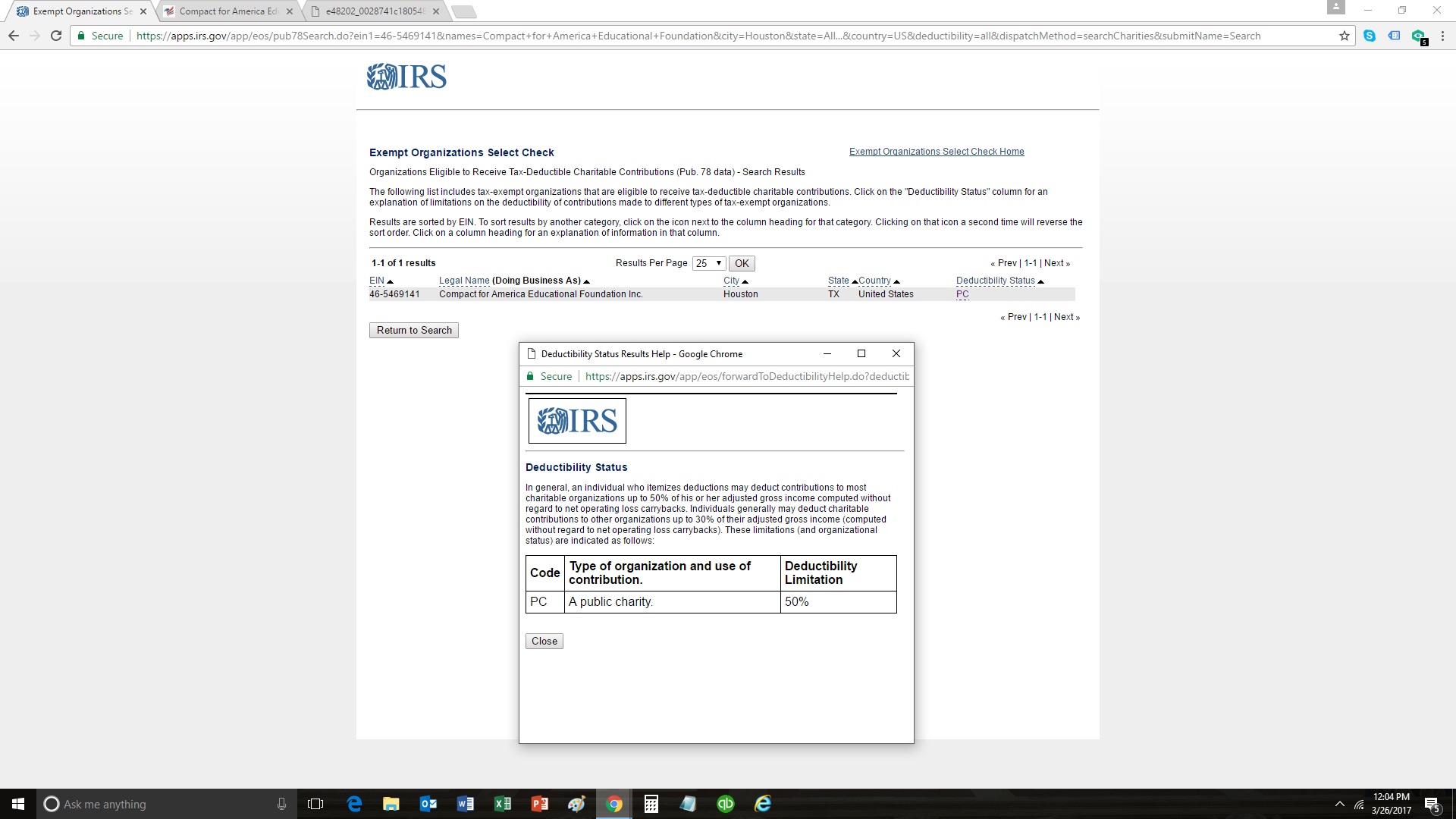

showing tax exempt organizations despite the publication of an IRS approval letter on the CFA website.  FOAVC raised the question to Compact for America regarding the lack of

proof regarding Compact for America--Action and was ultimately

sent a copy of a web page via email (later independently verified)

showing

the IRS record for Compact for America Educational Foundation, Inc.

A copy of the IRS database was sent

to FOAVC by Nick Dranias showing only a record for Compact for America

Educational Foundation Inc.

No corresponding database record for Compact for America(Action) was

furnished by CFA. If there are two organizations, there

should have been two IRS web pages listing two separate tax-exempt

organizations. CFA only produced evidence on the IRS database of one organization.

FOAVC raised the question to Compact for America regarding the lack of

proof regarding Compact for America--Action and was ultimately

sent a copy of a web page via email (later independently verified)

showing

the IRS record for Compact for America Educational Foundation, Inc.

A copy of the IRS database was sent

to FOAVC by Nick Dranias showing only a record for Compact for America

Educational Foundation Inc.

No corresponding database record for Compact for America(Action) was

furnished by CFA. If there are two organizations, there

should have been two IRS web pages listing two separate tax-exempt

organizations. CFA only produced evidence on the IRS database of one organization.

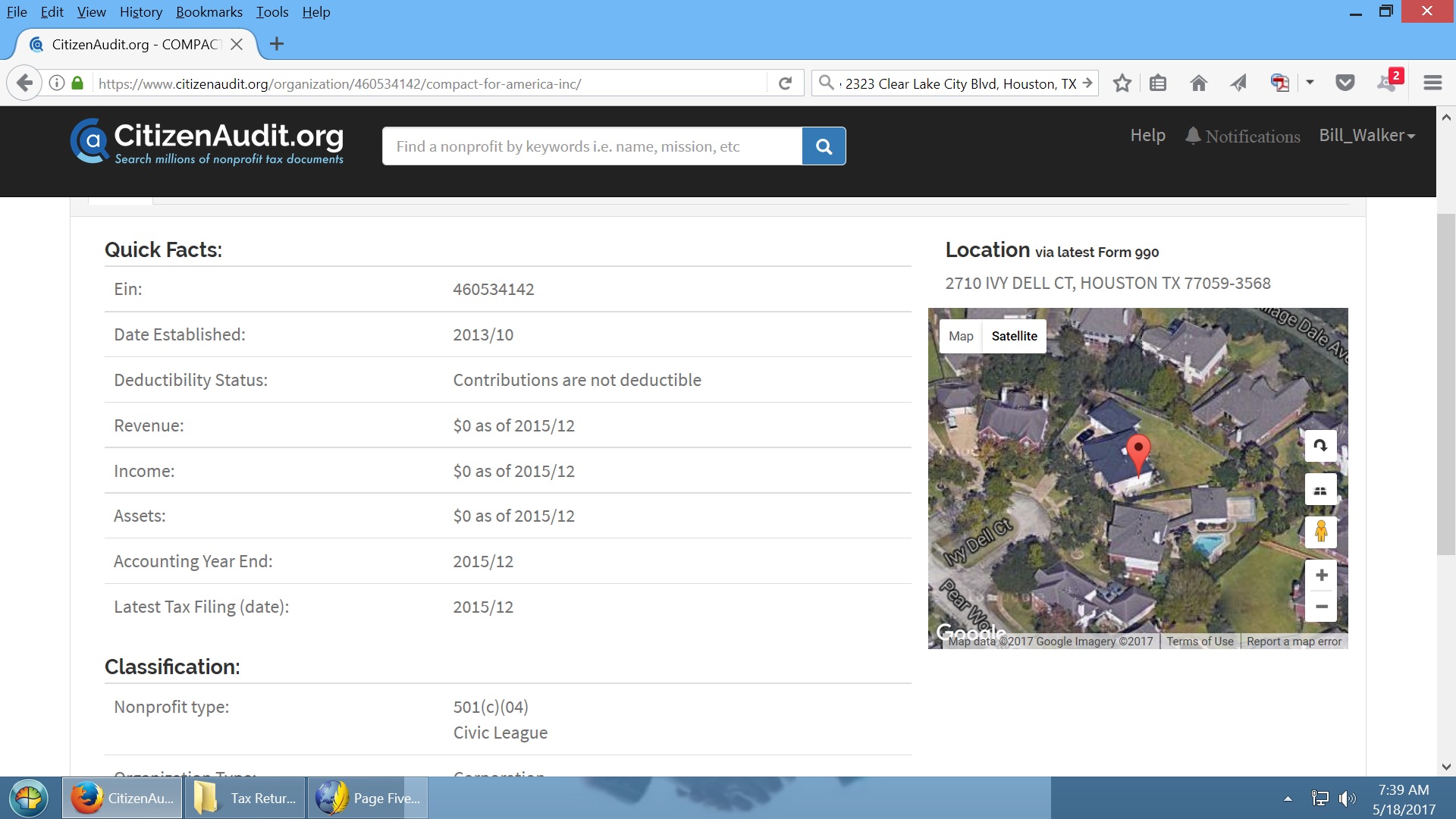

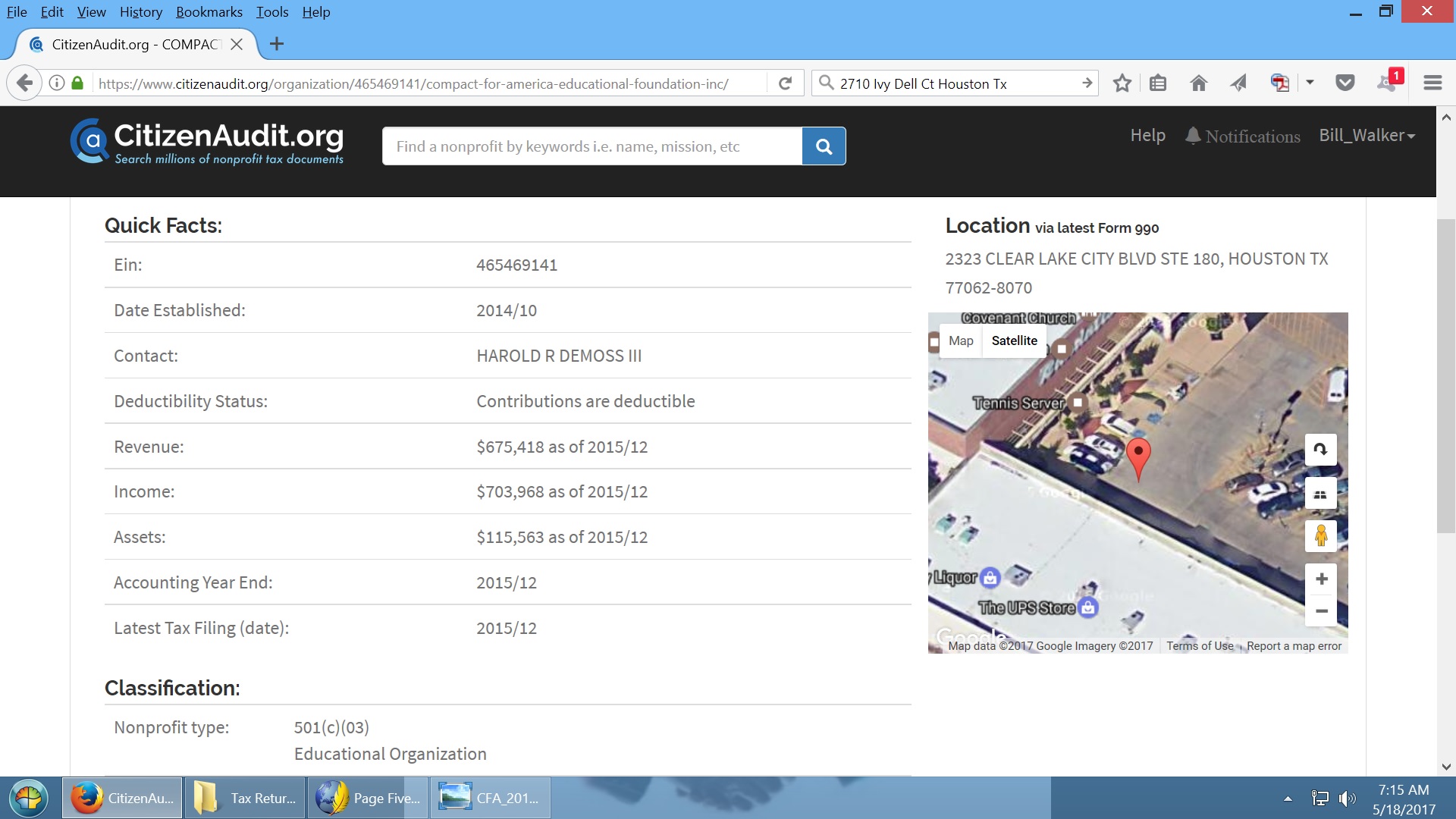

According

to the CitizenAudit.org website (click image left to enlarge) Compact

for

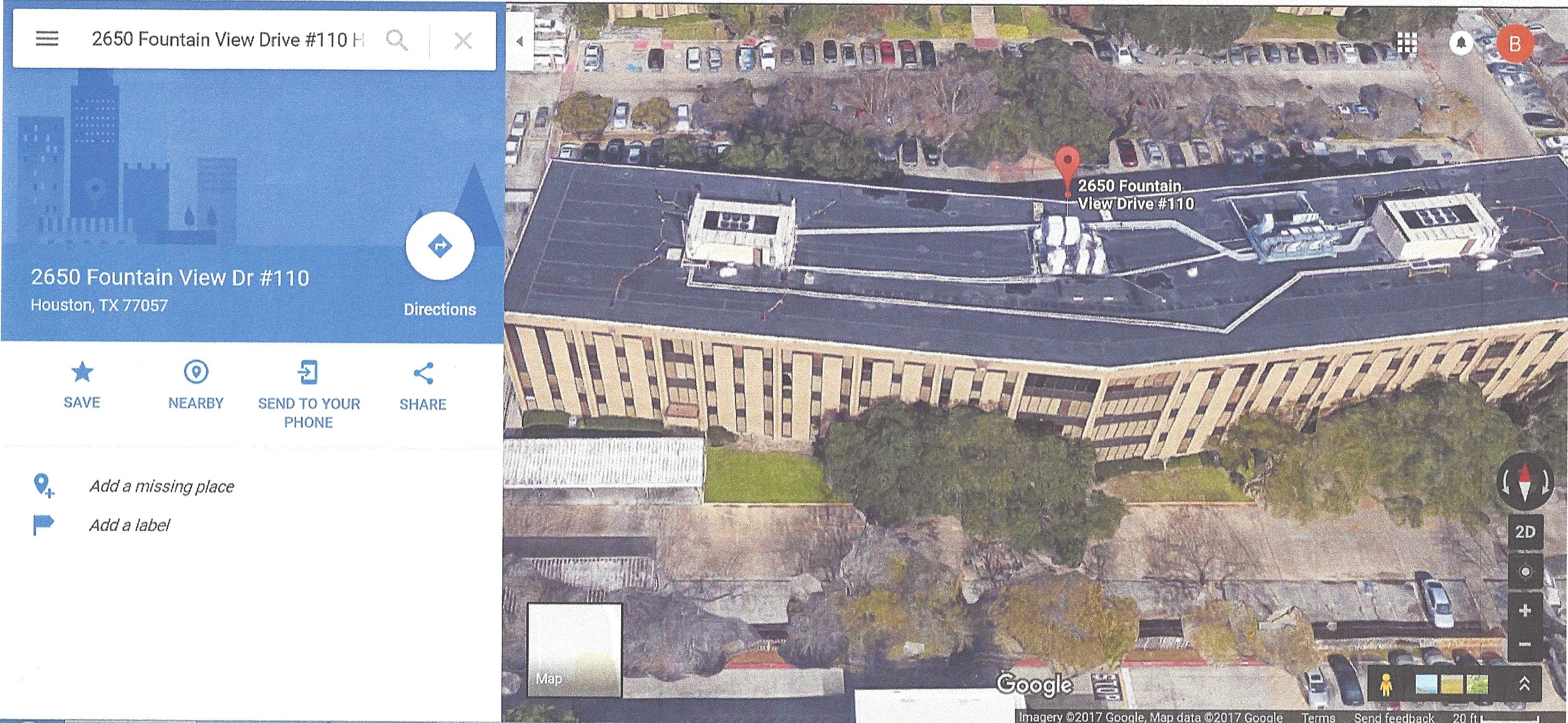

America Inc., which originally listed its address in 2012 and 2013 tax

returns as 2650 Fountain View Dr, Ste 110, Houston, TX, 77057 has since

moved to 2710 Ivy Dell Ct., Houston, TX 77059-3568.

The address 2650 Fountain View Dr., Ste 110, Houston, TX, 77057 is the

address of Tanglewood Capital Partners LLC (click image left to

enlarge.) According to the best information available the

firm is located in an office building in the Houston area. Tanglewood

Capital Partners LLC specializes in corporate financial advice, has

an annual revenue of $350,000 and a staff of approximately five.

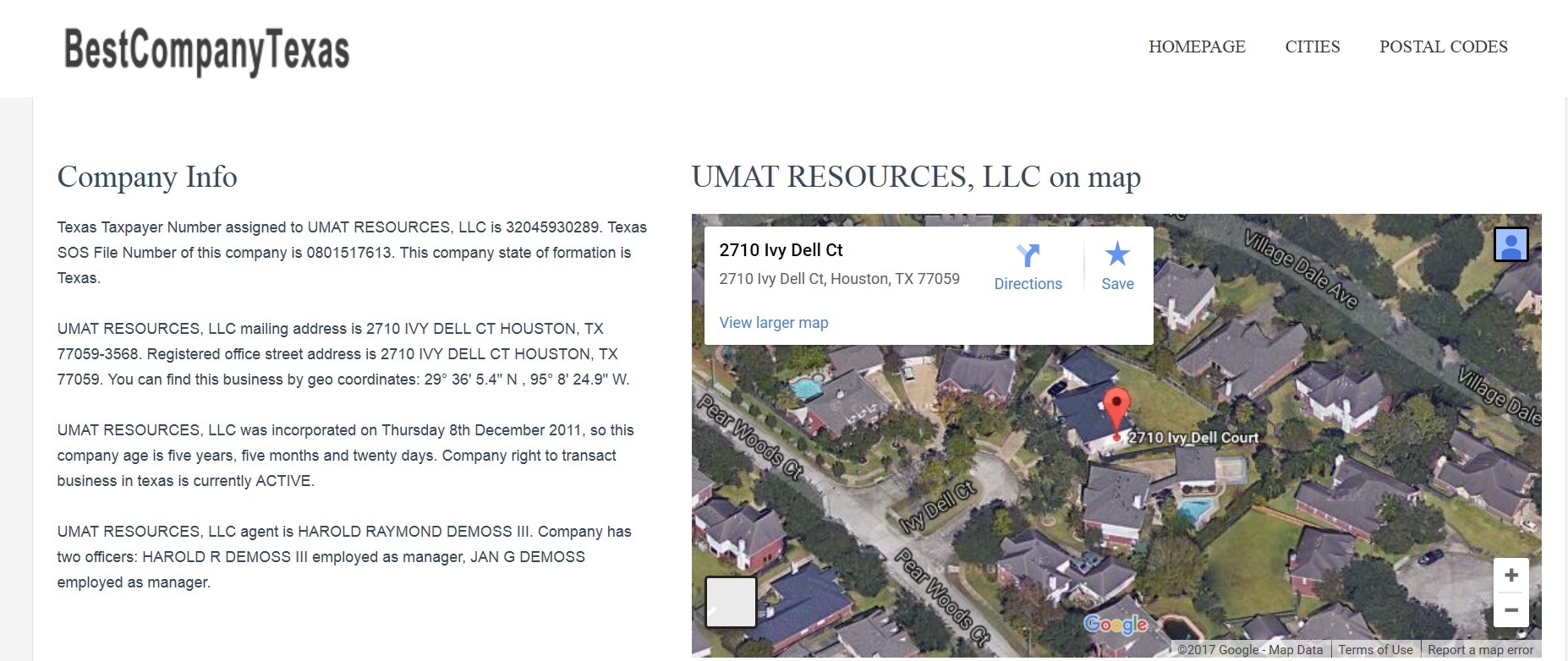

Chip

DeMoss states in his CFA information he is a managing director at

Tanglewood. Information obtained by FOAVC shows DeMoss also "controls"

UMAT Resources Limited, LLC whose address is listed as 2710 Ivy Dell

Ct, Houston, TX, 77059-3568 (click image right to enlarge).

According

to the CitizenAudit.org website (click image left to enlarge) Compact

for

America Inc., which originally listed its address in 2012 and 2013 tax

returns as 2650 Fountain View Dr, Ste 110, Houston, TX, 77057 has since

moved to 2710 Ivy Dell Ct., Houston, TX 77059-3568.

The address 2650 Fountain View Dr., Ste 110, Houston, TX, 77057 is the

address of Tanglewood Capital Partners LLC (click image left to

enlarge.) According to the best information available the

firm is located in an office building in the Houston area. Tanglewood

Capital Partners LLC specializes in corporate financial advice, has

an annual revenue of $350,000 and a staff of approximately five.

Chip

DeMoss states in his CFA information he is a managing director at

Tanglewood. Information obtained by FOAVC shows DeMoss also "controls"

UMAT Resources Limited, LLC whose address is listed as 2710 Ivy Dell

Ct, Houston, TX, 77059-3568 (click image right to enlarge).

