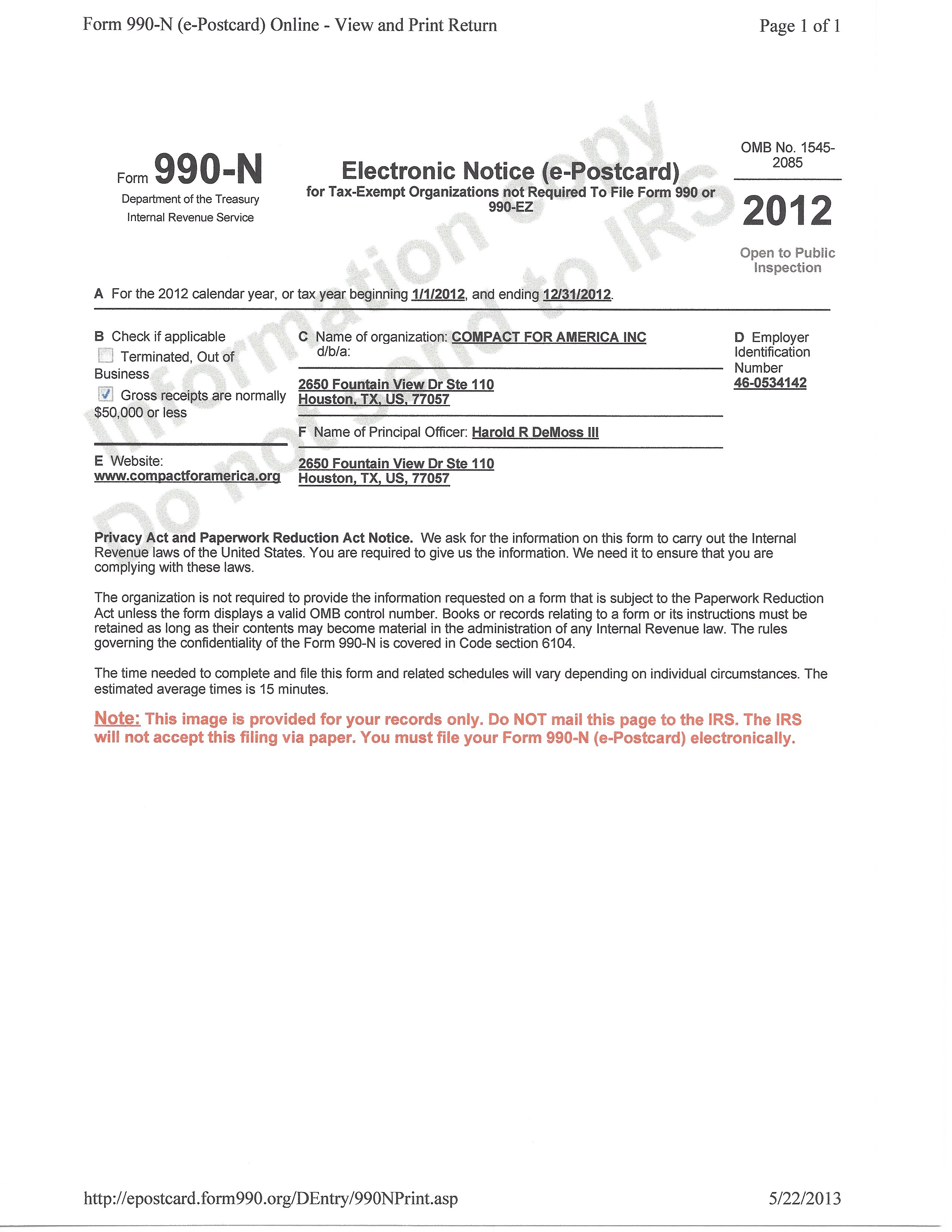

In

tax year 2012 Compact for America Inc., filed a

990-N tax form with the Internal Revenue Service. Form 990-N is used

exclusively by tax-exempt organizations not required under IRS

Regulations to file Tax Form 990 or 990-EZ to file their income tax

information with the IRS. IRS

Regulations allow tax-exempt organizations eligible to file Form 990-N

the option to file a Form 990 or Form 990-EZ. According to the

E-Postcard attached to it, the form was sent to the IRS on May 22,

2013. The form shows the Employer Identification Number (EIN) of

46-0534142 which is used in all tax filings by CFA. The form lists the

address of the filer as 2650 Fountain View

Drive, Ste 110, Houston, TX, 77057. The principle officer listed is

Harold R. DeMoss III.

