"You really don't need people to do this. You just need control over the legislature and you need money, and we have both."

Subjects Inside: Article

V Applications

FAQ,

Application Counts By

Congress, Articles,

AVC Legislative Report, CRS Reports,

Convention of State, Compact for America, COS, CFA--Which States are Which?, The Historic Record of COS, COS, CFA Laws, COS Articles, CRS Reports on COS/CFA, COS, CFA Financial Records, CFA Financials, COS Financials, COS/CFA Financial Conclusions, John

Birch Society, Con-Con, Runaway

Convention, Who Called the Convention, Congressional

Vote on a "Runaway" Convention, "Obey

the Constitution, Only Two More States", Illegal Rescissions, The Phony Burger Letter, The

Madison Letter, Fotheringham Exchange, JBS Articles, Sibley

Lawsuit, General Interest, Article V.org,

Robert Natelson, History

of Article V, Counting the Applications, The Numeric Count History, Congressional Decision of May 5, 1789,

Development of Article V, The Committee of the Whole, The Committee of Detail, August 30, September 10, Committee of Style, September 15, Official Government Documents,

History of FOAVC, Founders,

Audio/Visual,

Links,

Contact

Us, Legal

Page, 14th Amendment, The Electoral Process, Packets,

Definitions,

Numeric, (

Applications grouped by numeric count as required by the Constitution),

Same Subject (Applications grouped by amendment subject, not required by the Constitution for a convention call).