Others

listed as officers or directors of Compact for America Inc.,(Action)

include Nick Dranias and Jeff Utsch who list their employment

references on the CFA website. Dranias is the founder of Nick Dranias

Law & Policy Analysis LLC which, according to the best information available, is located at 15025 S. 8th St., Phoenix, AZ, 85048 (click image left to enlarge). Jeff Utsch is CEO of Tucson Acquisition & Development Corp

located at 6141 N. Pomona Rd, Tucson, AZ, 85704 (click image right to

enlarge). Both addresses appear to be single family residences.

Others

listed as officers or directors of Compact for America Inc.,(Action)

include Nick Dranias and Jeff Utsch who list their employment

references on the CFA website. Dranias is the founder of Nick Dranias

Law & Policy Analysis LLC which, according to the best information available, is located at 15025 S. 8th St., Phoenix, AZ, 85048 (click image left to enlarge). Jeff Utsch is CEO of Tucson Acquisition & Development Corp

located at 6141 N. Pomona Rd, Tucson, AZ, 85704 (click image right to

enlarge). Both addresses appear to be single family residences. According to the best information available the address 2710 Ivy Dell Ct., Houston, TX 77059-3568 is a single family

residence occupied by "J....Gott" and "H...DeMoss" together with

several family members.

Further, as shown by CitizenAudit.org (click image right to enlarge)

the address of Compact for America Educational Foundation Inc. listed

as 2323 Clear Lake City Blvd, Ste 180, Houston TX, 77062-8070 is the address of a local UPS Store. Ste 180 is not an office suite but instead is a UPS mailing

box.

According to the best information available the address 2710 Ivy Dell Ct., Houston, TX 77059-3568 is a single family

residence occupied by "J....Gott" and "H...DeMoss" together with

several family members.

Further, as shown by CitizenAudit.org (click image right to enlarge)

the address of Compact for America Educational Foundation Inc. listed

as 2323 Clear Lake City Blvd, Ste 180, Houston TX, 77062-8070 is the address of a local UPS Store. Ste 180 is not an office suite but instead is a UPS mailing

box. The CFA independent audit reports (discussed in more detail below) attempt to make it appear the two organizations, Compact for America Educational Foundation Inc., and Compact for America Inc.,(Action) are separate organizations but fail to mention both organizations are run out of the same Houston Texas household. It is not unreasonable to postulate the only real "separation" which exists between Compact for America Educational Foundation Inc., and Compact for America Inc.,(Action) is the records for each organization are kept in two separate files inside the same filing cabinet in the home office space of the same household. Statements in both independent audit reports support this allegation: "The Foundation currently operates rent free from facilities and using office equipment owned by the members of the Foundation's executive management. The accompanying financial statements do not include expense or contributions related to this arrangement." (See page 10, 2014 report and page 10, 2015 report). Based on all available evidence it appears Compact for America Inc.,(Action) and Compact for America Educational Foundation, Inc., despite declarations of separation by CFA, are in fact managed and controlled in the same single family residence and therefore are separate in name only.

Does CFA(Action) Actually Exist?

FOAVC finds it significant that according to the CitizenAudit.org web page the revenue, income and assets for Compact for America Inc.,(Action) are listed as "zero." Yet, as discussed below independent audits conducted by Compact for America Education Foundation Inc. show that Compact for America Inc., (Action) sent $600 to the Compact for America Educational Foundation, Inc. FOAVC asks: With no assets, income or revenue for Compact for America Inc.,(Action) where did this money come from? FOAVC also asks: How can Compact for America Inc.,(Action) carry out its supposed "independent" lobbying activities when it has no financial resources whatsoever to do so?

Organizational Details of Compact for America

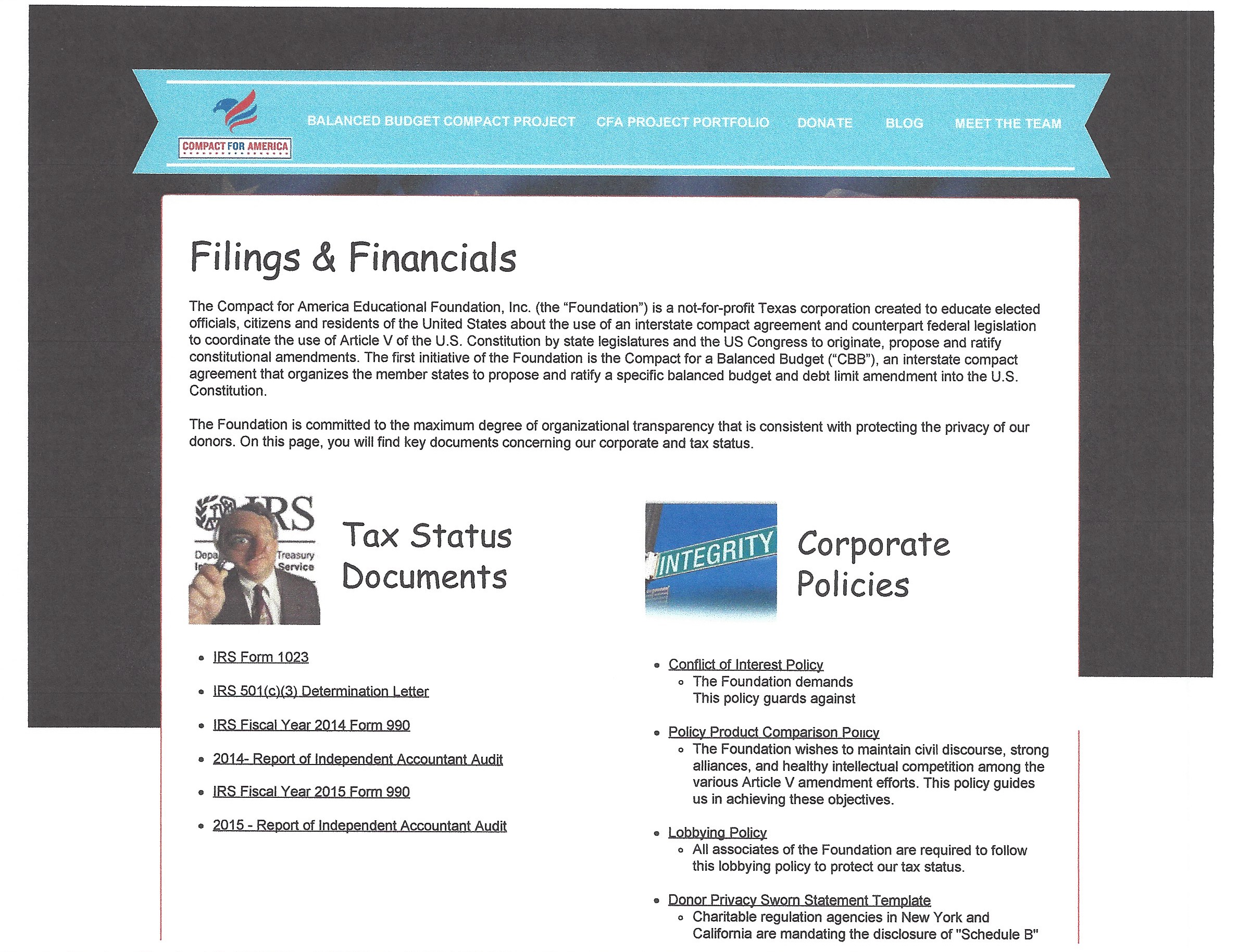

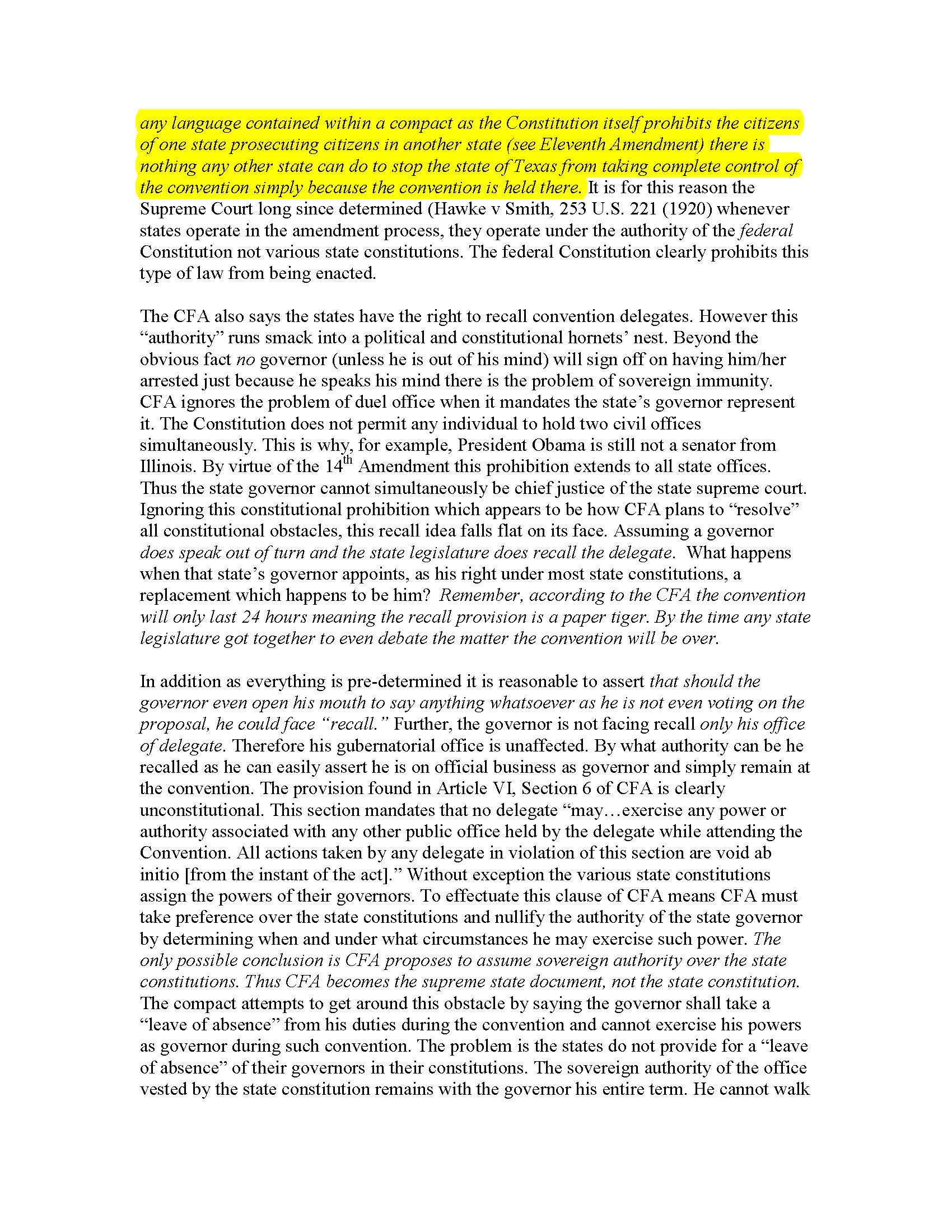

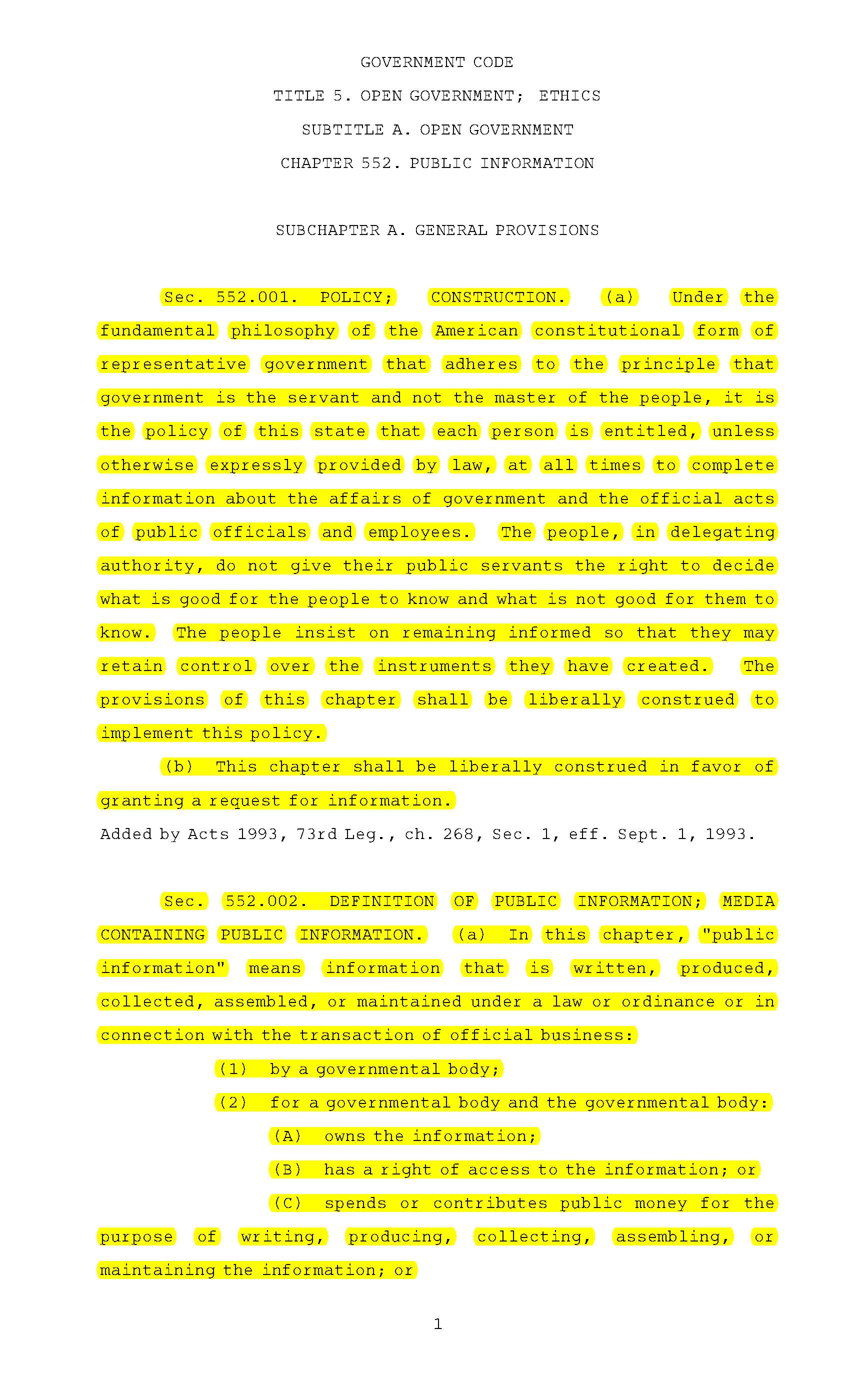

This

section will present all publications available dealing with

the organizational structure of Compact for America. The source of

these publication is the Compact for America website. As is our usual

policy

FOAVC

will provide unedited copies of all CFA documents but may highlight

certain

sections for reference and discussion. The CFA website page dealing

with financial information may be accessed by clicking the image at the

left.

This

section will present all publications available dealing with

the organizational structure of Compact for America. The source of

these publication is the Compact for America website. As is our usual

policy

FOAVC

will provide unedited copies of all CFA documents but may highlight

certain

sections for reference and discussion. The CFA website page dealing

with financial information may be accessed by clicking the image at the

left.Compact for America Corporation Papers and By-Laws

According

to records provided by Compact for America, the Compact for America

Educational Foundation Inc., referred to as the "Foundation" in its

corporate papers was incorporated in the State of Texas as a Domestic

Nonprofit Corporation on April 21, 2014 under file number 801974610 by

Texas Secretary of State Nandita Berry (click image right to enlarge).

According

to records provided by Compact for America, the Compact for America

Educational Foundation Inc., referred to as the "Foundation" in its

corporate papers was incorporated in the State of Texas as a Domestic

Nonprofit Corporation on April 21, 2014 under file number 801974610 by

Texas Secretary of State Nandita Berry (click image right to enlarge). Based on the public information available Compact for America Inc.,(Action) and Compact for American Educational Foundation Inc. appear to be the same organization. There is no corresponding corporate papers for Compact for America Inc., (Action) so far as FOAVC can determine. No corresponding corporate paperwork appears on the CFA website. The "Foundation" was formally incorporated in 2014 but it appears, so far as public record can determine, to be only a superficial name change from the original Compact for America, Inc. Despite the differences in names, all operational functions of the two organization appear to be simultaneous, that is, operating as a single organization.

Harold DeMoss is listed as CEO on all tax forms for both organizations. As discussed above the actual operations of the two organizations are supervised at the same address, the residence of "H...DeMoss." The reasons for Compact for America not providing the same information about Compact for America Inc.,(Action) (incorporation papers, certification of filing, list of officers, by-laws and so forth) as it has for the "Foundation" are unclear. All information provided by Compact for America on its website appear only to relate to the "Educational Foundation." There are no similar records relating to Compact for America Inc.,(Action) on the CFA website.

Based on the information signed by

CFA Corporate Secretary Keven R.C. Gutzman the Compact for America

Educational Foundation Inc., by-laws were originally signed on April

24, 2014 and later amended on October 24, 2014 (see page 8). Unlike the Constitution

which presents amendments separately the CFA by-laws were simply

rewritten in include any amendments. There is no way to determine what

text was amended or why it was amended. FOAVC provides a copy of

the CFA by-laws as posted on the CFA website (click image left to

enlarge). We have highlighted certain passages which we believe may

interest the public. Comments and discussion of the highlighted

portions will be referenced according to the page numbers of the

by-laws. There

is nothing in the by-laws of the "Foundation" stating it is a separate

organization from Compact for America Inc.,(Action) nor is there any

section devoted to Compact for America Inc.,(Action). CFA has not

published similar by-laws, internal regulations or similar material for

Compact for America, Inc.,(Action) thus leading to the conclusion

if such an organization exists, it exists in name only.

Based on the information signed by

CFA Corporate Secretary Keven R.C. Gutzman the Compact for America

Educational Foundation Inc., by-laws were originally signed on April

24, 2014 and later amended on October 24, 2014 (see page 8). Unlike the Constitution

which presents amendments separately the CFA by-laws were simply

rewritten in include any amendments. There is no way to determine what

text was amended or why it was amended. FOAVC provides a copy of

the CFA by-laws as posted on the CFA website (click image left to

enlarge). We have highlighted certain passages which we believe may

interest the public. Comments and discussion of the highlighted

portions will be referenced according to the page numbers of the

by-laws. There

is nothing in the by-laws of the "Foundation" stating it is a separate

organization from Compact for America Inc.,(Action) nor is there any

section devoted to Compact for America Inc.,(Action). CFA has not

published similar by-laws, internal regulations or similar material for

Compact for America, Inc.,(Action) thus leading to the conclusion

if such an organization exists, it exists in name only.The Question of "Education" Versus "Influence"

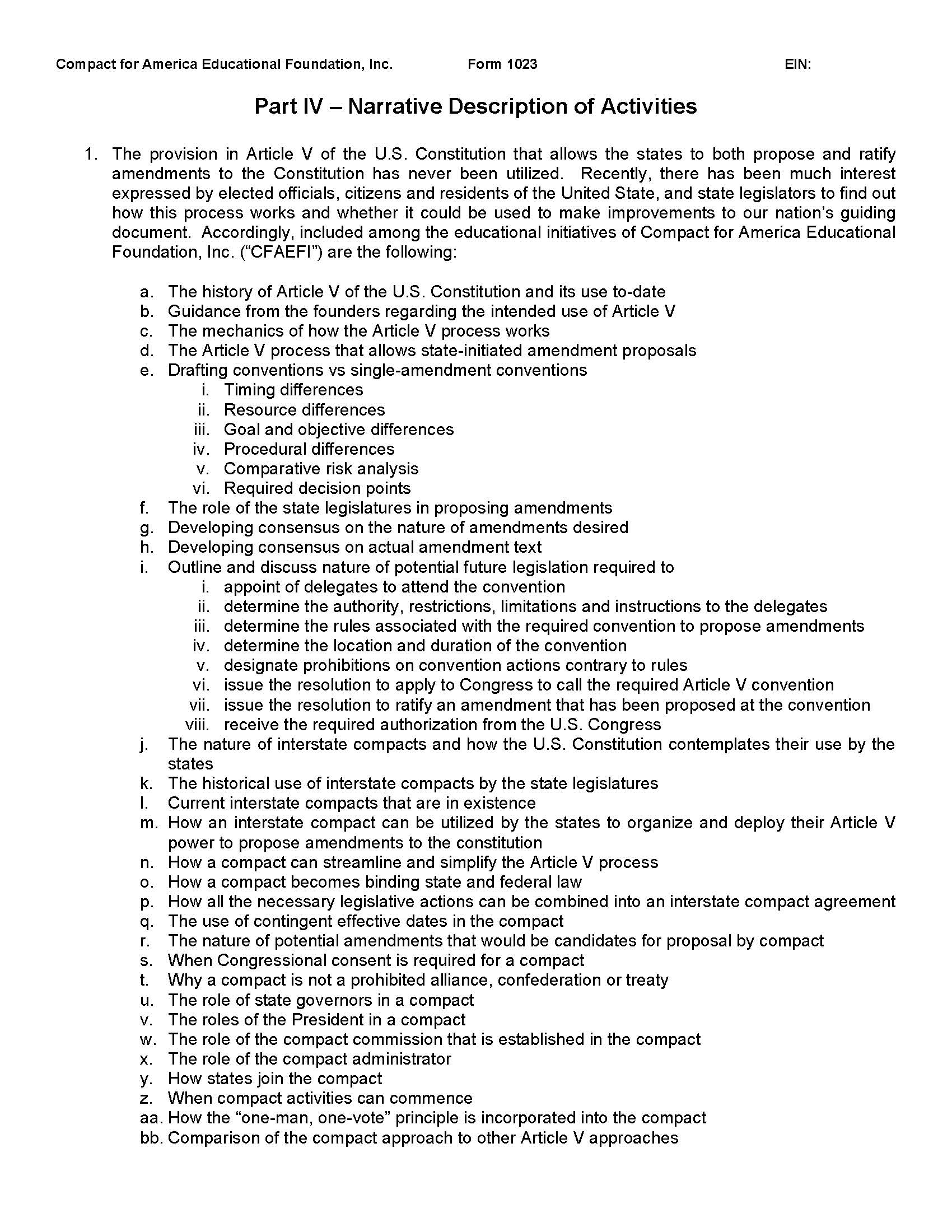

The most important clause in the CFA by-laws is on page 1, second paragraph. This clause states, "no substantial part of the activities of the corporation shall be the carrying on of propaganda, or otherwise attempting to influence legislation..." According to the requirements of the Constitution and federal law as well as Supreme Court rulings, the creation of a compact consists of nothing but passage of legislation by Congress and the states creating the compact. It is impossible to create a state compact without passage of legislation at both the federal and state level.