In

tax year 2012 Compact for America Inc., filed a

990-N tax form with the Internal Revenue Service. Form 990-N is used

exclusively by tax-exempt organizations not required under IRS

Regulations to file Tax Form 990 or 990-EZ to file their income tax

information with the IRS. IRS

Regulations allow tax-exempt organizations eligible to file Form 990-N

the option to file a Form 990 or Form 990-EZ. According to the

E-Postcard attached to it, the form was sent to the IRS on May 22,

2013. The form shows the Employer Identification Number (EIN) of

46-0534142 which is used in all tax filings by CFA. The form lists the

address of the filer as 2650 Fountain View

Drive, Ste 110, Houston, TX, 77057. The principle officer listed is

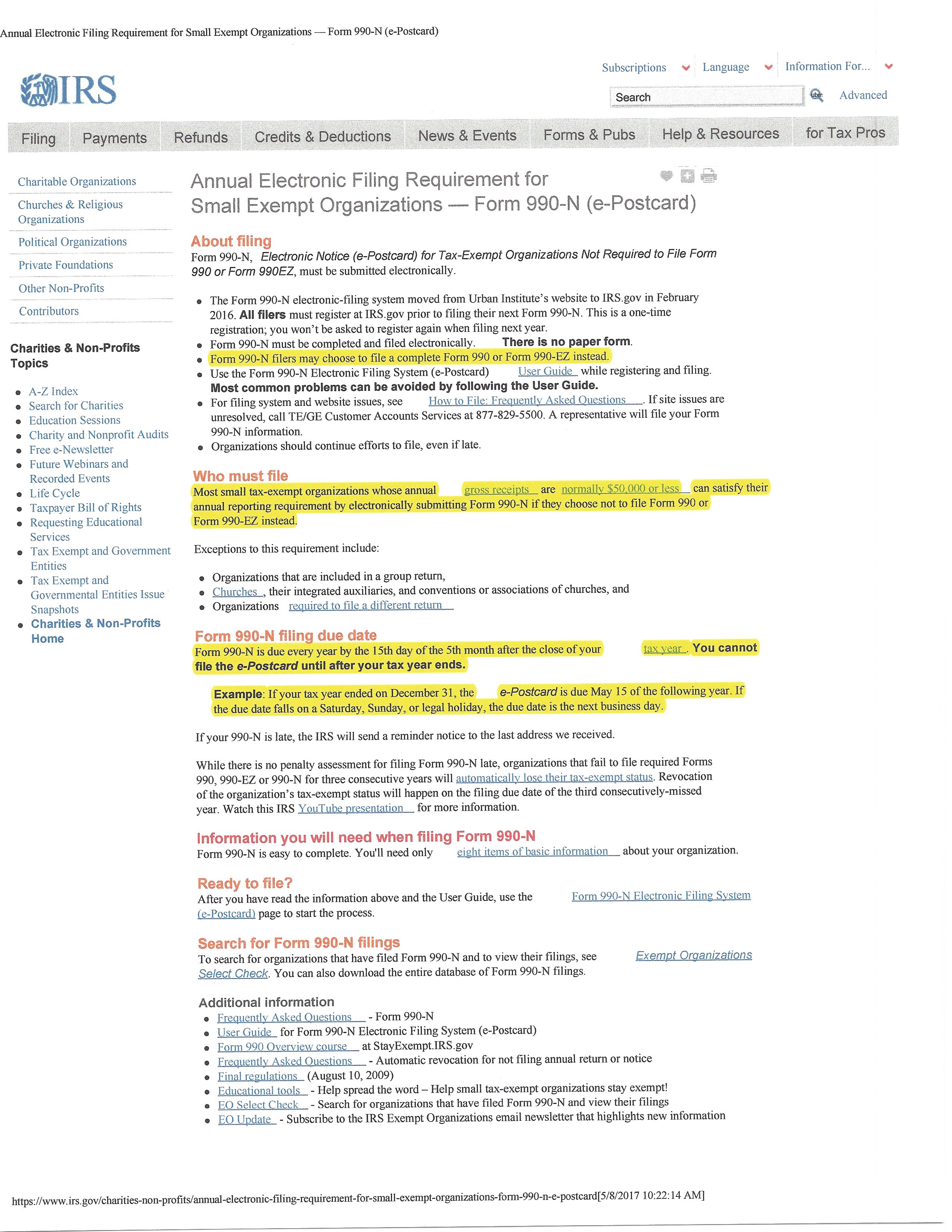

Harold R. DeMoss III.  IRS Regulations require a tax-exempt organization intending to

file a 990-N form to file it by the 15th day of the fifth month following

the end of the fiscal year of the tax-exempt organization. According to

the email of Mr. DeMoss,

the fiscal year for Compact for America ends

on December 31 of each year. May 15, 2013 fell on a Wednesday.