CFA 2013 Tax Return

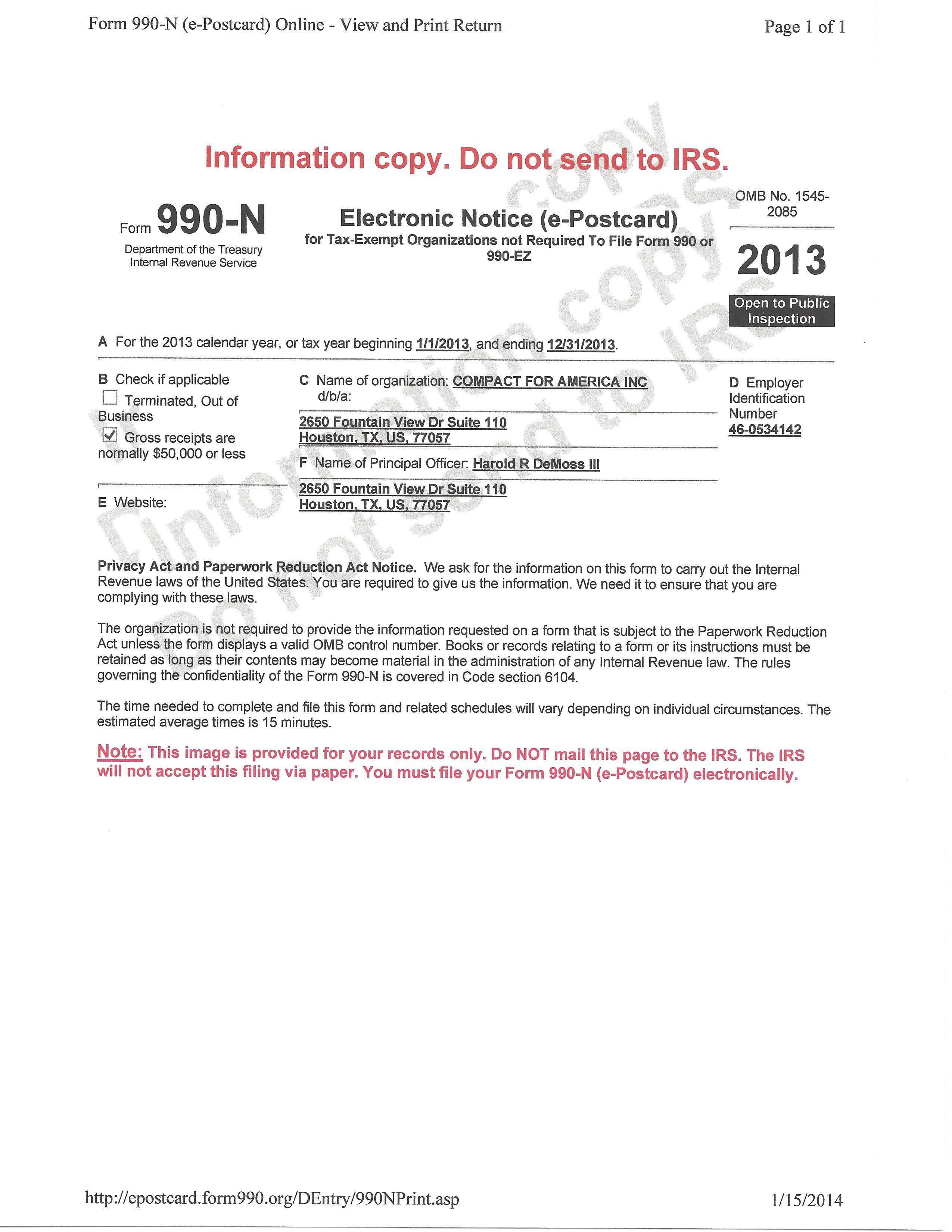

As

it has in tax year 2012 Compact for America Inc filed a

990-N tax form with the Internal Revenue Service for tax year 2013

(Click image left to enlarge). Unlike the 2012 990-N tax form however

the date of transmission to the IRS was not included. It can only be

surmised therefore the tax information was transmitted to the IRS on

time and the form was accepted by the Internal Revenue Service as

the income tax return for Compact for America for tax year 2013.

As

it has in tax year 2012 Compact for America Inc filed a

990-N tax form with the Internal Revenue Service for tax year 2013

(Click image left to enlarge). Unlike the 2012 990-N tax form however

the date of transmission to the IRS was not included. It can only be

surmised therefore the tax information was transmitted to the IRS on

time and the form was accepted by the Internal Revenue Service as

the income tax return for Compact for America for tax year 2013.