Therefore any effort (educational or otherwise) to create this particular form of compact (the first attempt in United States history) must be viewed as "attempting to influence legislation." This proposed form of amendment process has been created solely, exclusively and entirely by the organization known as Compact for America Inc. Whether the Internal Revenue Service would agree in this particular case, because of the unique nature of the compact sought by Compact for America and requirements of law which mandate nothing but passage of legislation that "education" and "influence" are, in fact, simultaneous, would of course be up to the IRS to determine.

Nevertheless FOAVC asks: how can Compact for America originate an entirely new form of compact law never existing in the history of the United States and not be attempting to influence legislation required to bring about the creation of this new form of compact law when no other option exists to accomplish that purpose except enactment of state and federal legislation creating this new form of compact law?

CFA Board of Directors

By-laws of Compact for America place total control of the organization in a "board of directors." (See page 2). Despite the fact the compact proposed by CFA influences the lives of every American with the passage of a proposed amendment by means of an entirely new amendment process, there is no provision in the by-laws for public input to influence any decision by this board of directors. FOAVC planned to present a pdf copy of the CFA page showing the CFA team (as the CFA web page phrases it). However it appears the page may be infected with a virus as attempts to download the page caused alerts from our virus protection software. FOAVC therefore provides the link to the CFA page instead: http://www.compactforamerica.org/meet-team. According to the by-laws (page 4) "any number of offices may be held by the same person." Thus, while the page shows several persons as members of the "team" as it is possible for one or two individuals to hold several titles within the organization, meaning only a few individuals may actually be involved in the day to day operations of Compact for America.

CFA Advisors--Just Window Dressing

On team page of the Compact for America website, CFA makes a emphasis on its "advisory" team members referred to as a "steering committee" in the by-laws (see pages 5-6). However closer examination of provisions in the by-laws reveals that, like the American people, these "advisors" have no real input in Compact for America. The by-laws state, "The sole function of the Steering Committee...shall be to advise and make non-binding recommendations to the Board of Directors within the areas of their respective experiences and expertise. In rendering advice to the Board of Directors, the Steering Committee shall have no obligation to conduct any individual research or investigation and shall be entitled to rely solely and exclusively upon the facts and information available to it at the time of the making of its recommendations, including, but not limited to, such facts and information as may be provided to the Steering Committee by the Corporation." [Emphasis added].

In sum, the CFA by-laws mandate any statements by any member of the CFA "steering committee" are not based on their own opinion or research but what they instructed to say by the Foundation board of directors. Any statement made by any member of the "steering committee" are therefore not statements made by the person himself based on his own independent thinking, but statements made by him as instructed by Compact for America. Therefore any reference by CFA to these "steering committee" statements really means CFA cites itself as its own reference of authority. FOAVC asks: As CFA by-laws forbid outside independent research or investigation of any CFA statement has any independent research or investigation of any "educational" information stated by CFA actually ever been conducted to verify the statements by Compact for America as valid, credible and accurate?

CFA Indemnification Policy

Compact for America by-laws contain a very extensive provision (see page 7-8) indemnifying the board of directors from any personal liability for "any action or omission of the Corporation." The inducement of indemnification is so central to officers and directors of Compact for America that CFA states in its by-laws indemnification from liability it is the major reason anyone has joined the organization at all. "The Corporation acknowledges that the foregoing indemnification is a material inducement to the officers and directors to serve in their capacities as such, and that such officers and directors would not agree to serve in the absence of the foregoing indemnification." With such obvious emphasis on indemnification and the fact Compact for America admits no one will serve in any capacity in Compact for America unless they are indemnified, FOAVC asks: why does Compact for America feel it must indemnify its directors and officers? According to their by-laws all CFA is attempting to do is "educate." What is it these officers and directors fear will occur to them if, as they say, all they are attempting to do is "educate" people?

Compact for America Conflict of Interest Policy

As

with many organizations, Compact for America has a financial conflict

of interest policy. The policy, (click image left to enlarge) deals

primarily with financial conflicts of interest between members of the

board of directors of Compact for America and "any entity with which

the Foundation has a transaction or arrangement...a compensation

arrangement [or] a potential ownership or investment interest in, or

compensation arrangement with, any entity or individual with which the

Foundation is negotiating a transaction or arrangement. (see page 1).

The Conflict of Interest Policy does not appear to apply to the general

membership of Compact for America. The policy calls for periodic

reviews of "activities that could jeopardize its [the Foundation's]

tax-exempt status.

As

with many organizations, Compact for America has a financial conflict

of interest policy. The policy, (click image left to enlarge) deals

primarily with financial conflicts of interest between members of the

board of directors of Compact for America and "any entity with which

the Foundation has a transaction or arrangement...a compensation

arrangement [or] a potential ownership or investment interest in, or

compensation arrangement with, any entity or individual with which the

Foundation is negotiating a transaction or arrangement. (see page 1).

The Conflict of Interest Policy does not appear to apply to the general

membership of Compact for America. The policy calls for periodic

reviews of "activities that could jeopardize its [the Foundation's]

tax-exempt status. Compact for America Independent Audits

According to the CFA Conflict of Interest Policy audit reviews are to include ("at the minimum") two subjects: "(a) Whether compensation arrangements and benefits are reasonable based on competent survey information, and the result of arm's length bargaining; and (b) whether partnerships, joint ventures, and arrangements with management organization conform to the Foundation's written policies, are properly record, reflect reasonable investment or payments for goods and services, further charitable purposes and do not result in inurement, impermissible private benefit or in an excess of benefit transaction." (See page 3).

As of May, 2017 Compact for America has published two independent audits both conducted by Ham, Langston & Brezina LLP, Certified Pubic Accountants, 11550 Fuqua, Suite 475, Houston, Texas 77034. Compact for America lists its address as 2323 Clear Lake Blvd., Suite 180-190, Houston, Texas, 77062, a UPS mailing box. The two addresses are located just over a mile from each other. Examination of Better Business Bureau records shows the firm of Ham, Langston & Brezina LLP, founded in 1996, to have an A+ rating with no complaints filed against it.

Despite the fact at least five states have passed legislation joining the Compact for a Balanced Budget there is no record of any member state conducting an independent audit of Compact for America Foundation, Inc., Compact for America(Action), or the Compact for a Balanced Budget Commission. Audit laws which appear to apply to either the Commission or Compact for America include Arizona, Alaska, Georgia and North Dakota. A specific decision to whether the laws are applicable would have to be made by state authorities.

Ham, Langston & Brezina first audit of Compact for America Foundation, released June 29, 2015, covered the time period from the inception of Compact for America Foundation

on April 21, 2014 to December 31, 2014. No reference is made to Compact for America (Action). The audit described the

financial position of COS as of December 31, 2014 as well as providing

a statement of activities of COS from April 21, 2014 to December 31,

2014 and a statement of cash flow for the same time period (Click image

left to enlarge).

Ham, Langston & Brezina first audit of Compact for America Foundation, released June 29, 2015, covered the time period from the inception of Compact for America Foundation

on April 21, 2014 to December 31, 2014. No reference is made to Compact for America (Action). The audit described the

financial position of COS as of December 31, 2014 as well as providing

a statement of activities of COS from April 21, 2014 to December 31,

2014 and a statement of cash flow for the same time period (Click image

left to enlarge).  The

second audit, released August 16, 2016, covered the financial position

of Convention of States (Foundation) for December 31, 2015 and 2014 also showed the state of activities for the year ending December 31, 2015 and

for the "Period from Inception, April 21, 2014 to December 31, 2014."

The statement of cash flows similarly covered the year ending December

31, 2015 and

"for the

Period from Inception, April 21, 2014 to December 31, 2014." (Click

image right to enlarge). This is a common auditing practice allowing

the

reader to compare sequential financial periods of an organization.

The

second audit, released August 16, 2016, covered the financial position

of Convention of States (Foundation) for December 31, 2015 and 2014 also showed the state of activities for the year ending December 31, 2015 and

for the "Period from Inception, April 21, 2014 to December 31, 2014."

The statement of cash flows similarly covered the year ending December

31, 2015 and

"for the

Period from Inception, April 21, 2014 to December 31, 2014." (Click

image right to enlarge). This is a common auditing practice allowing

the

reader to compare sequential financial periods of an organization.

CFA(Action) Lacks Independent Audits

Compact for America has never released any audit by Ham, Langston & Brezina (or any other independent accounting firm) regarding the first two years of CFA (2012-2013) under the name Compact for America Inc. or any audit for any other tax year under the name Compact for America Inc.,(Action).

The lack of public tax records, audits, incorporation papers, by-laws and other documents, many of which are required by law to be publicly available, for the organization labeled by CFA as "Compact for America Inc.,(Action) raise questions not only as to the existence of Compact for America Inc.,(Action) but the credibility of statements by Compact for America of "independence" between the two purported organizations. It is difficult to prove "independence" between two supposed organizations when it is impossible to prove one of the two organizations actually exists as a truly operational entity.

The fact there has not been an independent audit of Compact for America Inc.,(Action) by an organization which otherwise has gone out of its way to present the appearance of integrity indicate: (1) Compact for America does not want anyone snooping around in the financial records of "Compact for America Inc.,(Action) and/or (2) there are no financial records of Compact for America Inc.,(Action) to audit as they do not exist. The fact the only public financial records of Compact for America Inc.,(Action) available indicate Compact for America Inc.,(Action) has zero assets, zero revenue and zero income appear to support both conclusions as being true.

Auditors Refuse to Comment on CFA Audit Standards

The Compact for America Conflict of Interest Policy states that "at the minimum" any audit shall determine (a) "whether compensation agreements are reasonable" and (b) "whether arrangements with management organizations conform to the Foundation's written policies." Despite these requirements the independent auditors hired by Compact for America specifically declined to make any statements regarding effectiveness of what CPA labeled as "the Foundation's internal control[s]." Instead Ham, Langston and Brezina LLP only makes a "qualified audit opinion" stating, "In our opinion the financial statements referred to .... present fairly, in all material respects the financial position of the Foundation ... in conformity with accounting principles generally accepted in the United States of America."

Further, Ham, Langston and Brezina LLP make no mention nor comment on the first requirement of the Compact for America by-laws that an independent audit determine "Whether compensation arrangements and benefits are reasonable based on competent survey information, and the result of arm's length bargaining." There is no evidence or reference in the report "competent survey information" of any description nor any evidence or reference to prove bargaining for compensation was at "arm's length" negotiations. It is unclear whether Compact for America provided the independent auditing firm the required surveys and proof of "arm's length bargaining" needed to make such determination as required in their by-laws. Thus it is unknown whether Ham, Langston and Brezina LLP declined to include that information in their independent audit on their own initiative or simply never was provided the information in the first place by Compact for America.

Most of the comments by the CPA firm deals with the "internal control relevant to the Foundation's preparation and fair presentation of the financial statements that are free from material misstatement, whether due to fraud or error." The term, "fraud or error" is mentioned twice in the CPA report. The comments of the CPA firm are identical in the 2014 and 2015 report.

Ham, Langston and Brezina state, "An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures elected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Foundation's preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Foundation's internal control. Accordingly, we express no such opinion." (See Page 2 of the audit).

As there is no change in language regarding concerns of effectiveness by the CPA firm between the 2014 and 2015 reports it is fairly reasonable to conclude that despite the requirements of its own by-laws that an independent audit address two specific areas of "internal control" no action has been taken by Compact for America to correct the deficiencies causing Ham, Langston and Brezina LLP to decline rendering an audit opinion on the effectiveness of CFA internal controls between the time of the first report (June 29, 2015) and the second report (August 16, 2016).

Perhaps discovering one of the two purported "independent" CFA organizations has zero assets, income and revenue and is controlled in the same single family residence as the other "independent" organization may have a bearing on the decision of Ham, Langston and Brezina not to express an opinion on the "effectiveness of the Foundation's internal control."

Details of the Audits

Massive Contributions, Few Individuals

In the first report covering the period from April 21, 2014 to December 31, 2014 contributions to Compact for America totaled $256,362. Management was paid a total of $44,900 for the purposes of managing and directing Compact for America Inc.,(Action). (See pages 4, 9 of the report). The report notes $600 was advanced from Compact for America Inc.,(Action) (an organization which reports zero assets, zero revenue and zero income) to the Foundation. (See page 5 of the report). "In January, 2015, the Foundation received a major unrestricted cash contribution of $500,000" from only identified as "Donor Number 3." (See page 10 of the report). The report reveals that 59% ($153,817) of the $256,362 in donations received by Compact for America during this period came from two unnamed donors identified as Donor Number 1 and Donor Number 2. Donor Number 1 donated 39% of the total donations ($99,981.18). Donor Number 2 donated 20% of the total donations ($53,835.82). (See page 9 of the report).

In the second report covering the year 2015 (ending December 31, 2015) as well as the period from inception in 2014, the independent audit states a third unnamed donor (Donor Number 3) provided 73% of the contributions received by Compact for America. According to the audit report the two previous donors (Donor Number 1 and Donor Number 2) contributed less than 10 percent of total donations received by CFA in 2015. It is likely the person referred to as "Donor Number 3" in the 2015 audit report was the same person referred to in the 2014 report as donating $500,000 to Compact for America. However the 2015 report lists total contributions as $663,491. Seventy-three percent of $663,491 is $488,728.43 which is not the $500,000 stated in the audit. The audit fails to explain the apparent discrepancy in donation figures when the percentages given are calculated and compared to the reported amounts donated. (See pages 4 and 9 of the report).

Compact for America donor policy encourages secrecy for the express purpose of avoiding state regulations requiring tax-exempt organizations within their jurisdiction reveal the names of donors listed on a Schedule B Tax Form of their 990 income tax return. The Compact for America Financial page provides a Donor Privacy Sworn Statement Template which states, "Charitable regulation agencies in New York and California are mandating the disclosure of "Schedule B" donors by charities seeking contributions within their jurisdiction. Donors who are concerned about maintaining the confidentiality of their gift from such mandatory disclosure should review this template with their legal counsel and consider signing and delivering, after appropriate modifications, to the Foundation."

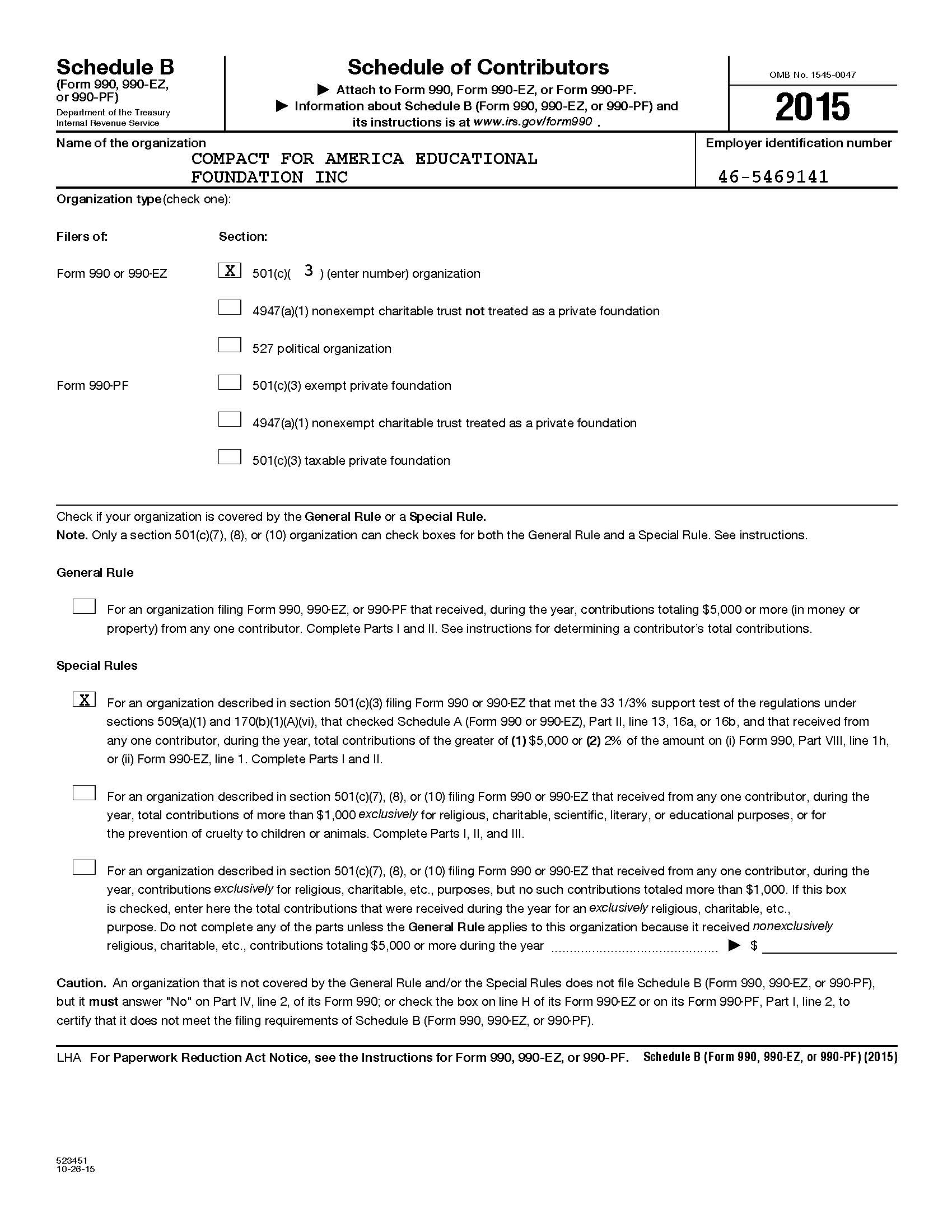

IRS regulations concerning listing names of donors on a Schedule B Tax Form are complex.

Whether a name is listed on the public inspection tax form is

determined by the amount of the donation and other factors described in

the tax form. In 2014 Compact for America Educational Foundation Inc.,

did not file a Schedule B Tax Form but stated in its 2014 audit report

that "Donor Number 1 and Donor Number 2" contributed approximately

$100,000 and $54,000 respectively to Compact for America that year.

Oddly, donations in amounts much less than the figures reported in the 2014 audit appear to have caused CFA to have to file a Schedule B Tax Form

in its 2015 tax return (click on image right to enlarge). CFA does not

provide the names of the donors in its 2015 Schedule B Tax Form.

IRS regulations concerning listing names of donors on a Schedule B Tax Form are complex.

Whether a name is listed on the public inspection tax form is

determined by the amount of the donation and other factors described in

the tax form. In 2014 Compact for America Educational Foundation Inc.,

did not file a Schedule B Tax Form but stated in its 2014 audit report

that "Donor Number 1 and Donor Number 2" contributed approximately

$100,000 and $54,000 respectively to Compact for America that year.

Oddly, donations in amounts much less than the figures reported in the 2014 audit appear to have caused CFA to have to file a Schedule B Tax Form

in its 2015 tax return (click on image right to enlarge). CFA does not

provide the names of the donors in its 2015 Schedule B Tax Form. Donated amounts shown on the 2015 Schedule B Tax Form do not correspond with amounts reported in the CFA 2015 independent audit. The independent audits and income tax forms for CFA were both prepared by the same CPA firm, Ham, Langston and Brezina. The reason for discrepancies is likely due to the fact the IRS sets different standards of reporting than Ham, Langston and Brezina felt was necessary for its own independent audit. Other than asking for general public donations, which for the years 2014-15 totaled $265,853, CFA appears to be an organization closed to the American public. The amount of general pubic donations of what can be described as "small amounts" received by CFA is arrived at by adding the total donations reported for the two years in the audit reports ($919,853) then subtracting donations described in the report by unnamed Donors Number 1,2 and 3 ($654,853). The result is $265,853 spread out over two years.

However, based on the amounts reported in the 2015 Schedule B Tax Form much of $265,853 came from three other unnamed donors. The amount donated by three individuals listed in the 2015 Schedule B Tax Form (not counting the $500,000 donation) totals $95,000. Subtracting this $95,000 from the $265,853 leaves approximately $170,853 in small amount public donations collected by Compact for America Educational Foundation Inc., over a two year period. CFA received approximately $94,998 a year (or approximately $7,900 a month) in small amount public donations. This amount is totally inadequate to support Compact for America based information contained in the independent audits. The approximately $95,000 in general public donations gathered over the year doesn't even cover the $280,900 spent in management compensation for Compact for America for the years 2014-15 (discussed in further detail below).