According to the email CFA normally requests a three-month extension to

file its income tax forms. This moves the filing date to August 15.

There is

no record showing CFA requested an extension of time for filing its

income tax return for the year 2012. Thus, according to the public

information released by Compact for America, CFA filed its income tax

form one week late. However, according to IRS Regulations there is no

penalty assessment for filing a 990-N form late unless it occurs in

three consecutive years. If this occurs, the organization automatically

loses it tax-exempt status.

IRS Regulations require a tax-exempt organization intending to

file a 990-N form to file it by the 15th day of the fifth month following

the end of the fiscal year of the tax-exempt organization. According to

the email of Mr. DeMoss,

the fiscal year for Compact for America ends

on December 31 of each year. May 15, 2013 fell on a Wednesday.

According to the email CFA normally requests a three-month extension to

file its income tax forms. This moves the filing date to August 15.

There is

no record showing CFA requested an extension of time for filing its

income tax return for the year 2012. Thus, according to the public

information released by Compact for America, CFA filed its income tax

form one week late. However, according to IRS Regulations there is no

penalty assessment for filing a 990-N form late unless it occurs in

three consecutive years. If this occurs, the organization automatically

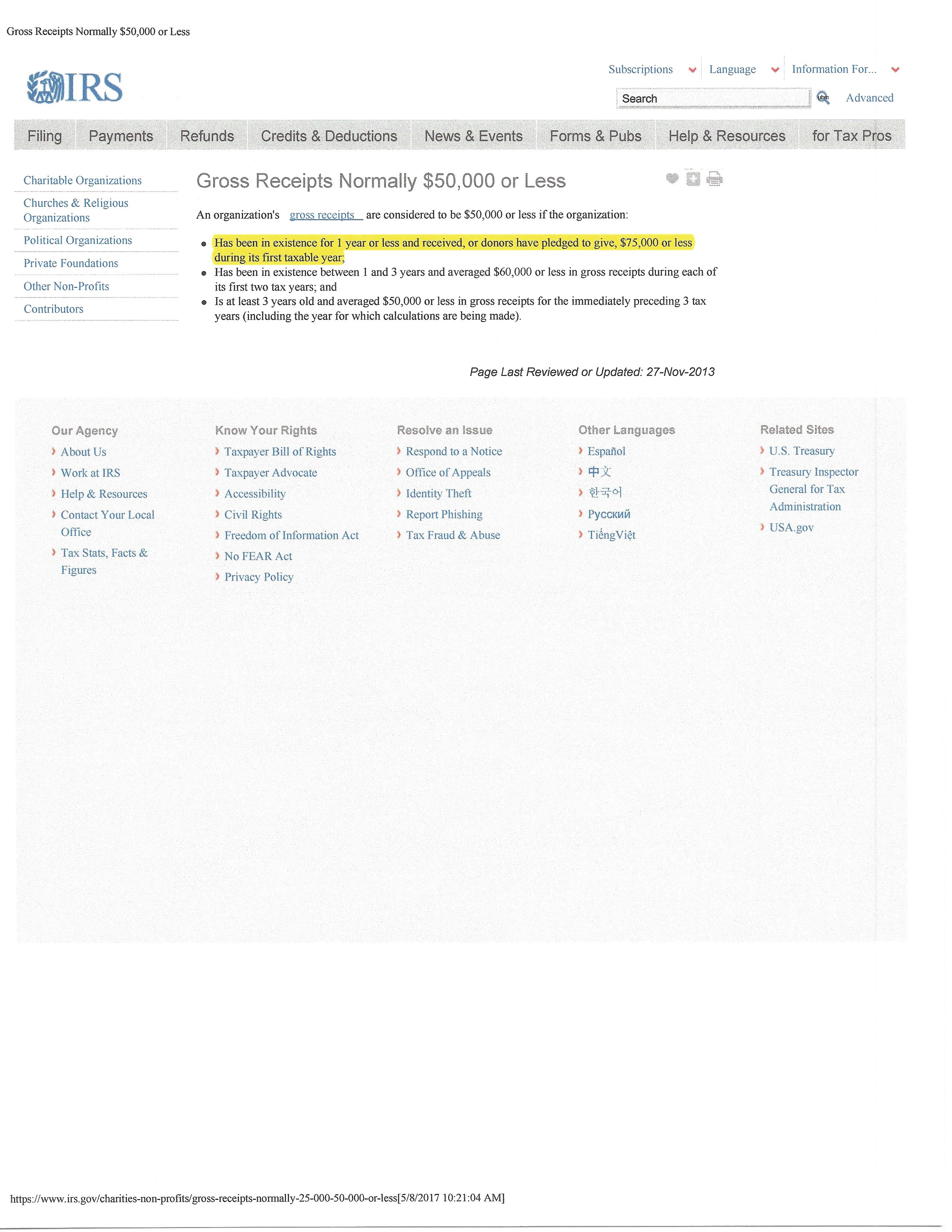

loses it tax-exempt status.  The

box stating "Gross receipts are normally $50,000 or

less" was checked in the Compact for America 2012 990-N tax form.

IRS Regulations specify three

conditions under which "gross receipts" for an organization may be

considered to be $50,000 or

less. As Compact for America was formed in 2012 the first condition

applies which is the organization "has been in existence for 1 year or

less and received, or donors have pledged to give, $75,000 or less

during its first taxable year." Therefore it can be stated according to

the 2012 tax records CFA had a total income not in excess of $75,000

from unknown donors. Form 990-N does not provide details of

donations or expenses for tax-exempt organizations.

The

box stating "Gross receipts are normally $50,000 or

less" was checked in the Compact for America 2012 990-N tax form.

IRS Regulations specify three

conditions under which "gross receipts" for an organization may be

considered to be $50,000 or

less. As Compact for America was formed in 2012 the first condition

applies which is the organization "has been in existence for 1 year or

less and received, or donors have pledged to give, $75,000 or less

during its first taxable year." Therefore it can be stated according to

the 2012 tax records CFA had a total income not in excess of $75,000

from unknown donors. Form 990-N does not provide details of

donations or expenses for tax-exempt organizations.