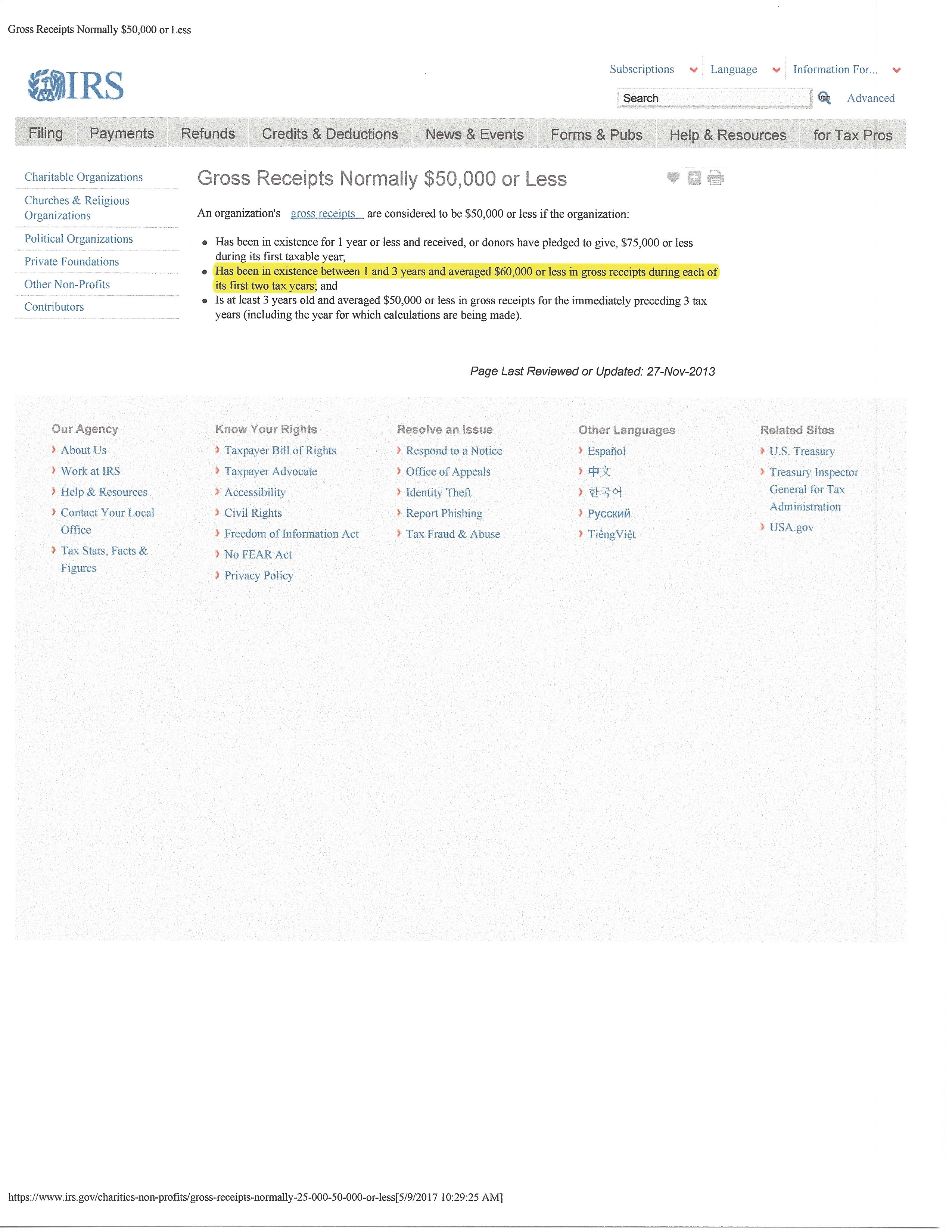

Compact

for America again reported its gross receipts were under $50,000 or

less for the tax year 2013. The IRS Regulation defining "gross

receipts" changes for an organization using the 990-N tax form. In the

first year of existence Compact for America was allowed to "receive, or

donors have pledged to give $75,000 or less during its first taxable

year. However when the organization has been existence "between 1 and 3

years and averaged $60,000 or less in gross receipts during each of the

first two tax years" then it is qualified to claim gross receipts as

$50,000 or less. Based on this regulation it can be stated the total

gross

income of Compact for America for its first two years of existence did

not exceed $120,000. According to IRS Regulations, "Gross receipts are

the total amounts the organization received from all sources during its

annual accounting period, without subtracting any costs or expenses."

As CFA filed a 990-N form for the tax years 2012 and 2013 there is no

public record of the organization's costs or expenditures for those tax

years.

Compact

for America again reported its gross receipts were under $50,000 or

less for the tax year 2013. The IRS Regulation defining "gross

receipts" changes for an organization using the 990-N tax form. In the

first year of existence Compact for America was allowed to "receive, or

donors have pledged to give $75,000 or less during its first taxable

year. However when the organization has been existence "between 1 and 3

years and averaged $60,000 or less in gross receipts during each of the

first two tax years" then it is qualified to claim gross receipts as

$50,000 or less. Based on this regulation it can be stated the total

gross

income of Compact for America for its first two years of existence did

not exceed $120,000. According to IRS Regulations, "Gross receipts are

the total amounts the organization received from all sources during its

annual accounting period, without subtracting any costs or expenses."

As CFA filed a 990-N form for the tax years 2012 and 2013 there is no

public record of the organization's costs or expenditures for those tax

years.