For all practical financial intents Compact for America Educational Foundation Inc., and Compact for America Inc.,(Action) appear to be supported by six wealthy unnamed individuals. Without the large donations from these six wealthy individuals Compact for America Education Foundation Inc., and Compact for America Inc.,(Action) would, financially speaking, cease to exist.

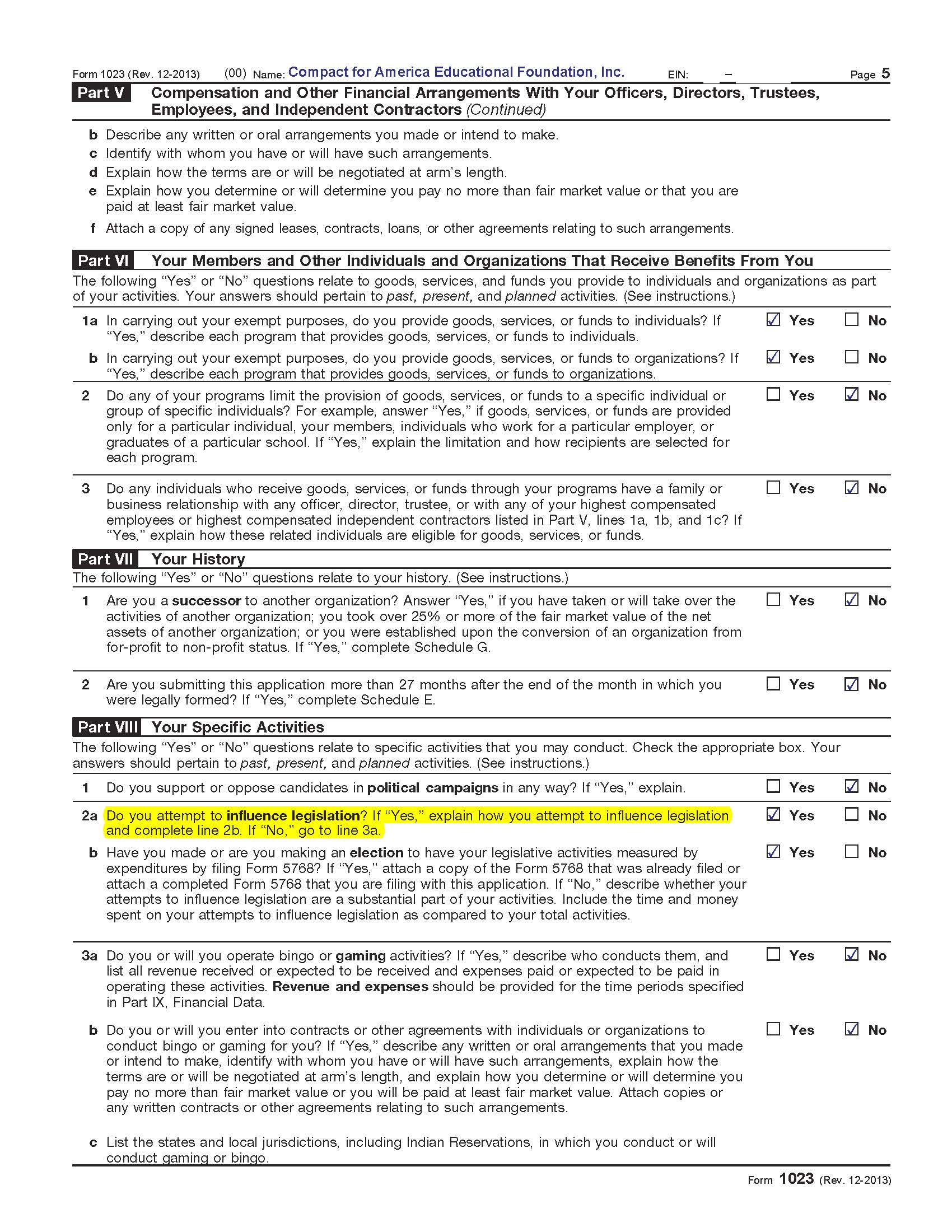

Statement of Limited Influence, Government Exemption

Both reports contain the identical statement, "The Foundation does not participate in any political activities involving the election of federal, state or local candidates for public office. Pursuant to section 501(h) of the Internal Revenue Code, the Foundation has elected to make limited expenditures to influence legislation. Further, in its capacity as the Compact Administer of the Compact for a Balanced Budget, the Foundation and its officers are serving at the direction of the Compact for a Balanced Budget Commission, a recognized interstate agency, and are therefore exempt from lobbying registration under most state laws. Separate and apart from the Foundation, Compact for America, Inc. ("CFA-Action"), a Texas not-for-profit tax-exempt social welfare organization formed under section 501(c)(4) of the Internal Revenue Code and recognized as such by the Internal Revenue Service, has been established to conduct additional lobbying activities to influence legislation related to the Foundation. ... [The] Foundation and CFA-Action are not technically affiliated entities and have officers and members of the board of directors that differ from each other..." (See page 6, 2014 report and page 6, 2015 report of the report).

CFA Management and Director Crossovers

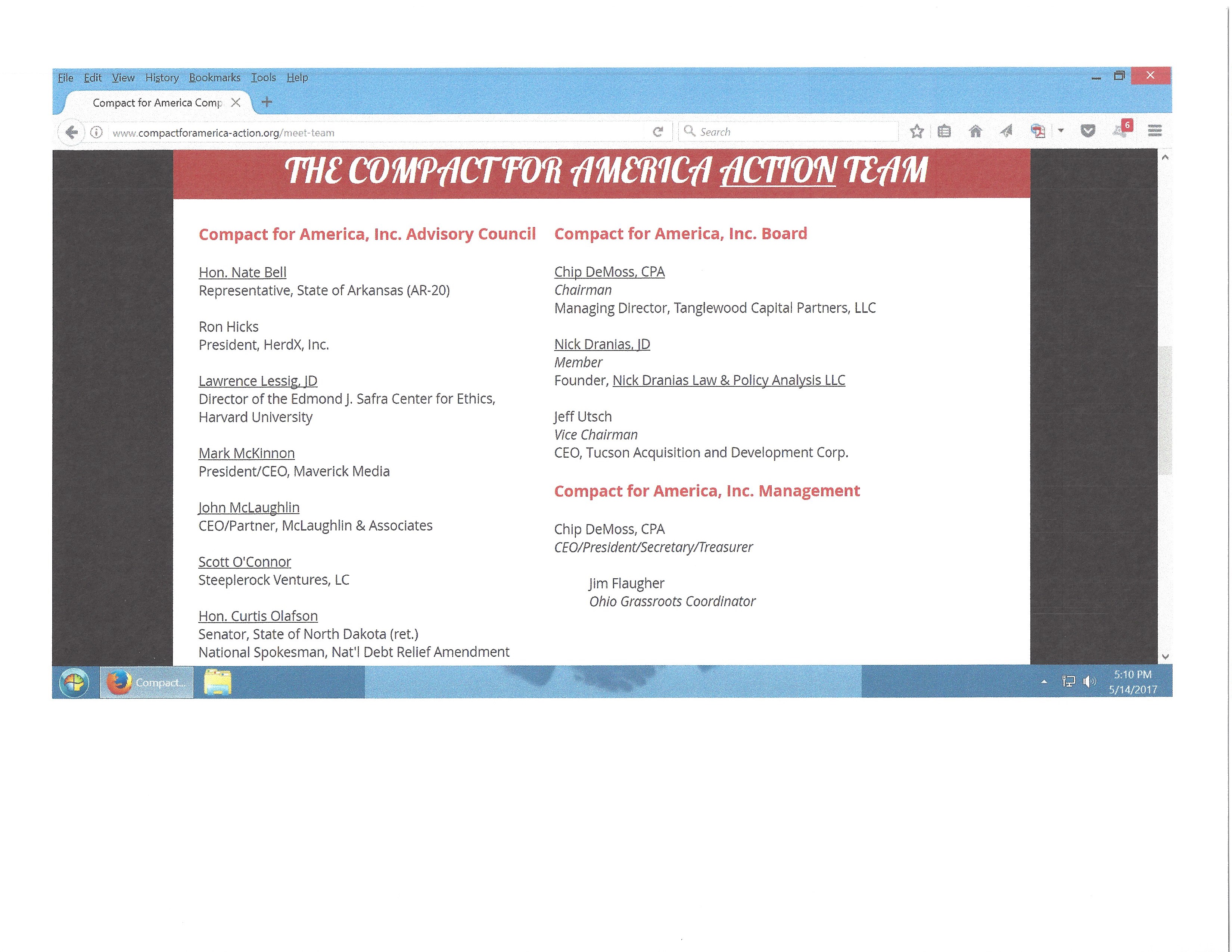

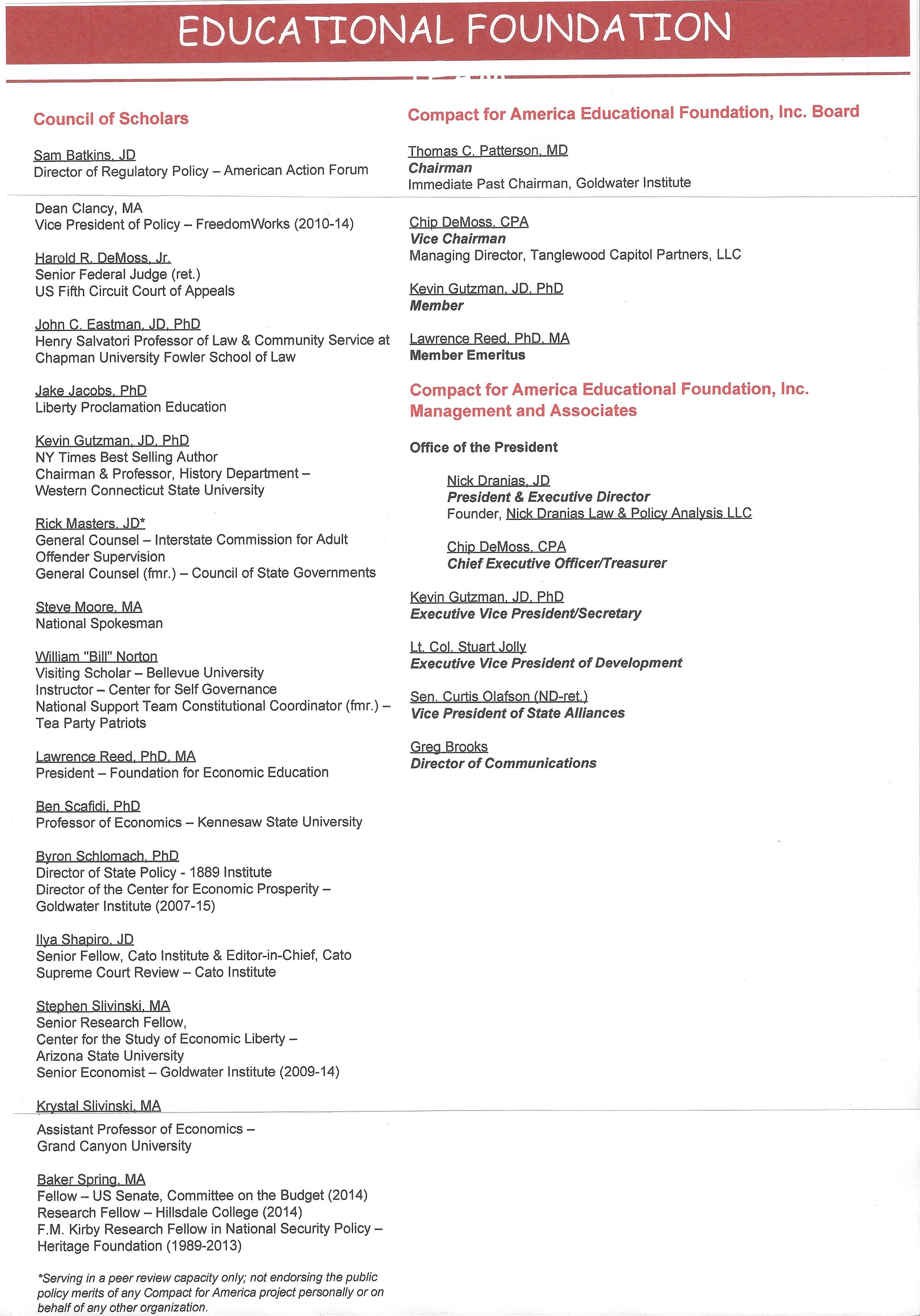

As shown by the screen shot of the Compact for

America Action website (click image left to enlarge), the

statement

made in the financial report relating to technical

affiliation is not entirely accurate. As permitted

under the by-laws of Compact for America Educational Foundation, Inc.

(which, presumably, are also the by-laws for Compact for America

Inc.,(Action) as no other by-laws appear to exist) officers are permitted

to hold several offices simultaneously. The board, management and

advisors of Compact for America Educational Foundation Inc. may be read

by clicking the image right to enlarge.

As shown by the screen shot of the Compact for

America Action website (click image left to enlarge), the

statement

made in the financial report relating to technical

affiliation is not entirely accurate. As permitted

under the by-laws of Compact for America Educational Foundation, Inc.

(which, presumably, are also the by-laws for Compact for America

Inc.,(Action) as no other by-laws appear to exist) officers are permitted

to hold several offices simultaneously. The board, management and

advisors of Compact for America Educational Foundation Inc. may be read

by clicking the image right to enlarge.  The

Compact for America Inc.,(Action) board of

directors

consists of three persons: Chip DeMoss, Nick Dranias and Jeff Utsch.

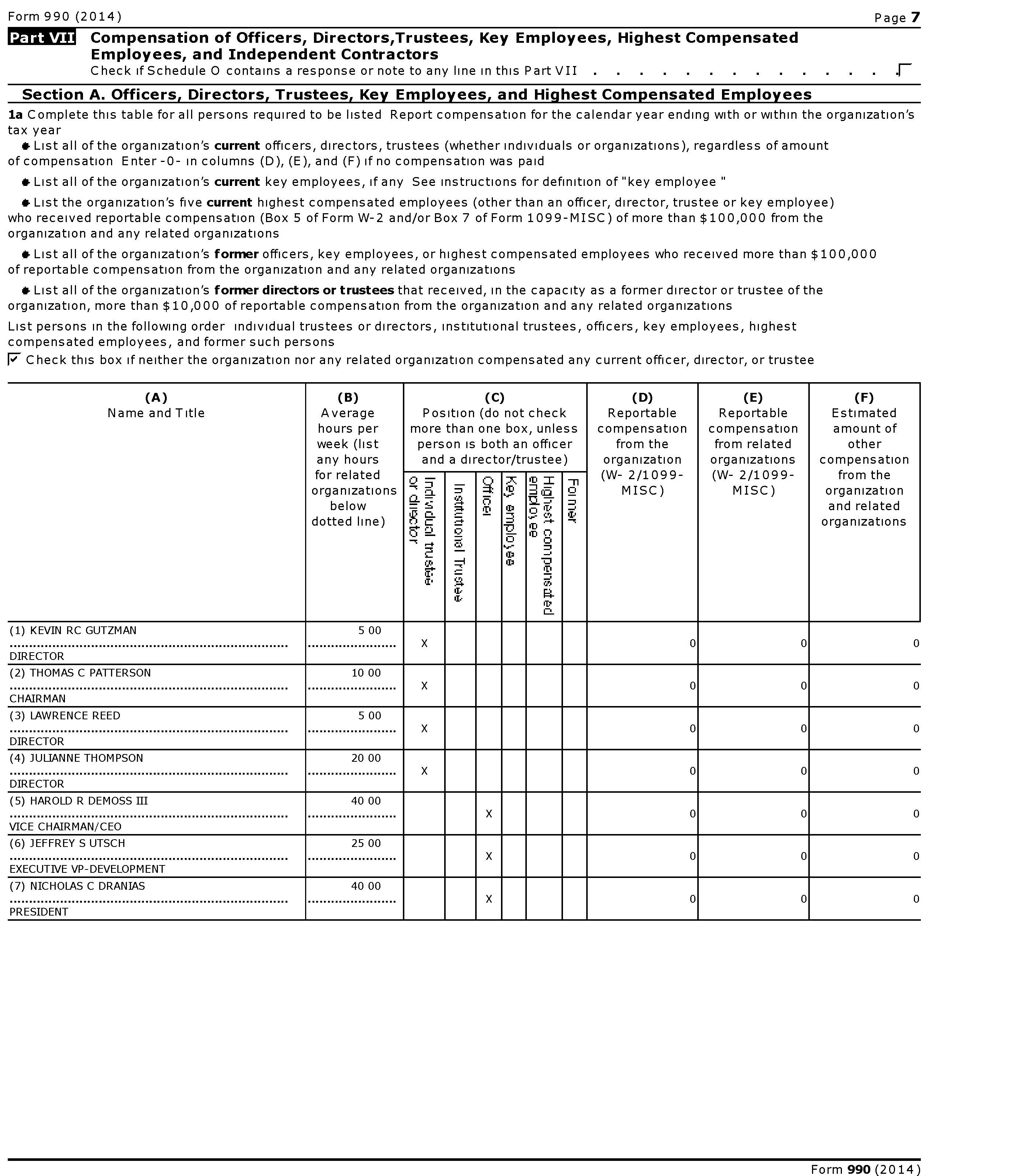

All three individuals are listed in Section A in the 2014 tax return

of Compact for America Educational Foundation Inc. Section A deals with

Officers,

Directors, Trustees, Key Employees and Highest Compensated Employees of

a tax-exempt organization. The three men are also listed as

either a Director, CEO or Vice President of CFA Educational Foundation.

(Click image left to enlarge).

The

Compact for America Inc.,(Action) board of

directors

consists of three persons: Chip DeMoss, Nick Dranias and Jeff Utsch.

All three individuals are listed in Section A in the 2014 tax return

of Compact for America Educational Foundation Inc. Section A deals with

Officers,

Directors, Trustees, Key Employees and Highest Compensated Employees of

a tax-exempt organization. The three men are also listed as

either a Director, CEO or Vice President of CFA Educational Foundation.

(Click image left to enlarge).Under the Foundation's by-laws members of the Advisory Council for the Foundation and the Council of Scholars for Compact for America Inc.,(Action) are irrelevant. As previously discussed, the board of directors is not required to take advice from either body. In fact, according to the by-laws, the board of directors controls the opinions expressed by the members of these two councils.

The single management officer listed for Compact for America Inc.,(Action) is Chip DeMoss. DeMoss holds three offices--president, secretary and treasurer. The CFA website lists the management officers for Compact for America Educational Foundation Inc., as being held by Chip DeMoss and Nick Dranias. DeMoss is also listed as a Vice Chairman of the board of directors for the Foundation.

Thus, according to the information supplied by Compact for America the day-to-day operations of Compact for America Educational Foundation Inc., and Compact for America Inc.,(Action) appear to be run by the same two people--Chip DeMoss and Nick Dranias.

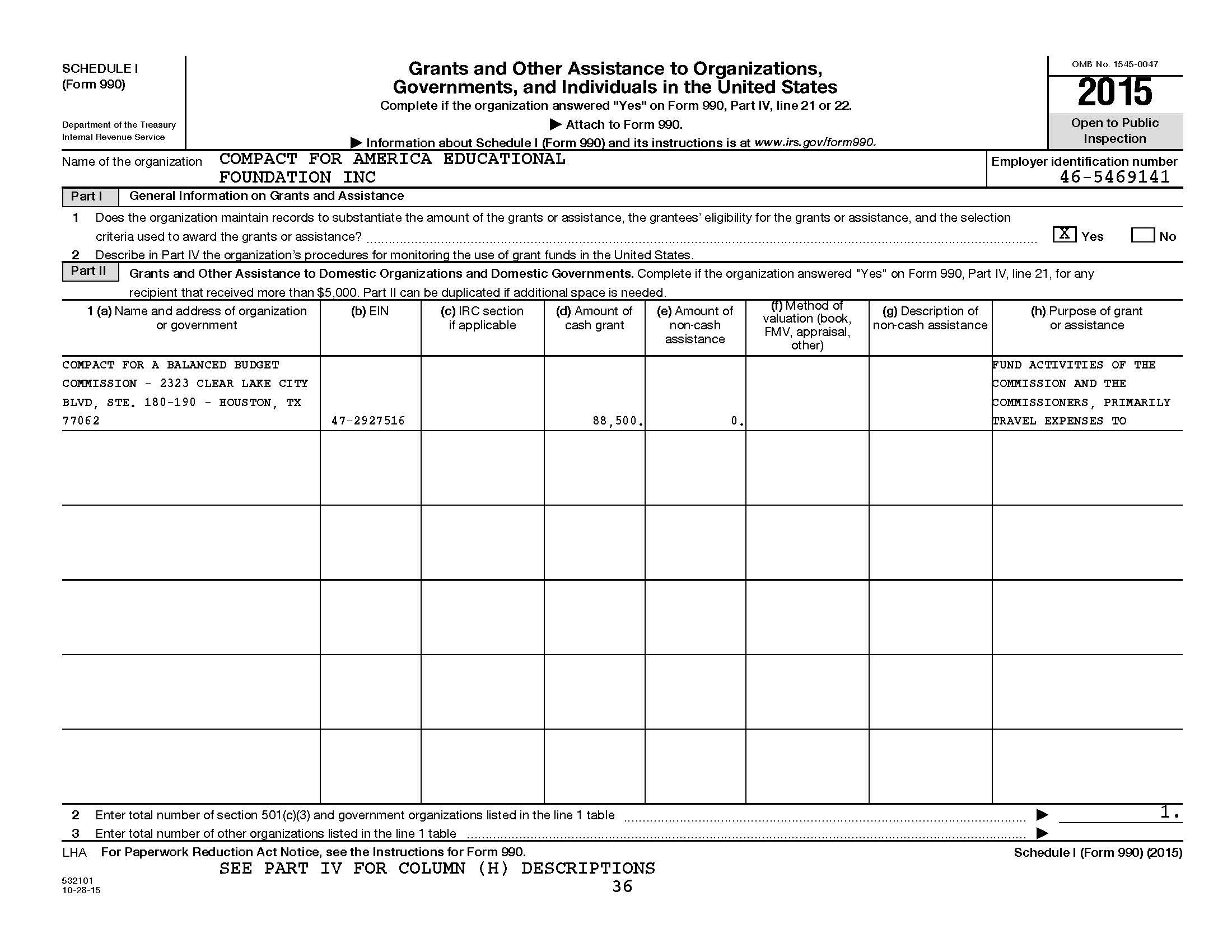

Management Compensation

The June 29, 2015 and August 16, 2016 independent audit reports discusses the management relationship of Chip DeMoss and Nick Dranias between Compact for America Education Foundation Inc., and Compact for America Inc.,(Action). (See page 9, 2014 report and page 9, 2015 report). The reports state CFA Foundation and CFA (Action) shared a "common director" and single common manager. Instead of paying the individuals directly however the report states payment was made to "entities" which "furnished" the director and manager.