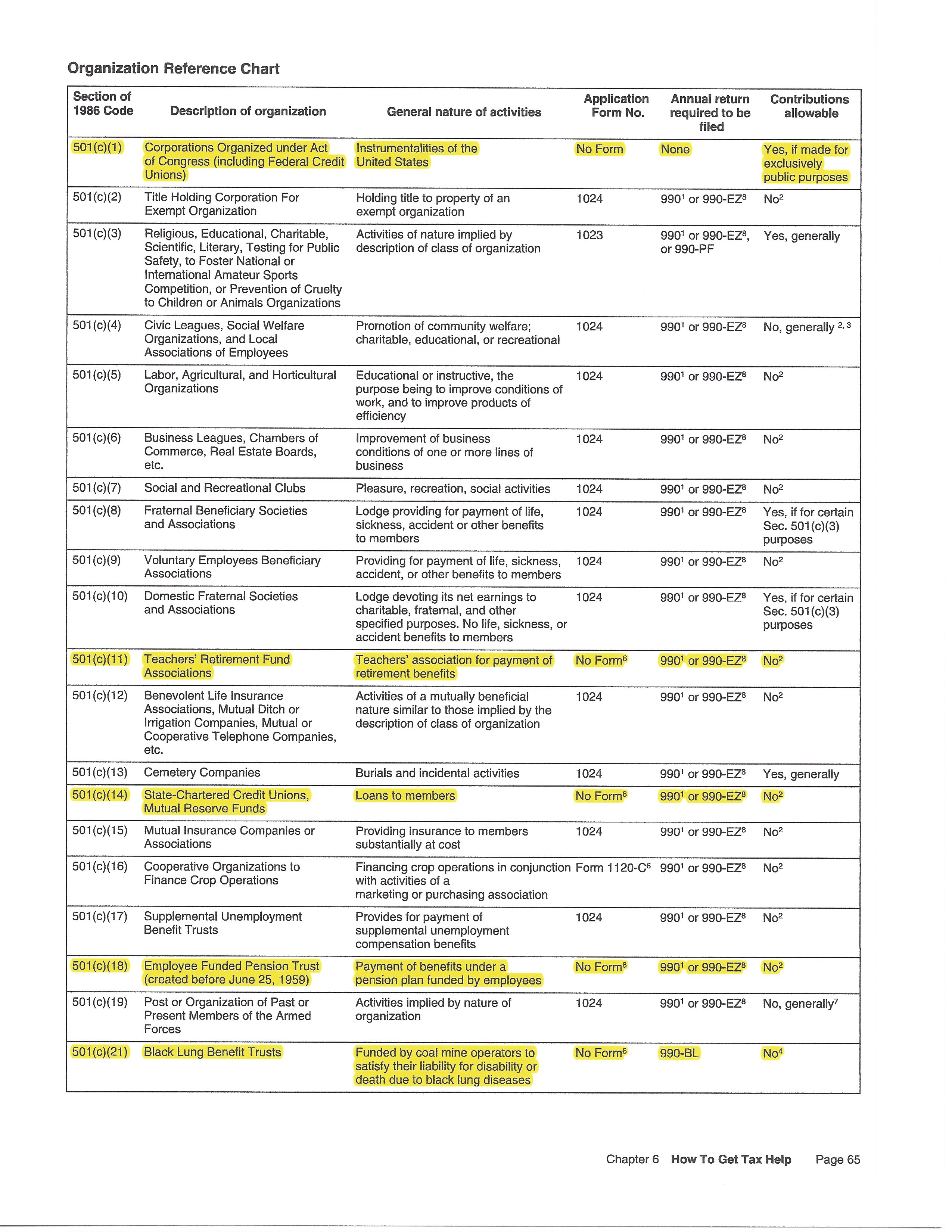

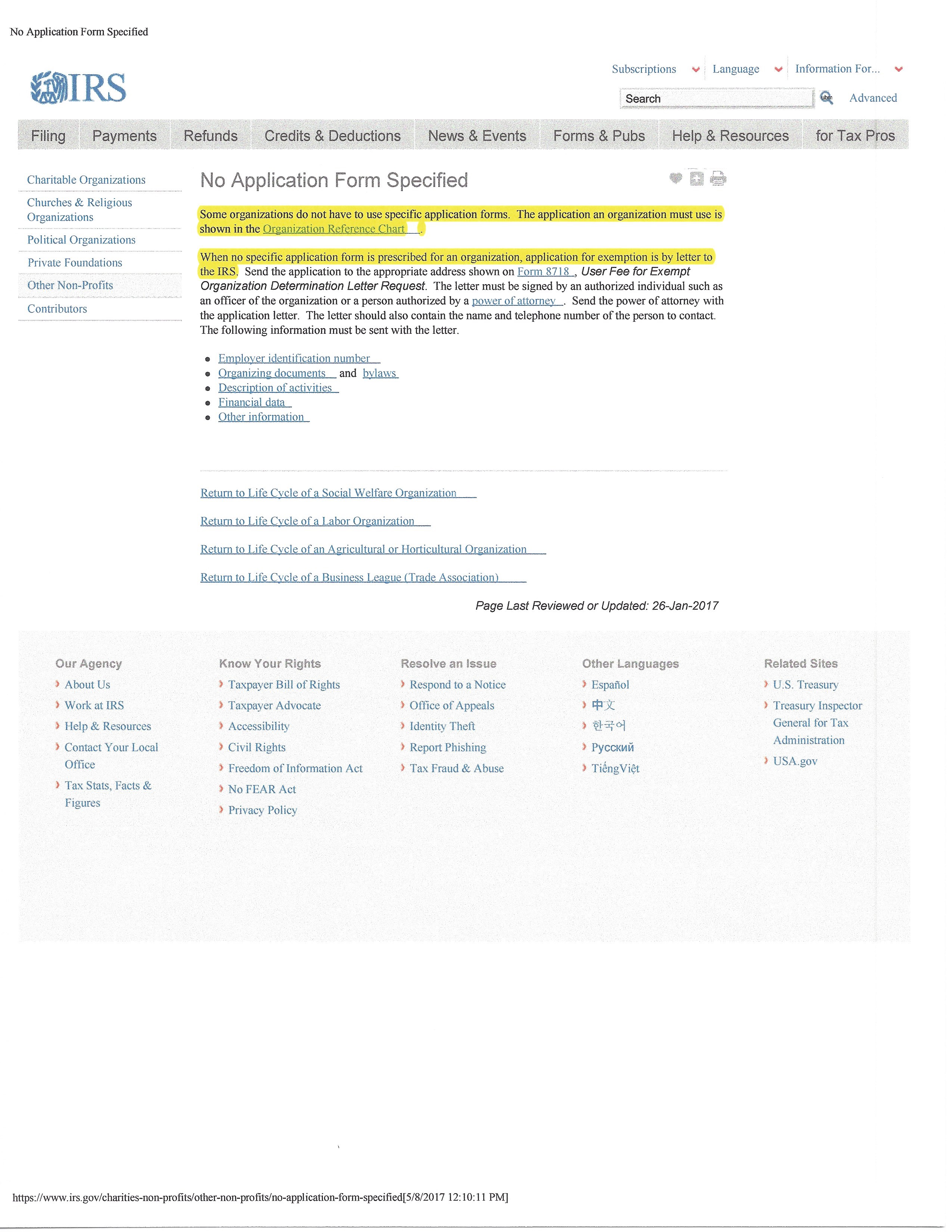

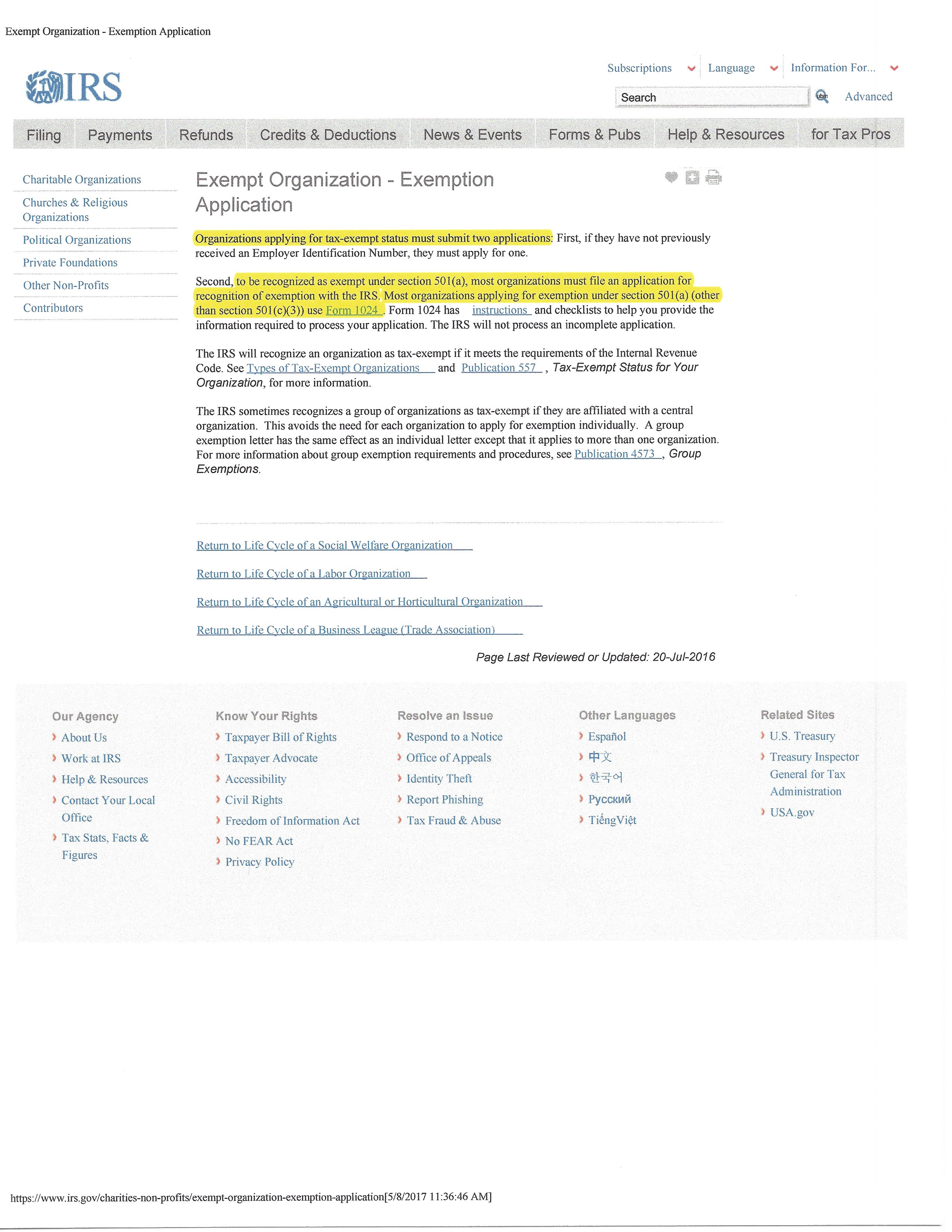