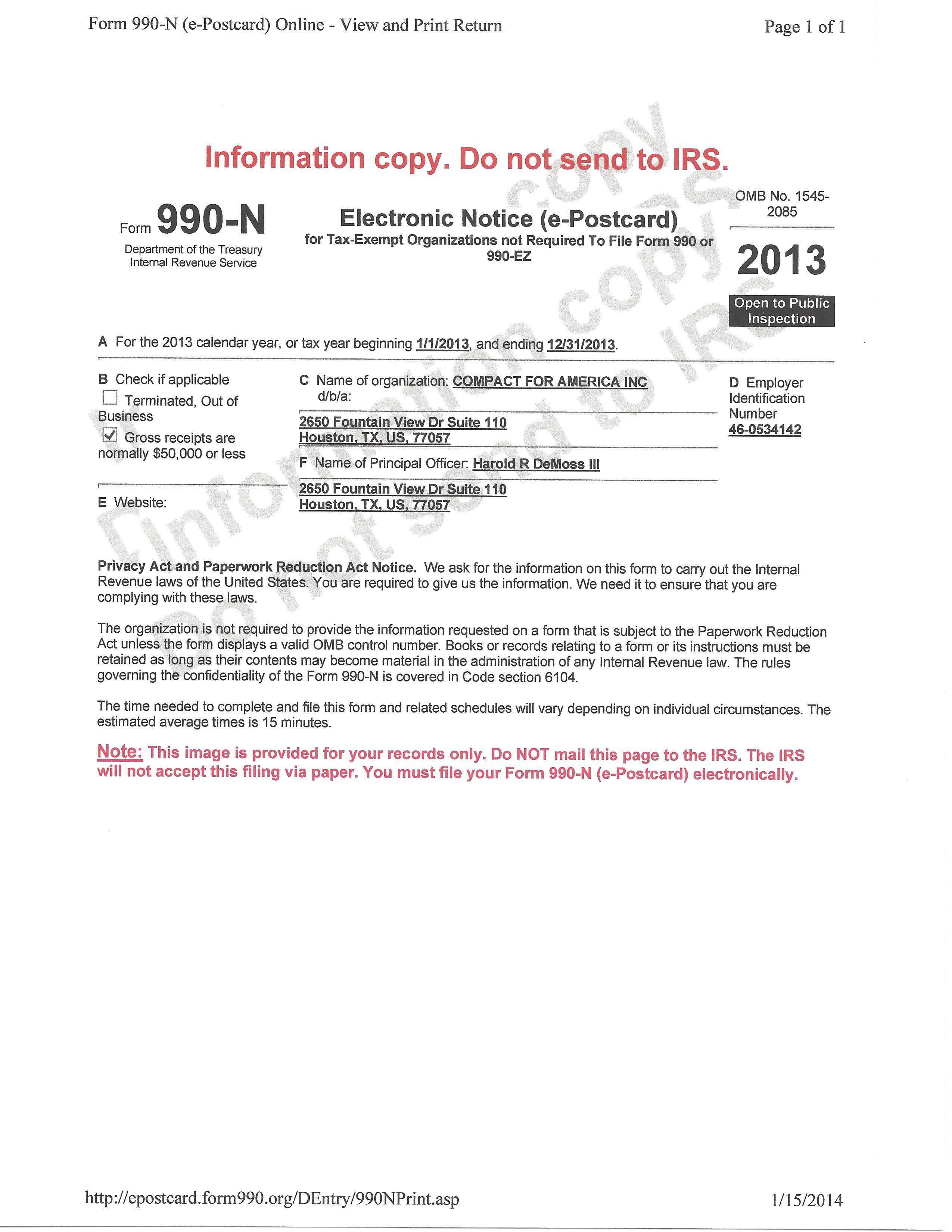

As

it has in tax year 2012 Compact for America Inc filed a

990-N tax form with the Internal Revenue Service for tax year 2013

(Click image left to enlarge). Unlike the 2012 990-N tax form however

the date of transmission to the IRS was not included. It can only be

surmised therefore the tax information was transmitted to the IRS on

time and the form was accepted by the Internal Revenue Service as

the income tax return for Compact for America for tax year 2013.

As

it has in tax year 2012 Compact for America Inc filed a

990-N tax form with the Internal Revenue Service for tax year 2013

(Click image left to enlarge). Unlike the 2012 990-N tax form however

the date of transmission to the IRS was not included. It can only be

surmised therefore the tax information was transmitted to the IRS on

time and the form was accepted by the Internal Revenue Service as

the income tax return for Compact for America for tax year 2013.  Compact

for America again reported its gross receipts were under $50,000 or

less for the tax year 2013. The IRS Regulation defining "gross

receipts" changes for an organization using the 990-N tax form. In the

first year of existence Compact for America was allowed to "receive, or

donors have pledged to give $75,000 or less during its first taxable

year. However when the organization has been existence "between 1 and 3

years and averaged $60,000 or less in gross receipts during each of the

first two tax years" then it is qualified to claim gross receipts as

$50,000 or less. Based on this regulation it can be stated the total

gross

income of Compact for America for its first two years of existence did

not exceed $120,000. According to IRS Regulations, "Gross receipts are

the total amounts the organization received from all sources during its

annual accounting period, without subtracting any costs or expenses."

As CFA filed a 990-N form for the tax years 2012 and 2013 there is no

public record of the organization's costs or expenditures for those tax

years.