The 2014 audit describes payments made by Compact for America Education Foundation Inc. to an unnamed "entity" which "furnished the [unnamed] executive manger" for the Foundation as well as providing "the same executive manger to CFA-Action." The report states "a different [unnamed] member of the Foundation's executive management also served as a director on the board of CFA-Action." The report states in 2014, "The Foundation incurred management compensation expense in the amount of $24,000 under a service contract to the entity that furnished the executive manager to the Foundation and "provided the same executive manager to CFA-Action." Additionally, the "Foundation incurred management compensation expense in the amount of $20,900 to the entity that furnished the executive manager for the Foundation. This director for CFA-Action served solely as a volunteer for CFA-Action at all times."

The 2015 audit report states $118,000 was paid "to the [unnamed] entity that furnished the [unnamed] executive manager for the Foundation." Additionally the report states "the Foundation incurred management compensation expense of $118,000 to the [unnamed] entity that furnished the [unnamed] executive manger for the Foundation." The 2015 audit report again repeats, "this director for CFA-Action served solely as a volunteer for CFA-Action at all times." The reports describes "service contracts" which purportedly set limitations on these two individuals. However CFA has not provided (and is not legally required to provide) copies of these "service contracts" for public inspection showing what the terms and limitations of these contracts.

The 2014 and 2015 tax returns of Compact for America

Education Foundation Inc., clarifies matters by identifying the "entities" which provided

the manager and director for CFA(Action) and the specific individuals involved.

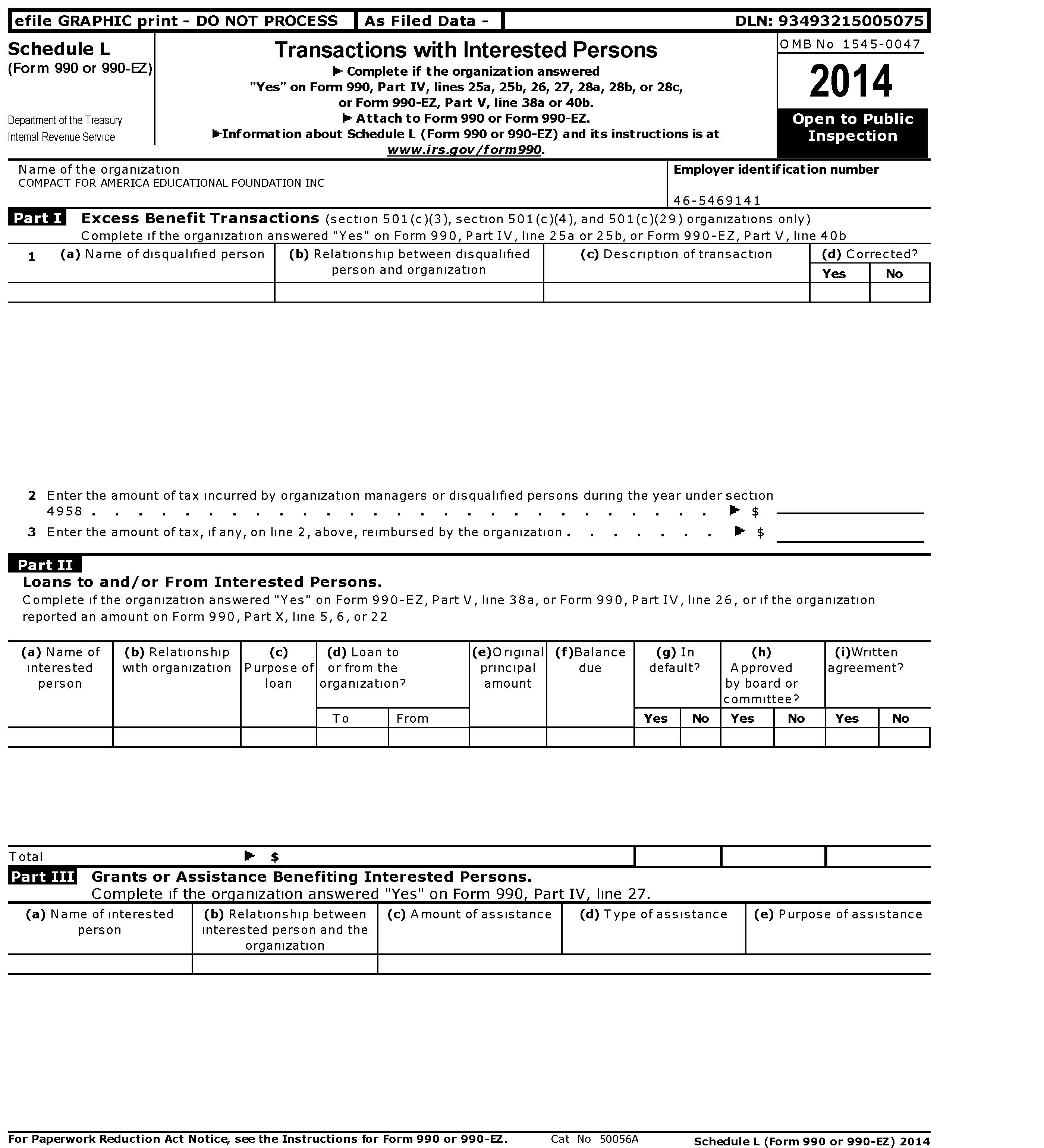

According to the 2014 Schedule L Form the firm of

Nick Dranias Law & Policy Analysis LLC received $20,900 (an hourly wage of $10.88) for

"management compensation" (click images left to enlarge). The form states, "Organization's president

controls Nick Dranias Law & Policy Analysis LLC." The 2014 Schedule

L Form also states the

Foundation paid $24,000 in "management compensation" to UMAT Resources

LLC which calculates to an hourly wage of $12.50. UMAT Resources LLC is described as being "controlled by the Foundation's

Vice Chairman/CEO

Harold DeMoss."

The 2014 and 2015 tax returns of Compact for America

Education Foundation Inc., clarifies matters by identifying the "entities" which provided

the manager and director for CFA(Action) and the specific individuals involved.

According to the 2014 Schedule L Form the firm of

Nick Dranias Law & Policy Analysis LLC received $20,900 (an hourly wage of $10.88) for

"management compensation" (click images left to enlarge). The form states, "Organization's president

controls Nick Dranias Law & Policy Analysis LLC." The 2014 Schedule

L Form also states the

Foundation paid $24,000 in "management compensation" to UMAT Resources

LLC which calculates to an hourly wage of $12.50. UMAT Resources LLC is described as being "controlled by the Foundation's

Vice Chairman/CEO

Harold DeMoss."

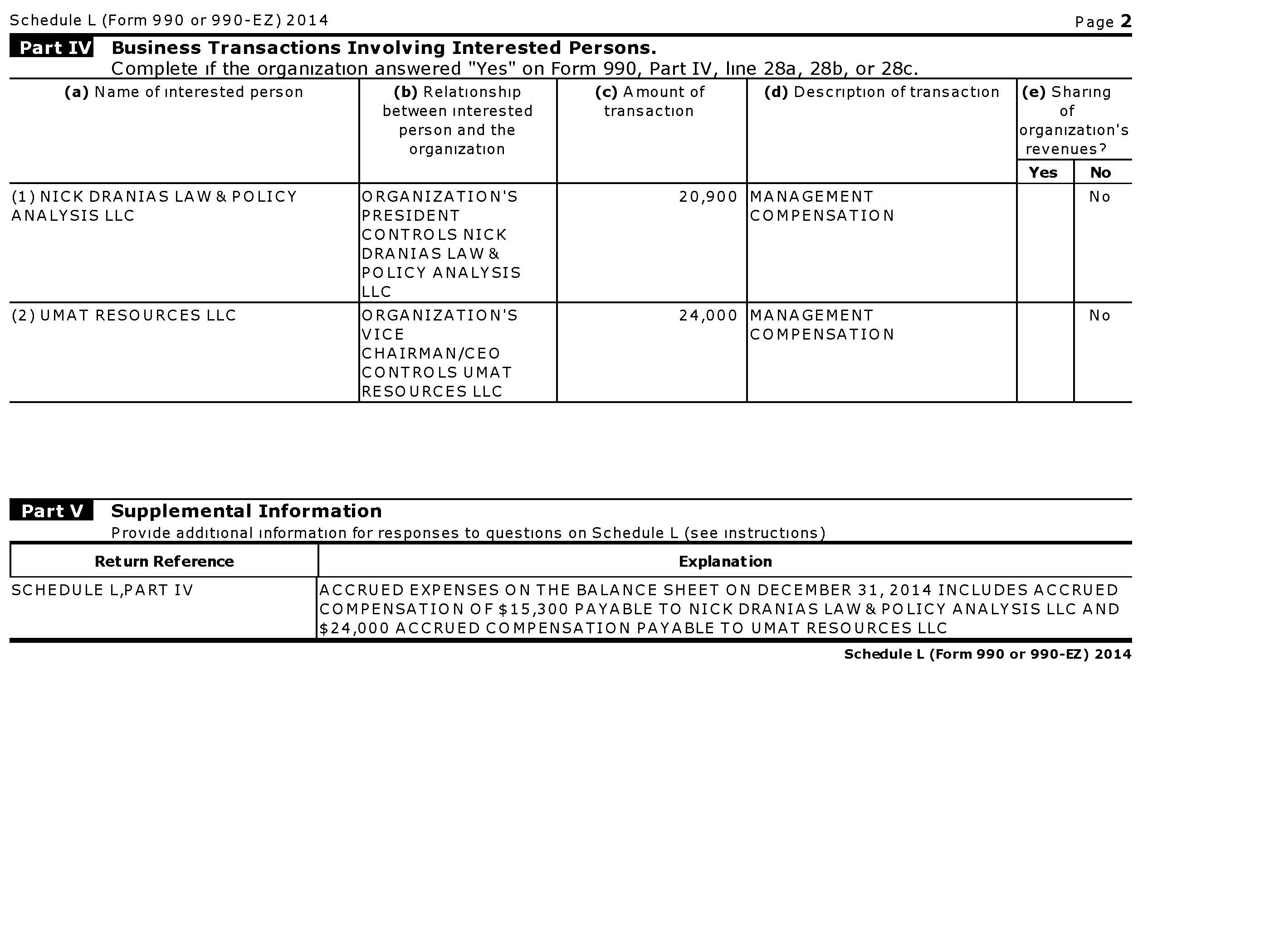

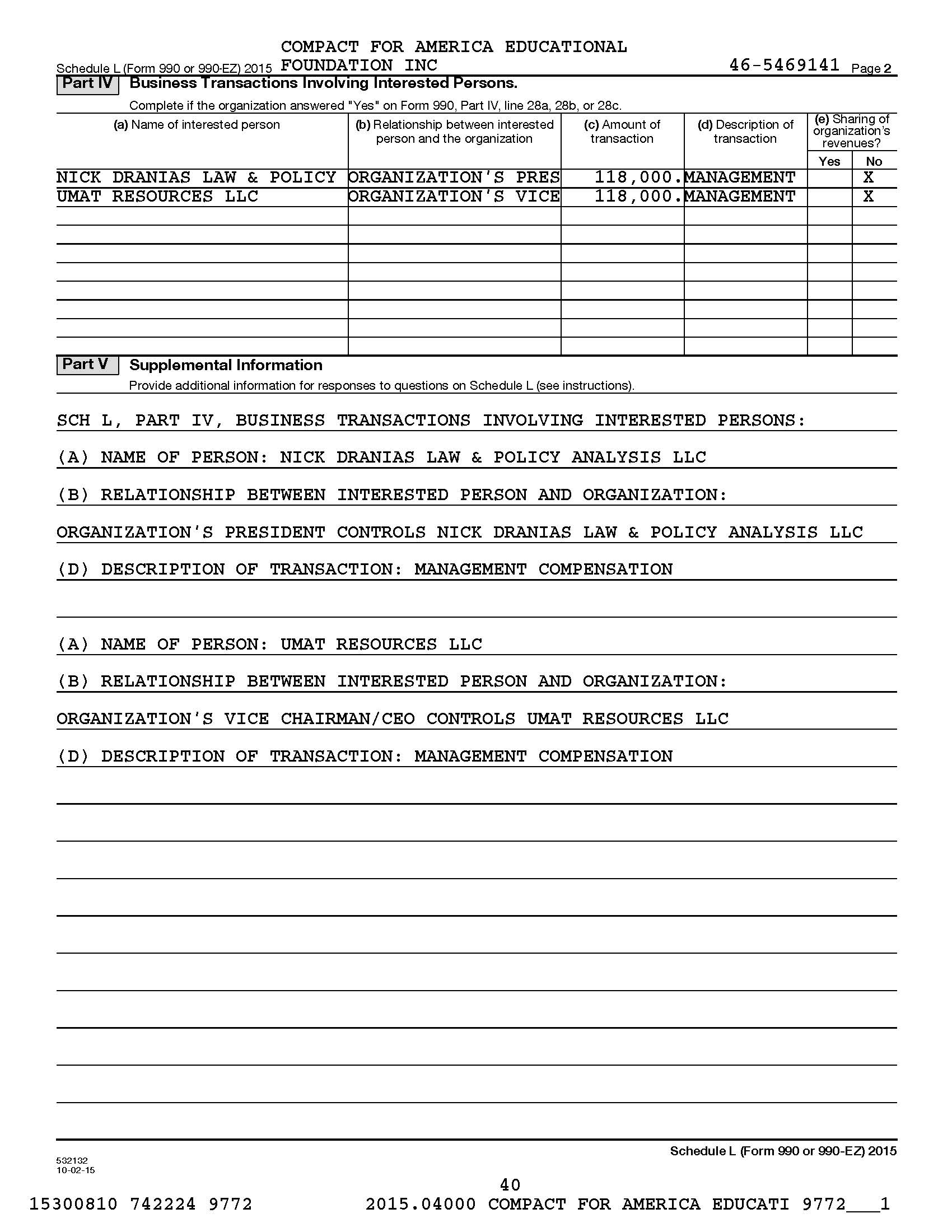

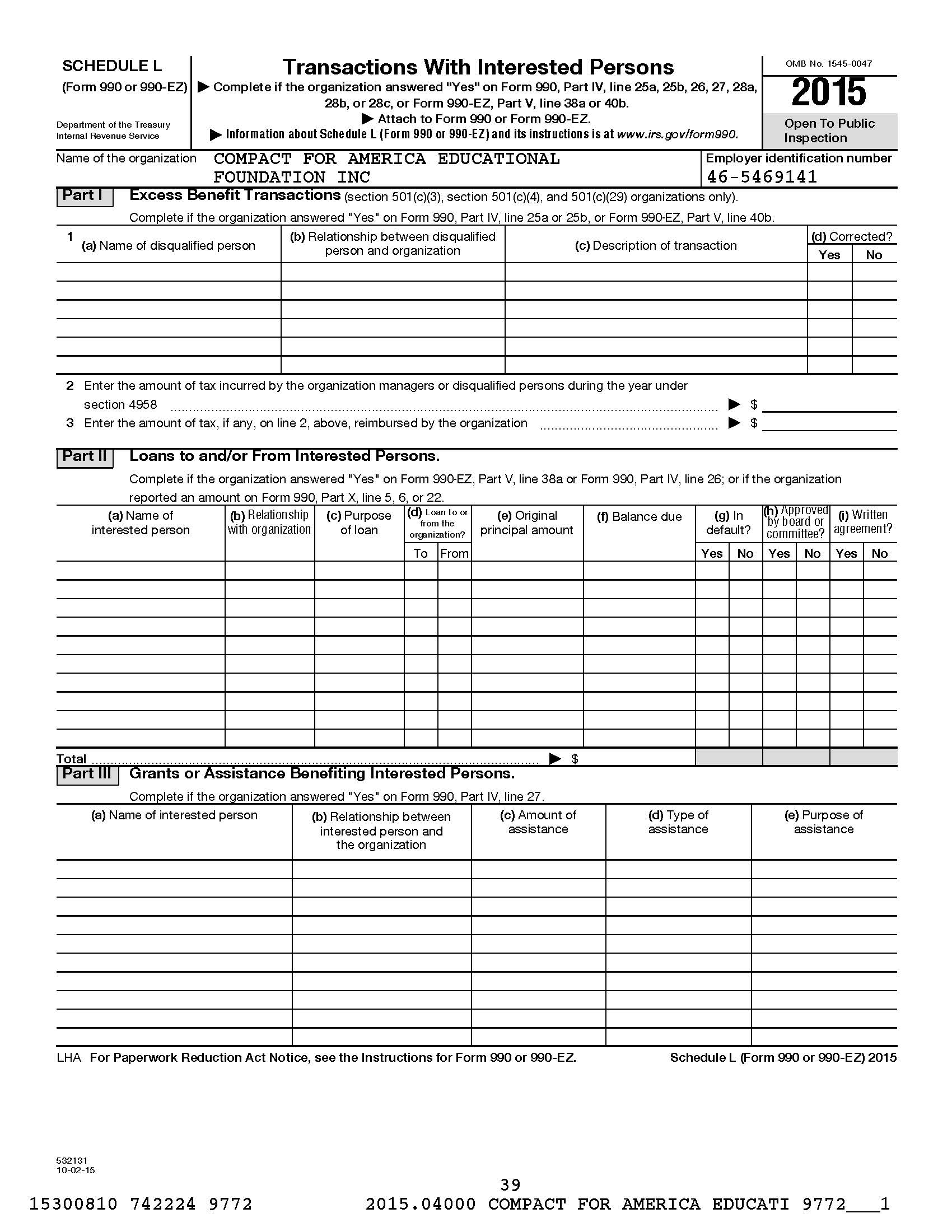

The 2015 Schedule L Form states the same two individuals DeMoss and Dranias received $118,00 each (an hourly wage of $61.45) totally

$236,000 in "management compensation" to manage Compact for America Inc.,(Action) which, according to all information

available, has zero assets, revenue and income. According to the independent audit the $236,000 in "management

compensation" was the single largest expense of Compact for America Educational Foundation Inc.,

amounting to nearly 34% of the total operating expenses ($702,201) of the

Foundation. Compact

for America provides no explanation why the "management

compensation" for an organization having no assets, revenue or income

was increased 392% between 2014 and 2015. CFA has not

explained how such an increase complies with the "reasonable

compensation" rule of its Conflict of Interest policy. CFA has not

provided any survey information required in its policy justifying a

392% increase in "management compensation" of an organization having

zero assets, income and revenue.

The 2015 Schedule L Form states the same two individuals DeMoss and Dranias received $118,00 each (an hourly wage of $61.45) totally

$236,000 in "management compensation" to manage Compact for America Inc.,(Action) which, according to all information

available, has zero assets, revenue and income. According to the independent audit the $236,000 in "management

compensation" was the single largest expense of Compact for America Educational Foundation Inc.,

amounting to nearly 34% of the total operating expenses ($702,201) of the

Foundation. Compact

for America provides no explanation why the "management

compensation" for an organization having no assets, revenue or income

was increased 392% between 2014 and 2015. CFA has not

explained how such an increase complies with the "reasonable

compensation" rule of its Conflict of Interest policy. CFA has not

provided any survey information required in its policy justifying a

392% increase in "management compensation" of an organization having

zero assets, income and revenue. CFA Volunteers?

Unlike most tax-exempt organizations Compact for America Educational Foundation Inc., and Compact for America Inc.,(Action) appear to have no volunteer base. Both 2014 and 2015 CFA tax forms state the number of CFA volunteers as "10."