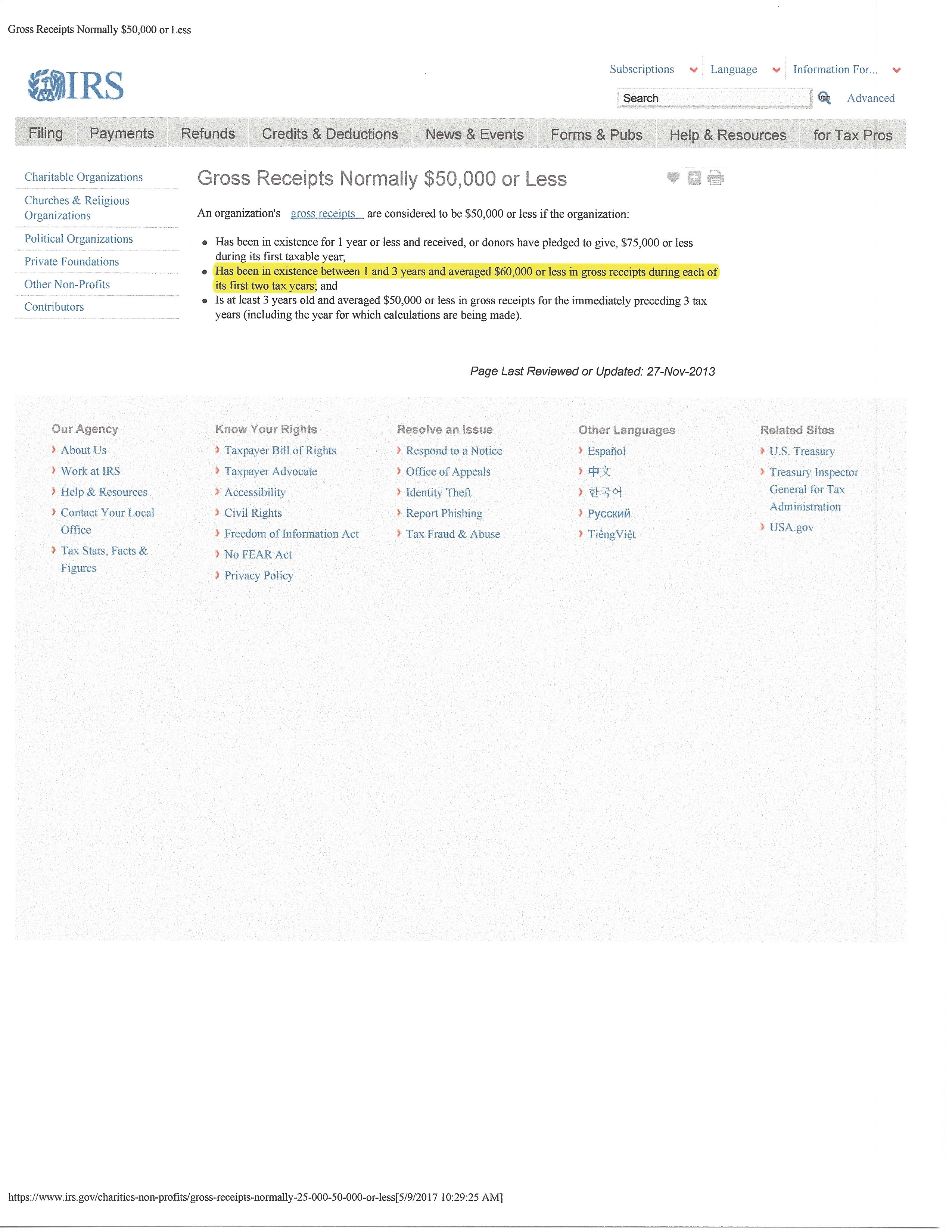

Compact

for America again reported its gross receipts were under $50,000 or

less for the tax year 2013. The IRS Regulation defining "gross

receipts" changes for an organization using the 990-N tax form. In the

first year of existence Compact for America was allowed to "receive, or

donors have pledged to give $75,000 or less during its first taxable

year. However when the organization has been existence "between 1 and 3

years and averaged $60,000 or less in gross receipts during each of the

first two tax years" then it is qualified to claim gross receipts as

$50,000 or less. Based on this regulation it can be stated the total

gross

income of Compact for America for its first two years of existence did

not exceed $120,000. According to IRS Regulations, "Gross receipts are

the total amounts the organization received from all sources during its

annual accounting period, without subtracting any costs or expenses."

As CFA filed a 990-N form for the tax years 2012 and 2013 there is no

public record of the organization's costs or expenditures for those tax

years.