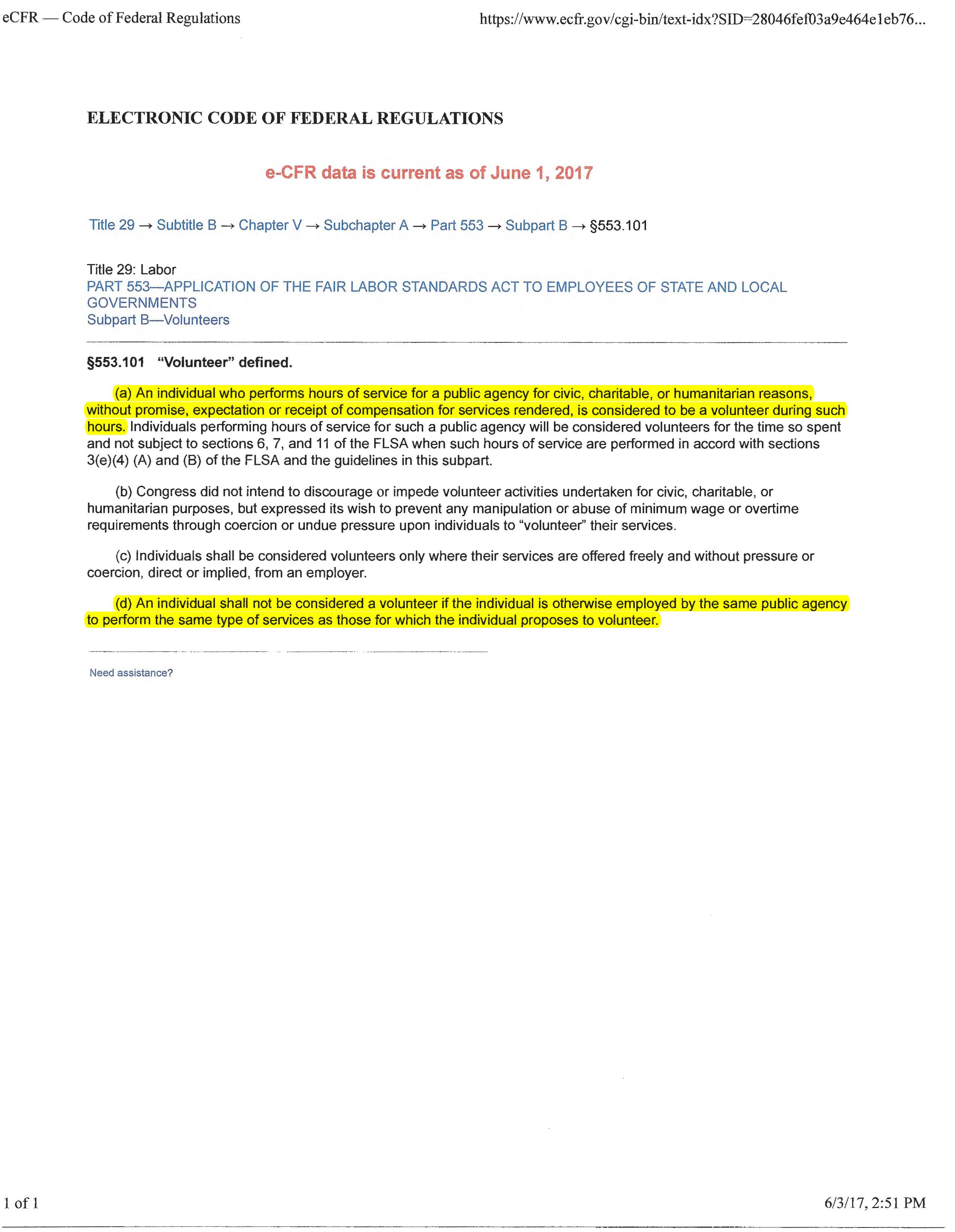

Under

normal circumstances whether someone is a volunteer or not has little

bearing on a tax-exempt organization. IRS regulations set limits on

how much lobbying a 501(c)(3) organization may do based on

participation of both paid and volunteer workers. However as Compact for America claims its officers are "public officials" and its "commission" is a governmental body, other federal laws apply. One example is Part 553 Section 553.101 (click image left to enlarge) of the federal Fair Labor Standards Act to Employees of State and Local Governments. The

Internal Revenue Service uses this law to define what is "volunteer"

work by government employees The law defines "volunteer" work by

government employee as being when "an individual who performs hours of

service for a public agency for civic, charitable, or humanitarian

reasons without promise, expectation or receipt of compensation for

services rendered..." The law further directs that "an individual shall

not be considered a volunteer if the individual is otherwise employed

by the same public agency to perform the same type of services as those

for which the individual proposes to volunteer."

Under

normal circumstances whether someone is a volunteer or not has little

bearing on a tax-exempt organization. IRS regulations set limits on

how much lobbying a 501(c)(3) organization may do based on

participation of both paid and volunteer workers. However as Compact for America claims its officers are "public officials" and its "commission" is a governmental body, other federal laws apply. One example is Part 553 Section 553.101 (click image left to enlarge) of the federal Fair Labor Standards Act to Employees of State and Local Governments. The

Internal Revenue Service uses this law to define what is "volunteer"

work by government employees The law defines "volunteer" work by

government employee as being when "an individual who performs hours of

service for a public agency for civic, charitable, or humanitarian

reasons without promise, expectation or receipt of compensation for

services rendered..." The law further directs that "an individual shall

not be considered a volunteer if the individual is otherwise employed

by the same public agency to perform the same type of services as those

for which the individual proposes to volunteer."Both audit reports state a "director for CFA_Action served solely as a volunteer for CFA_Action [despite the fact his law firm was paid $138,900 over two years to provide the director] at all times and did not engage in any executive management of CFA-Action." Despite the assertion of separation of "education" and "influence" by Compact for America, however, facts of public record do not support this. The requirements for causing passage of legislation necessary to bring about the creation of the compact sought by CFA, so far as FOAVC can determine by means of public record, do not allow sufficient separation of function to consider "education" and "influence" separate in the case of Compact of America. Moreover, based on public record, FOAVC has not located any substantial evidence demonstrating that as a "public officials," officers and directors of Compact for America are not performing the same identical functions regardless of whether they represent Compact for America Educational Foundation Inc., or Compact for America Inc.,(Action).

FOAVC asks: if someone is paid approximately $139,000 over a two year period under the terms of a "service" contract to be a "manager" of an organization, how can that individual be construed to be a "volunteer" when a business he wholly owns and in which he is apparently the sole employee, is being paid $139,000 by Compact for America to furnish his services to CFA? FOAVC emphasizes so far as it is aware there is no violation of law in these arrangements. Any such determination of infraction of law would have to be made by the appropriate governmental agency charged with investigation of any complaints alleging a violation of law.

Compact for America Communications Policy

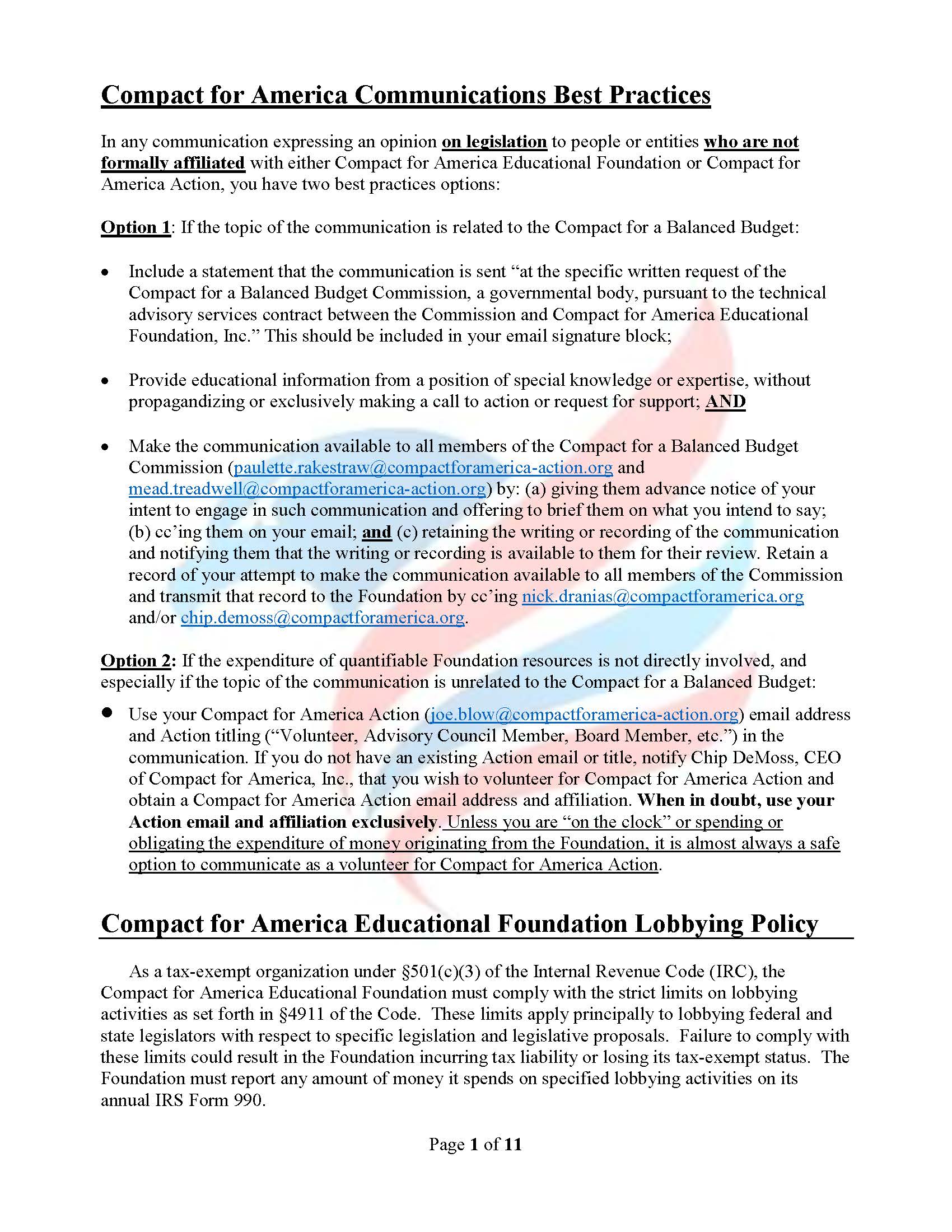

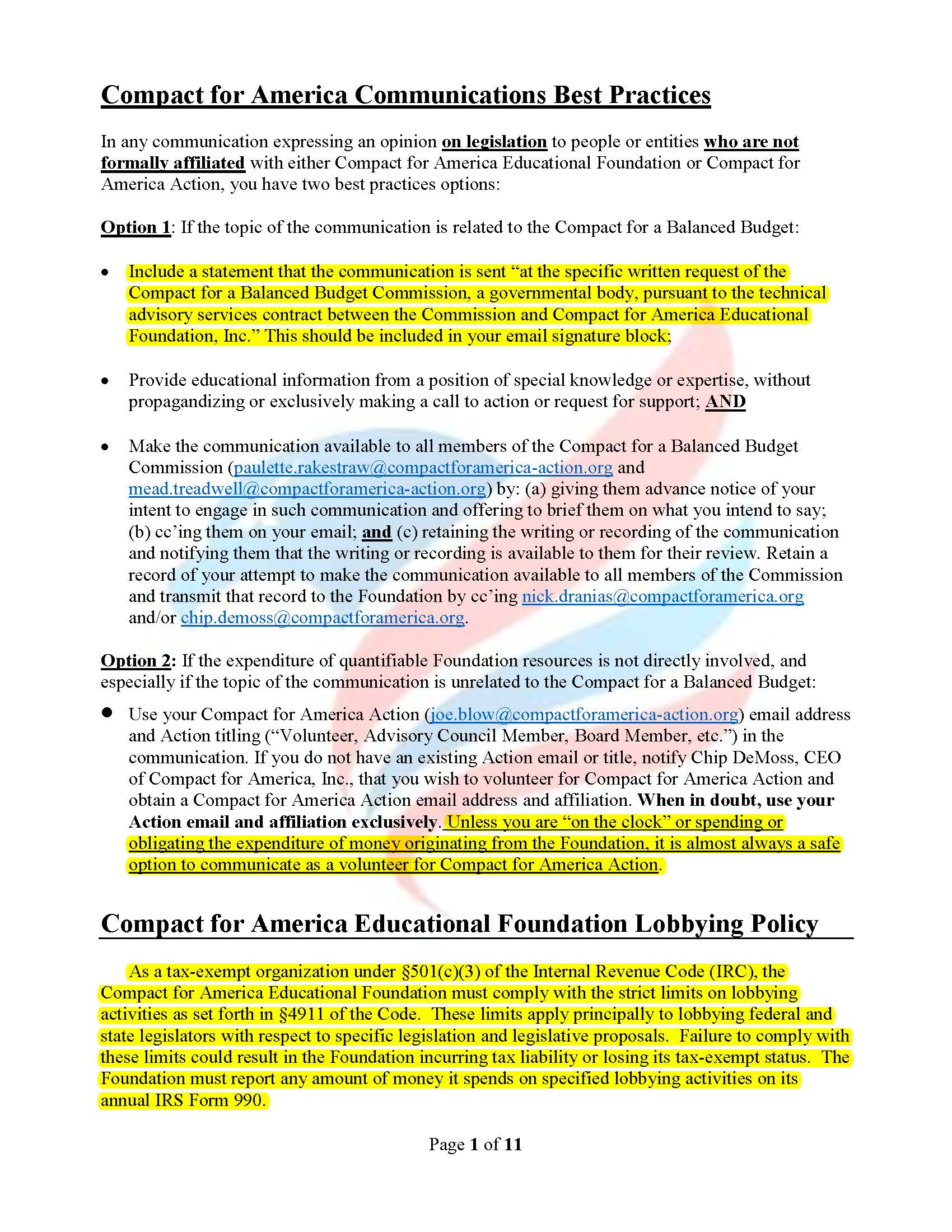

Compact

for America's Communications Policy which, according to the first

paragraph of the 11 page document, apparently applies to both Compact

for America Educational Foundation and Compact for America

Inc.,(Action) (click image left to enlarge). The document discusses

"two options" which it recommends regarding communications about

legislation (presumably state legislation creating a compact to propose

amendments in a particular state) or "entities who are not formally

affiliated with Compact for America Educational Foundation or Compact

for America Action." (Click image right to enlarge). The report recommends that a "statement that

communication is sent at the specific written request of the Compact

for a Balanced Budget Commission, a governmental body, pursuant to the

technical advisory services contract between the Commission and Compact

for America Educational Foundation, Inc." be included in all communications.

Compact

for America's Communications Policy which, according to the first

paragraph of the 11 page document, apparently applies to both Compact

for America Educational Foundation and Compact for America

Inc.,(Action) (click image left to enlarge). The document discusses

"two options" which it recommends regarding communications about

legislation (presumably state legislation creating a compact to propose

amendments in a particular state) or "entities who are not formally

affiliated with Compact for America Educational Foundation or Compact

for America Action." (Click image right to enlarge). The report recommends that a "statement that

communication is sent at the specific written request of the Compact

for a Balanced Budget Commission, a governmental body, pursuant to the

technical advisory services contract between the Commission and Compact

for America Educational Foundation, Inc." be included in all communications.

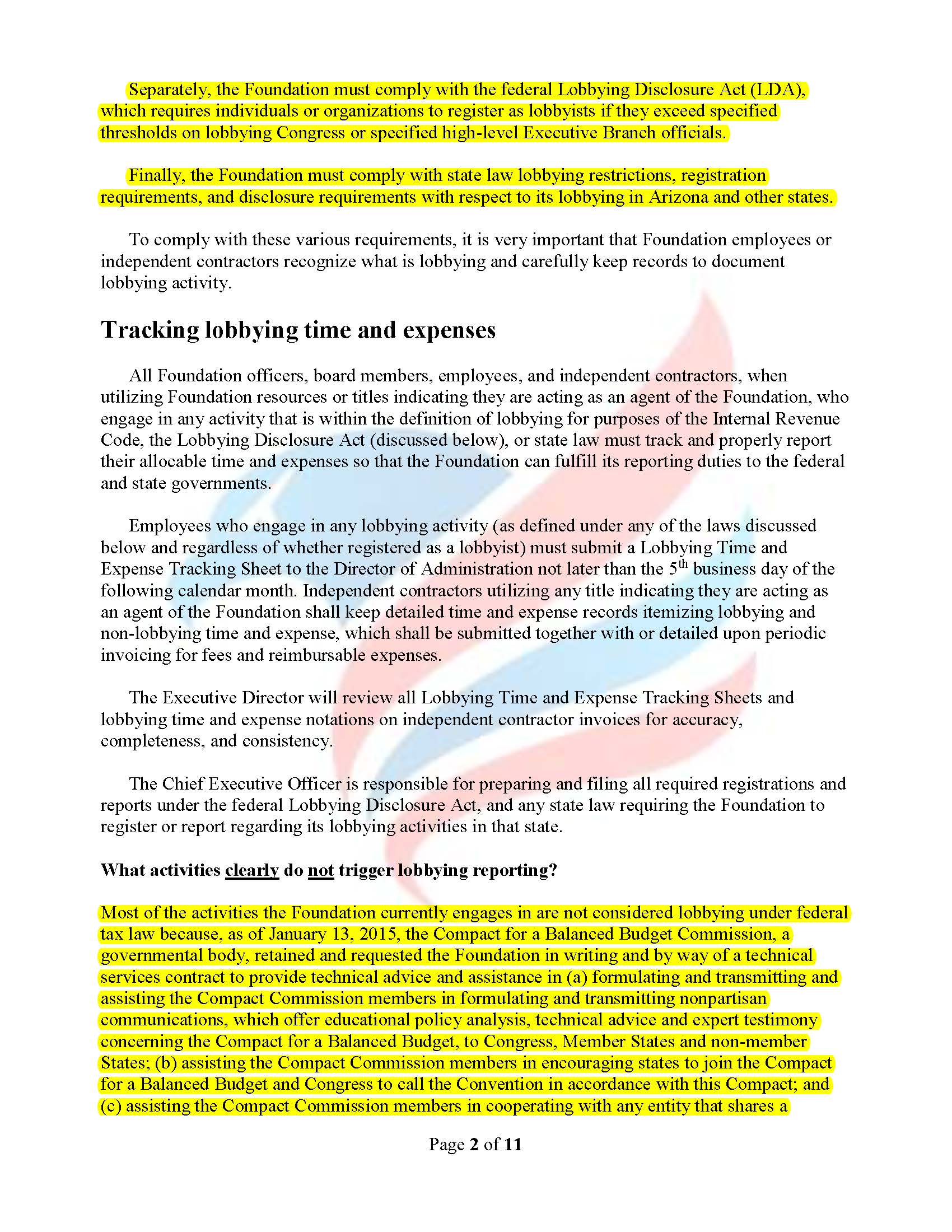

Compact for America Educational

Foundation Inc., places a great deal of reliance on the proposition

expressed on Page 2 (click on image left to enlarge) and Page 3 (click

on image right to enlarge) of its Communications Policy that because of

the "technical services" contract between it and the Compact for a

Balanced Budget Commission, "most of the activities the Foundation

currently engages in are not considered lobbying under federal tax law."

Compact for America Educational

Foundation Inc., places a great deal of reliance on the proposition

expressed on Page 2 (click on image left to enlarge) and Page 3 (click

on image right to enlarge) of its Communications Policy that because of

the "technical services" contract between it and the Compact for a

Balanced Budget Commission, "most of the activities the Foundation

currently engages in are not considered lobbying under federal tax law."

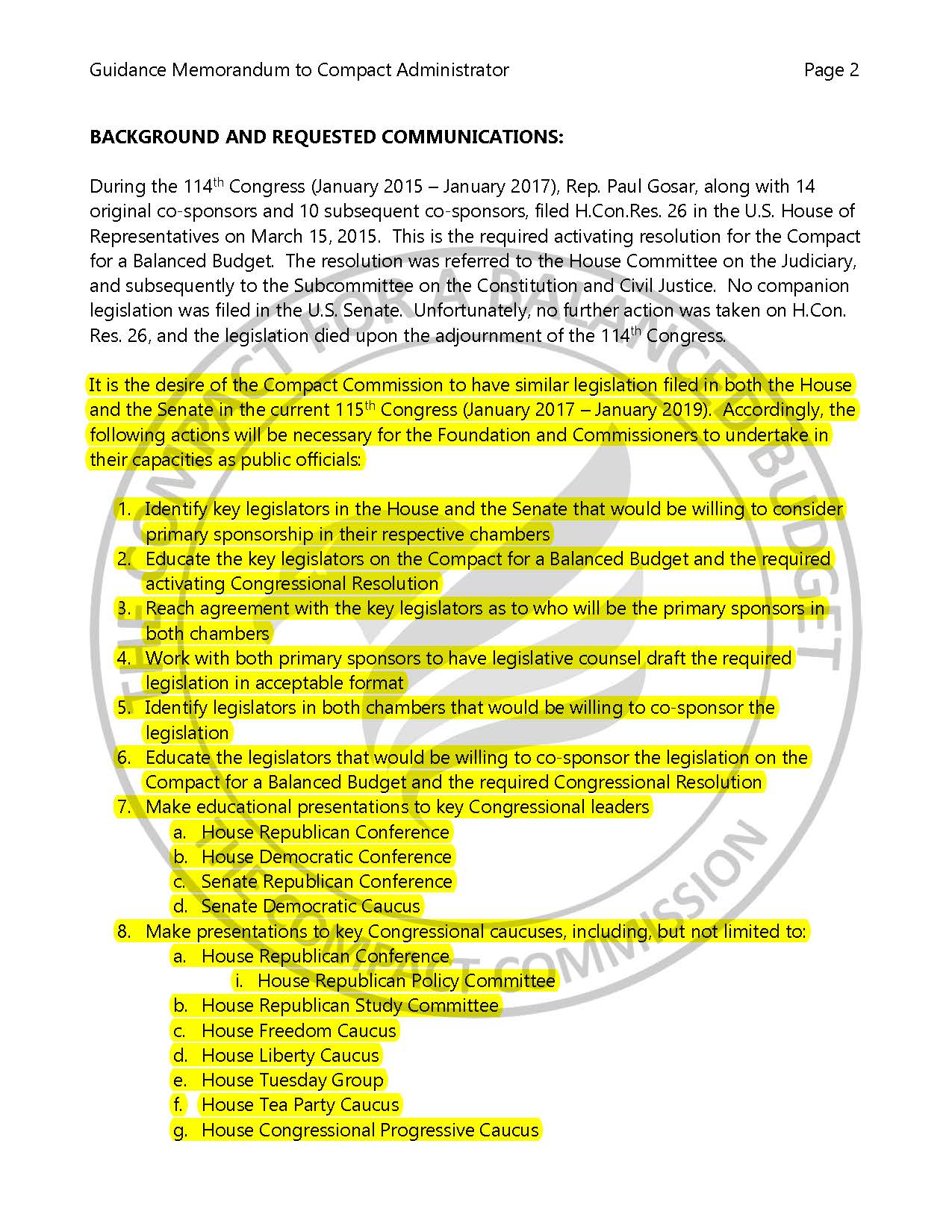

The CFA statement states "because, as of January 13, 2015, the Compact for a Balanced Budget Commission, a governmental body, retained and requested the Foundation in writing and by way of a technical services contract to provide technical advice and assistance in (a) formulating and transmitting and assisting the Compact Commission members in formulating and transmitting nonpartisan communications, which offer educational policy analysis, technical advice and expert testimony concerning the Compact for a Balanced Budget, to Congress, Members States and non-member States; (b) assisting the Compact Commission members in encouraging states to join the Compact for a Balanced Budget and Congress to call the Convention in accordance with this Compact; and (c) assisting the Compact Commission members in cooperating with any entity that shares a common interest with the Compact Commission and engages in policy research, public interest litigation or lobbying in support of the purposes of the Compact."

The Commission's "technical service" agreement with Compact for America Foundation, which refers to the Commission as a "multi-state agency" took effect on January 15, 2015. The agreement was later amended on July 31, 2015. The agreement requires the Foundation to "serve as interim Compact Administrator", "educate" various state and federal officials and others on the compact and its various aspects, "provide expert testimony before state legislative and congressional committees", "maintain the books and records of the Commission", "maintain a bank trust account for funds received" and "develop and maintain the Commission Internet website." In sum, for all practical purposes, the operations of the Commission were turned over to Compact for America Foundation.

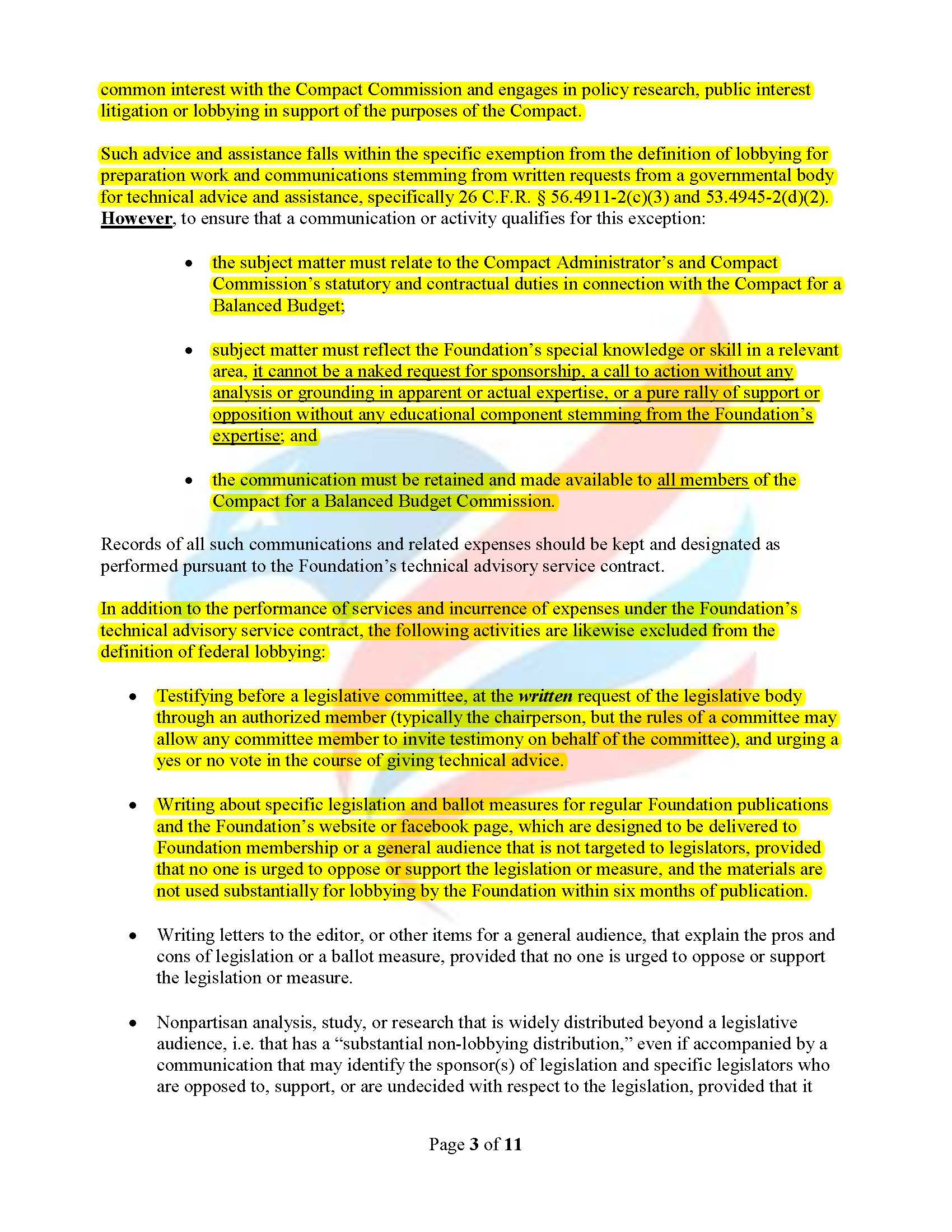

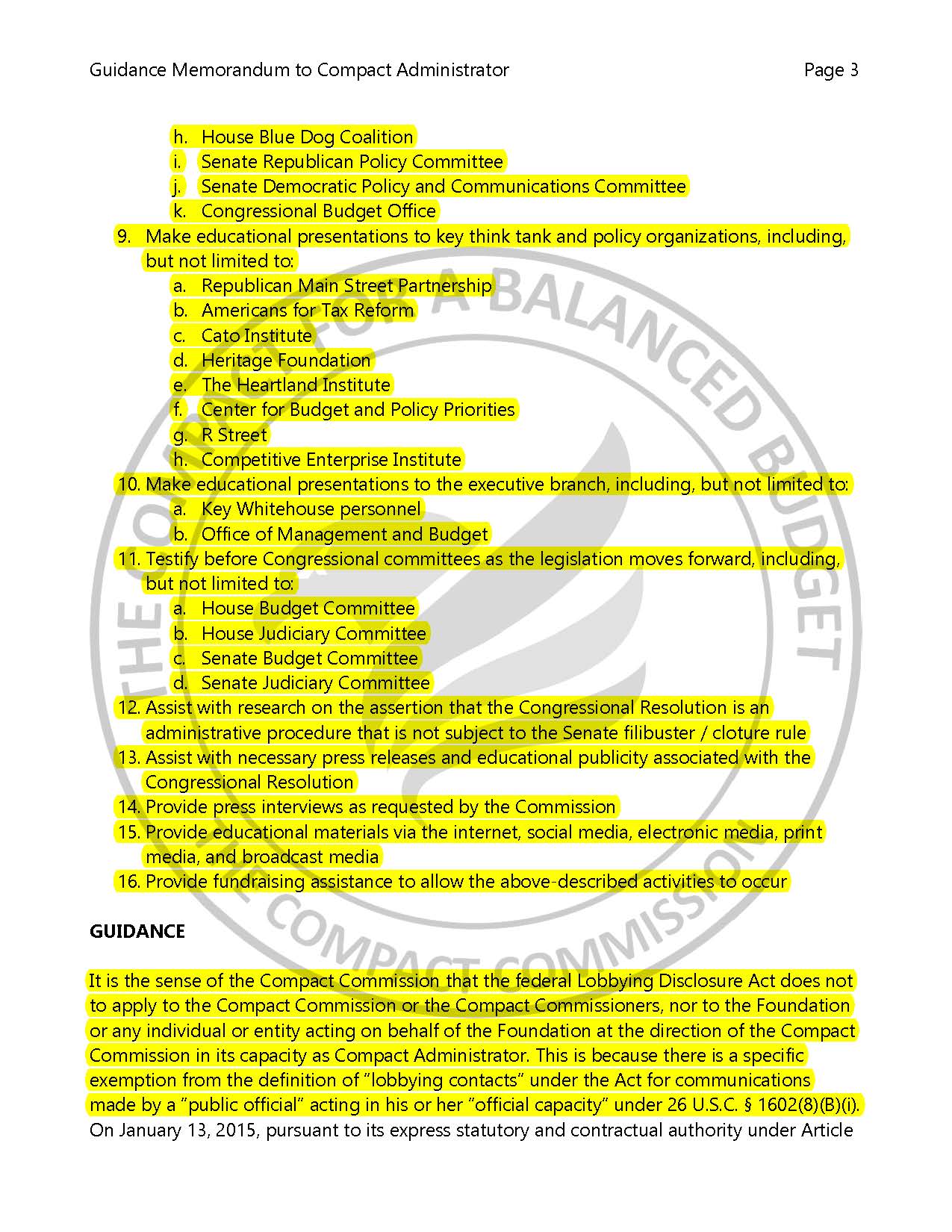

The Communications Policy then states "such advice and assistance falls within the specific exemption from the definition of lobbying for preparation work and communications stemming from written requests from a governmental body for technical advice and assistance, specifically 26 C.F.R. § 56.4911-2(c)(3) and 53.4945-2(d)(2)." The policy then continues, "However [emphasis in original] to ensure that a communication or activity qualifies for this exception: (1) the subject matter must relate to the Compact Administrator's and Compact Commission's statutory and contractual duties in connection with the Compact for a Balanced Budget; (2) subject matter must reflect the Foundation's special knowledge or skill in a relevant area, it cannot be a naked request for sponsorship, a call to action without any analysis or grounding in apparent or actual expertise, or a pure rally of support or opposition without any education component stemming from the Foundation's expertise; [emphasis in original] and (3) the communication must be retained and made available to all members of the Compact for a Balanced Budget Commission." [emphasis in original].

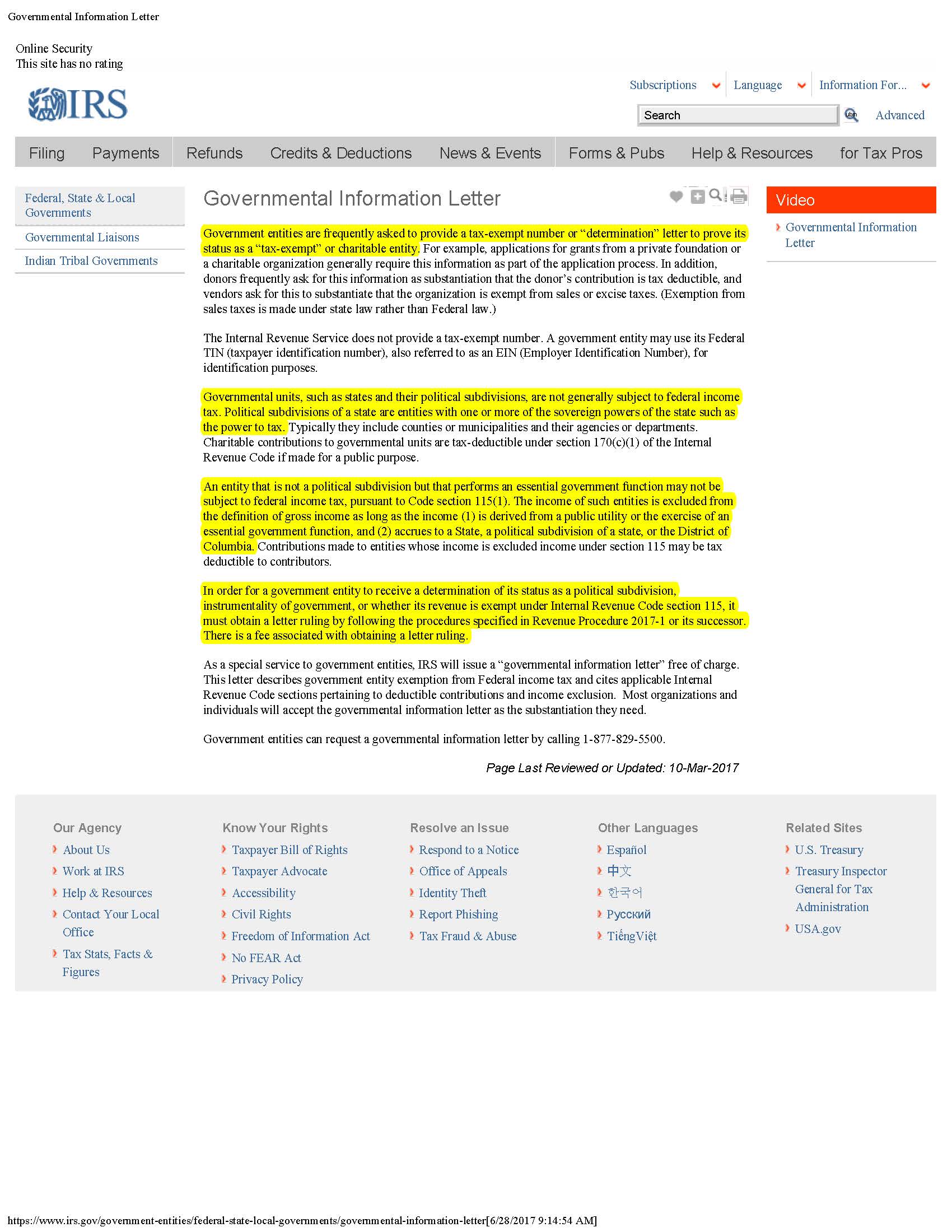

The reliance of this form of indemnification, repeatedly expressed in the Compact for America documents, is anchored in the proposition the Compact for a Balanced Budget Commission is in all respects a "governmental body." If the Commission is not a "governmental body," that is, it does not qualify as a "governmental body" under law, then the entire premise of "immunity" for the actions of Compact for America Educational Foundation Inc., and all other groups associated with Compact for America falls to the ground. Further, if the Commission is not a "governmental body," any "technical services contract" between it and any party is voided as a contract between a "governmental body" and that party. The contract may still exist as an agreement between two private parties but any immunities or other authority alluded to it under the premise of it being made by a "governmental body" do not exist because the "governmental body" does not exist. Thus any action taken by any party under such "contract" would be judged, not by the terms of the "contract" and its purported immunity being made with a "governmental body" but under the terms and condition of appropriate law of a contract made between two private parties.

The document briefly discusses various state and federal laws to which Compact for America must "comply." These include 501(c)(3) regulations "set form in §4911 of the [IRS] Code." Also mentioned is compliance with the "federal Lobbying Disclosure Act (LDA) and "state law lobbying restrictions...with respect to is lobbying in Arizona and other states." Despite these statements, Compact for America Educational Foundation states, "the Foundation and its officers are serving as public officials at the direction of the Compact for a Balanced Budget Commission and therefore exempt from lobbying registration under most state laws." [Emphasis added].

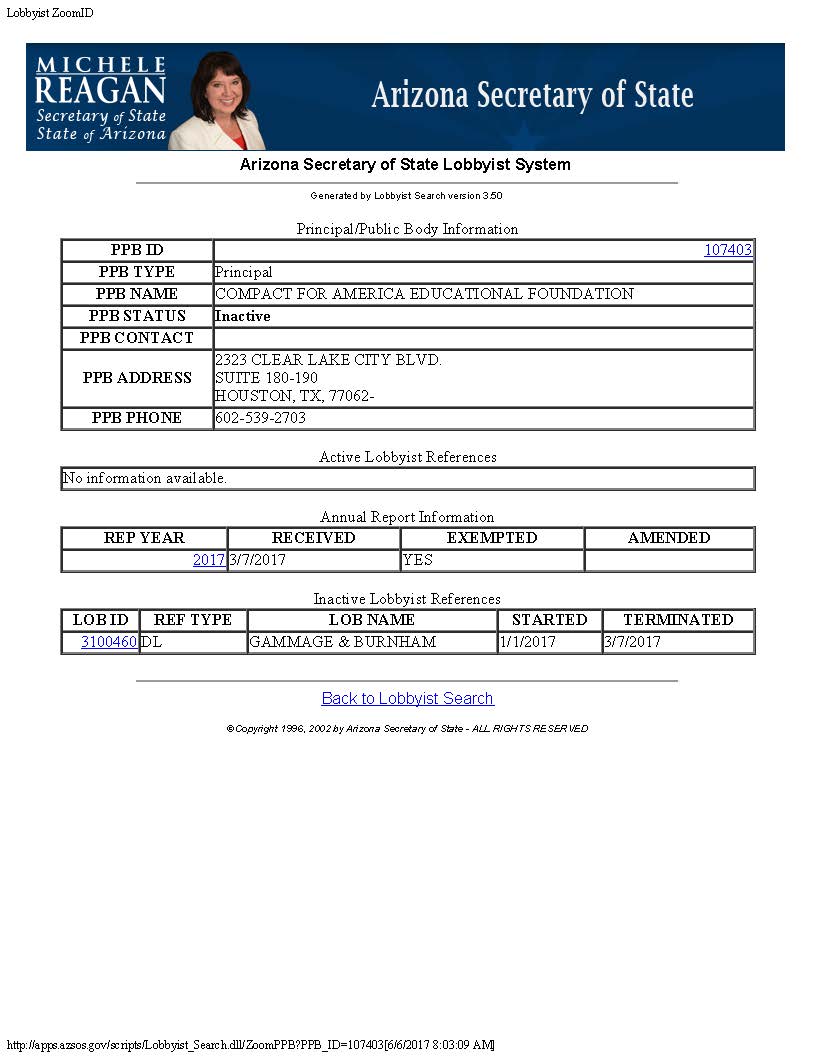

As stated on its website

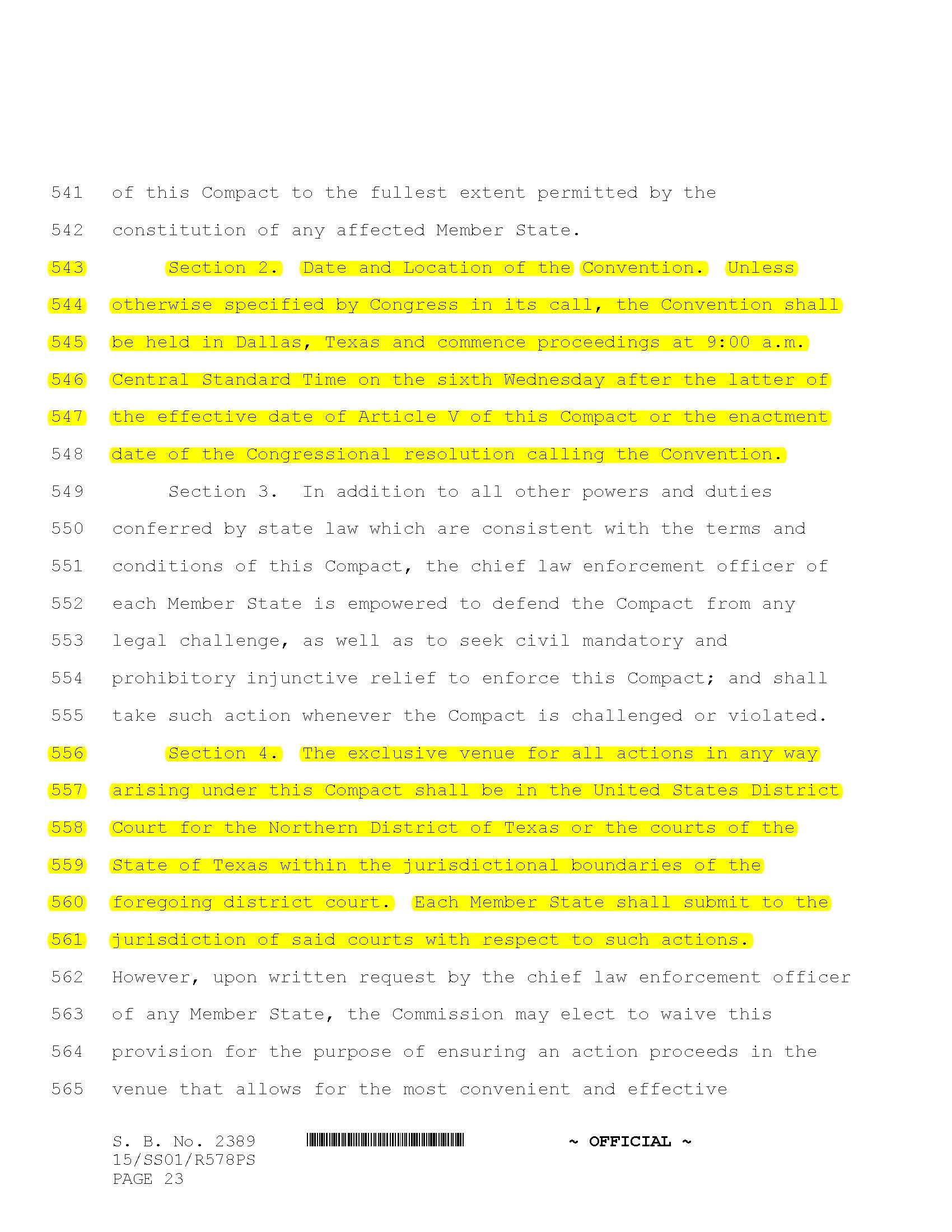

the LDA has little effect on any lobbying performed by Compact for

America as it primarily addresses lobbying by professional lobbying

organizations hired by individuals or corporations lobbying Congress.

Because it is required under the terms of the Constitution however, passage of a federal law authorizing the

compact is required. This implies some form of federal

lobbying by CFA to bring about this legislation. Despite the caution

regarding the LDA in the Compact for America Communications Practices Policy, FOAVC is unable to locate any record of filing by

Compact for America or any of its officers as lobbyists as required by

LDA. Compact for America Educational Foundation Inc., is registered

(currently inactive) as a lobbying organization in the state of

Arizona. There is no record of Compact for America Inc.,(Action) being

registered as a lobbying organization in the state of Arizona nor with

LDA.

As stated on its website

the LDA has little effect on any lobbying performed by Compact for

America as it primarily addresses lobbying by professional lobbying

organizations hired by individuals or corporations lobbying Congress.

Because it is required under the terms of the Constitution however, passage of a federal law authorizing the

compact is required. This implies some form of federal

lobbying by CFA to bring about this legislation. Despite the caution

regarding the LDA in the Compact for America Communications Practices Policy, FOAVC is unable to locate any record of filing by

Compact for America or any of its officers as lobbyists as required by

LDA. Compact for America Educational Foundation Inc., is registered

(currently inactive) as a lobbying organization in the state of

Arizona. There is no record of Compact for America Inc.,(Action) being

registered as a lobbying organization in the state of Arizona nor with

LDA. The Compact for a Balanced Budget Commission

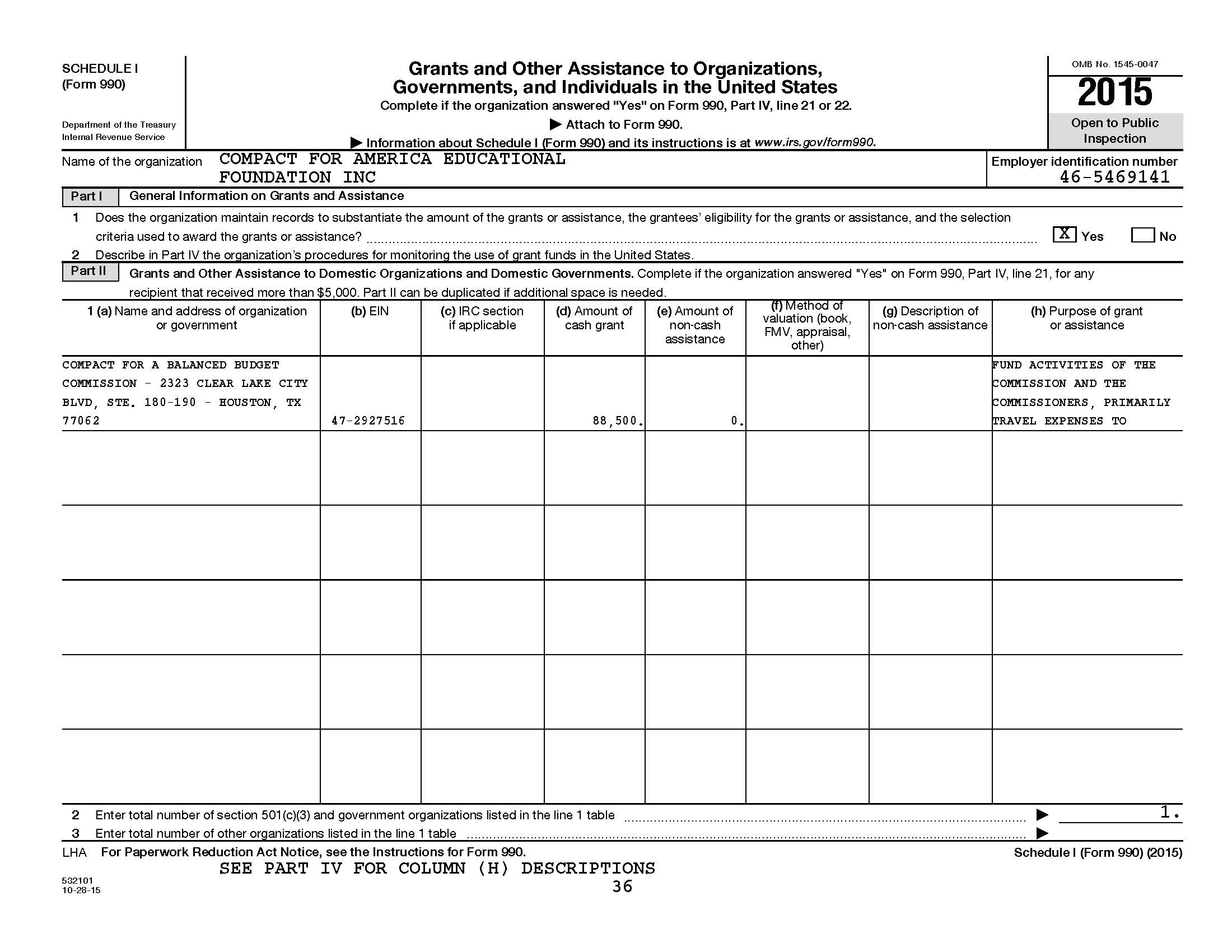

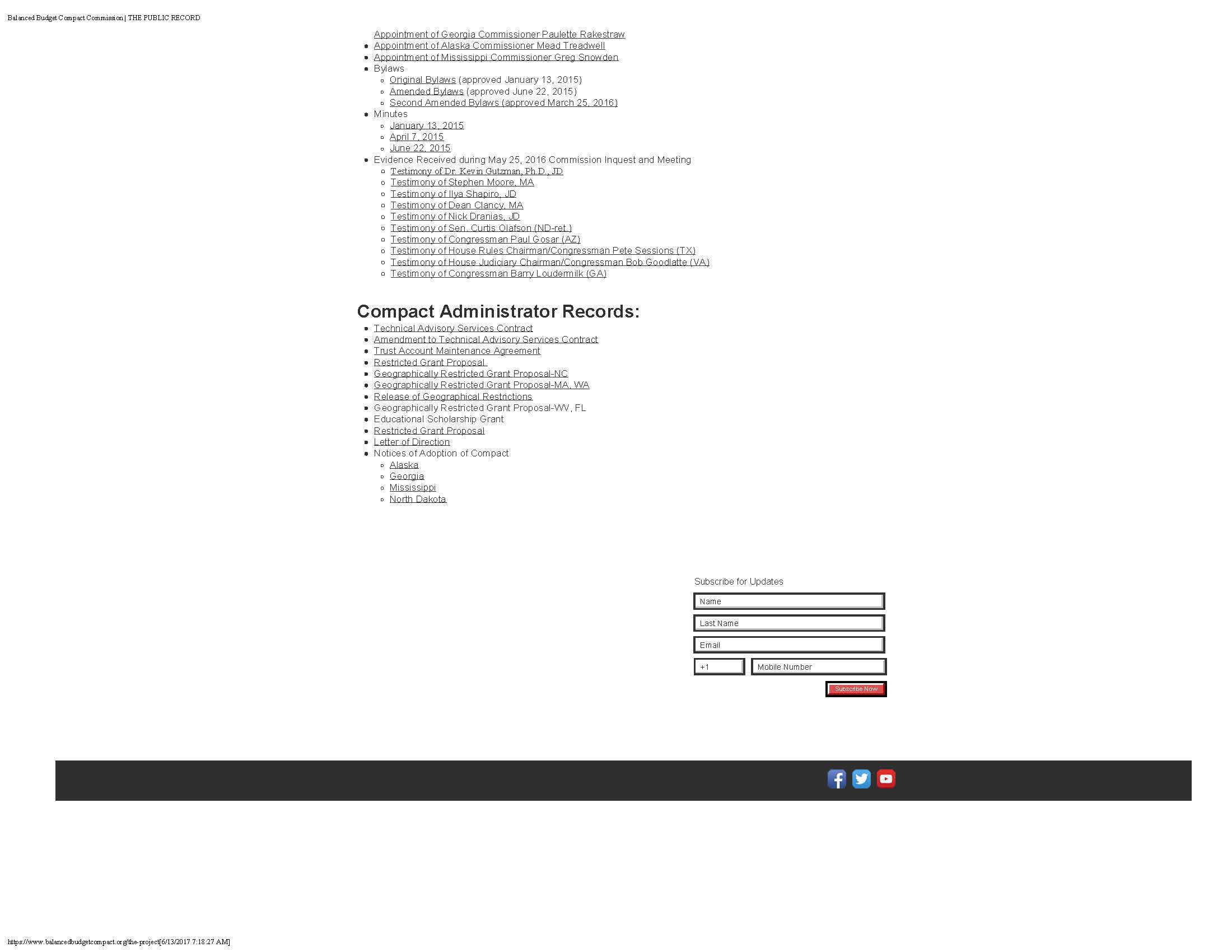

Investigation by FOAVC has revealed the financial records of Compact for America Educational Foundation Inc., and the Compact for a Balanced Budget Commission are inextricably linked. It is impossible to fully discuss the financial records of Compact for America without also discussing the Compact for a Balanced Budget Commission. In order to present a complete picture of the financial relationship between these two operations therefore, FOAVC will present information found on the Compact for a Balanced Budget Commission website as it continues its analysis of the financial records of Compact for America Inc.

The financial records shows a clear financial relationship between Compact for America Educational Foundation Inc., a 501(c)(3) tax-exempt organization and the Balanced Budget Commission but no such similar financial relationship between Compact for America Inc.,(Action) a purported 501(c)(4) tax-exempt organization and the Commission. Therefore all actions taken, so far as federal tax law is concerned, must be judged on the laws associated with a 501(c)(3) tax-exempt organization.

Compact for America claims the Compact for a Balanced Budget Commission is a "governmental body" that is an "interstate agency." In normal circumstances an "interstate agency" has relevant state and federal laws associated it making it "interstate." However FOAVC has been unable to find any federal law incorporating the Commission as an "interstate" agency. The only state law FOAVC has been able to uncover is the Compact for a Balanced Budget itself. Without federal law authorizing the Commission as an "interstate" agency it is impossible for the Commission to be an actual "interstate" agency. For the compact (and thus the Commission) to have actual legal authority as an "interstate agency" the Constitution demands the compact creating the "interstate agency" be approved by Congress. This has not occurred. Five states have approved the compact but this fact alone does not make the Commission an "interstate agency" as defined by the Constitution.

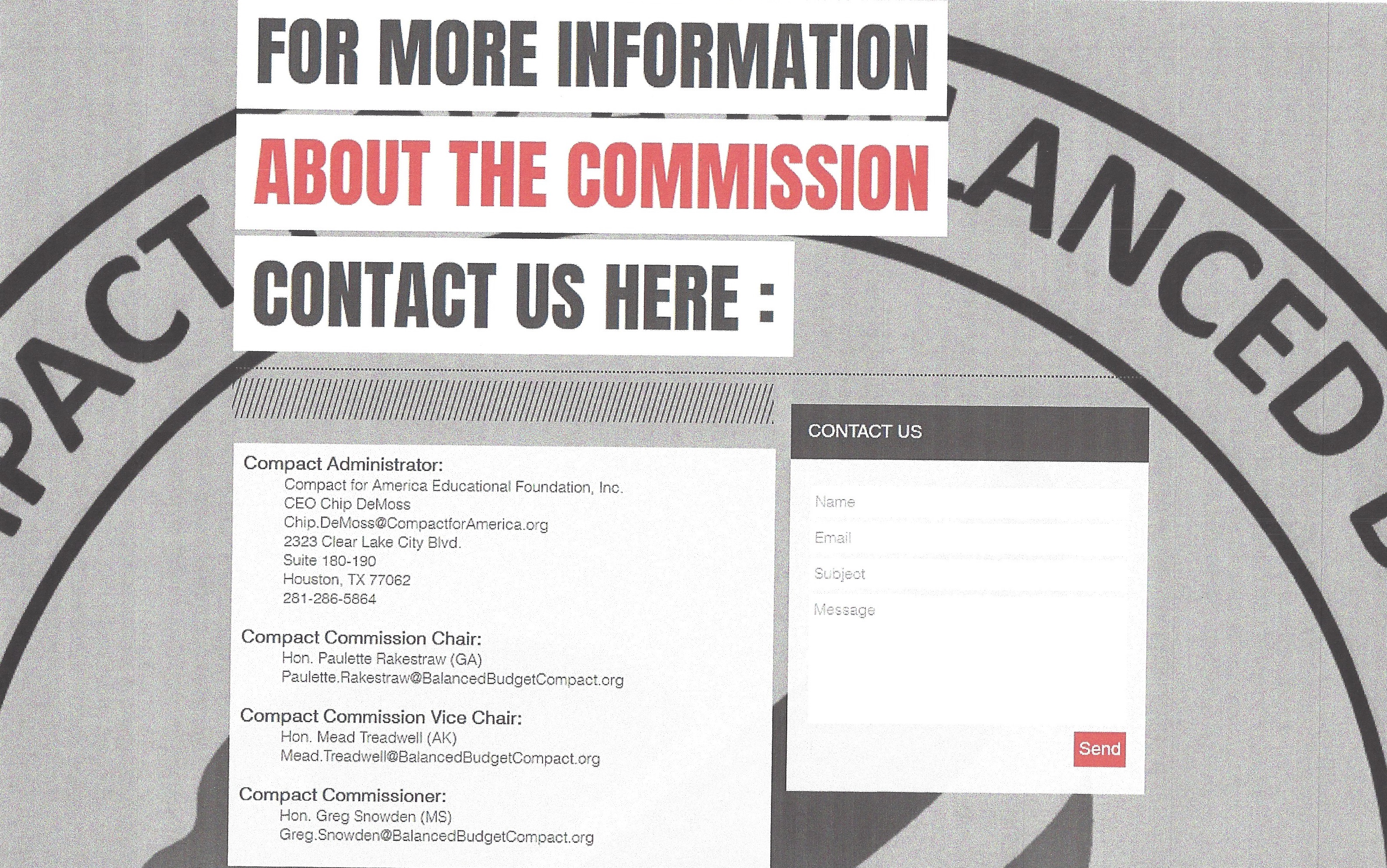

Other

facts do not support the "Commission" as an actual

"interstate" governmental agency as claimed by Compact for America. As an "interstate" governmental agency it is reasonable

to expect a certain level of professional business performance as is

typical with all governmental agencies including "interstate" agencies. The Commission

lists its address as 2323 Clear Lake City

Blvd., Suite 180-190, Houston, TX 77062. It lists its phone number of

281-286-5864 (click image left to enlarge). FOAVC called the "business

" number of the Commission during the regular work week and during what

is

normally considered regular business hours (8 a.m. to 5 p.m.). Instead

of a person answering the phone, FOAVC reached what appears to be a

private message machine. The machine's message

identified itself as "Jeff"

followed by

an apology that "Jeff and Jan could not get to the phone." No mention

of the phone number being the official office phone for the Compact for

a Balanced Budget Commission was made in the message. Assuming the

phone number is accurate it appears to be the phone number for a

private residence rather than the official office phone of an

"interstate agency" known as the Compact for a Balanced Budget

Commission. Unlike other "interstate" agencies the Commission

does not appear to have regular office

hours as none are posted

on the Commission website.

Other

facts do not support the "Commission" as an actual

"interstate" governmental agency as claimed by Compact for America. As an "interstate" governmental agency it is reasonable

to expect a certain level of professional business performance as is

typical with all governmental agencies including "interstate" agencies. The Commission

lists its address as 2323 Clear Lake City

Blvd., Suite 180-190, Houston, TX 77062. It lists its phone number of

281-286-5864 (click image left to enlarge). FOAVC called the "business

" number of the Commission during the regular work week and during what

is

normally considered regular business hours (8 a.m. to 5 p.m.). Instead

of a person answering the phone, FOAVC reached what appears to be a

private message machine. The machine's message

identified itself as "Jeff"

followed by

an apology that "Jeff and Jan could not get to the phone." No mention

of the phone number being the official office phone for the Compact for

a Balanced Budget Commission was made in the message. Assuming the

phone number is accurate it appears to be the phone number for a

private residence rather than the official office phone of an

"interstate agency" known as the Compact for a Balanced Budget

Commission. Unlike other "interstate" agencies the Commission

does not appear to have regular office

hours as none are posted

on the Commission website. As discussed above, the address 2323 Clear Lake City Blvd., Suite 180-190, Houston, TX 77062 is a UPS Mailing Box used

by Compact for America Educational Foundation Inc., and Compact for

America Inc.,(Action). The Clear Lake City Blvd., address is confirmed

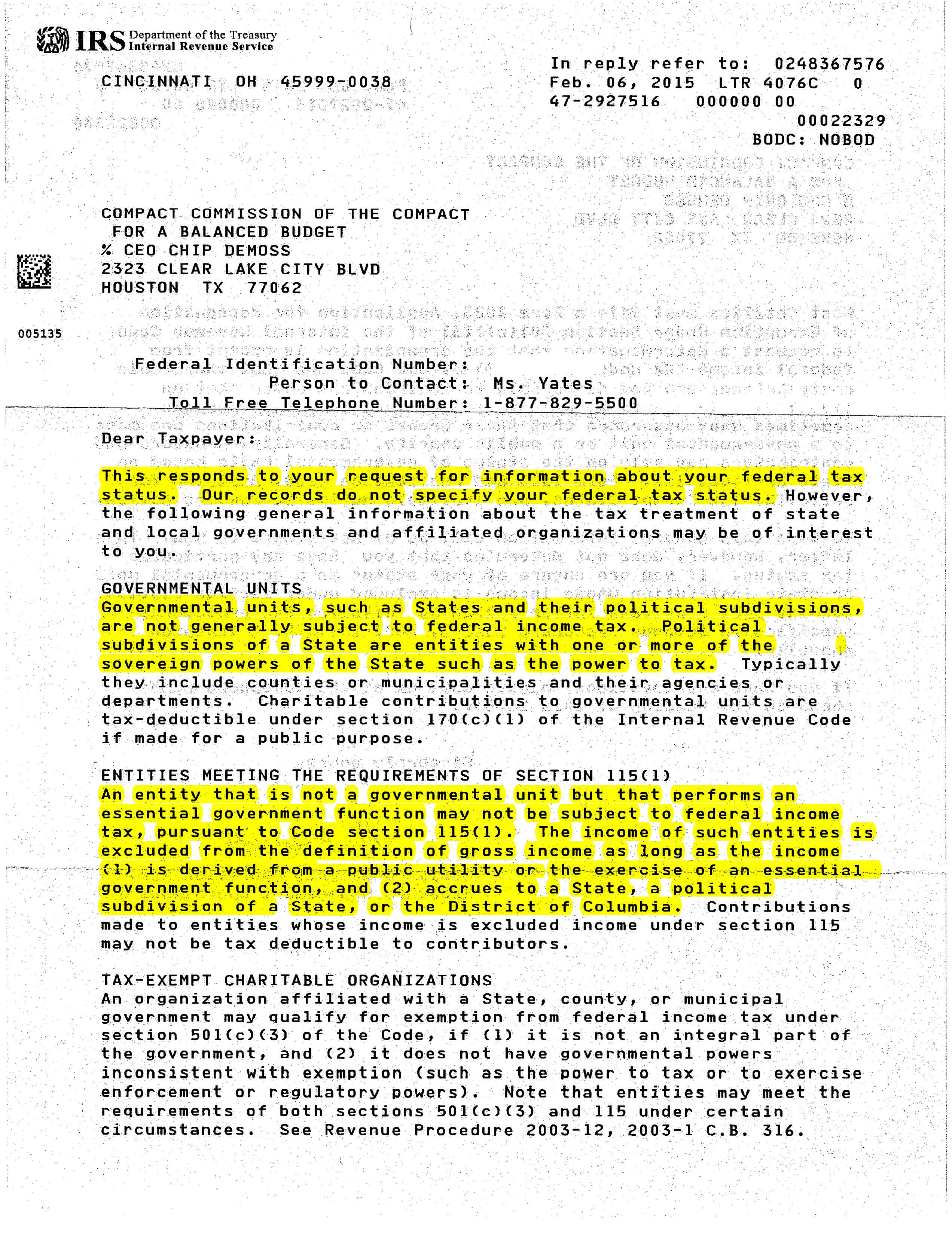

by the 2015 Income Tax Form of Compact for America Educational