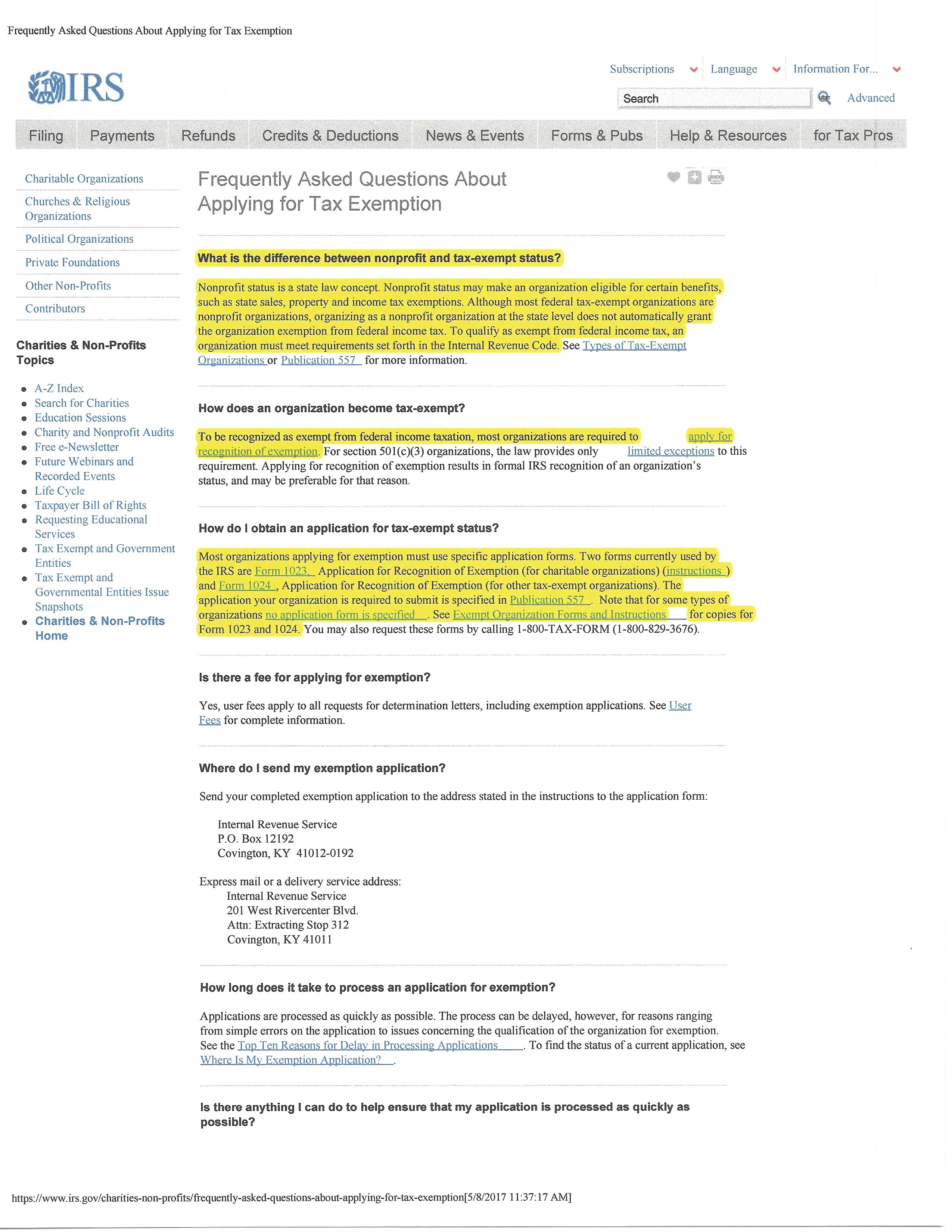

The Internal Revenue Service explicitly states under what conditions an organization shall become a tax exempt organization (Click image near right to enlarge). There are some exceptions for filing for tax exempt

status, none of which apply in this case (Click image 2nd right to

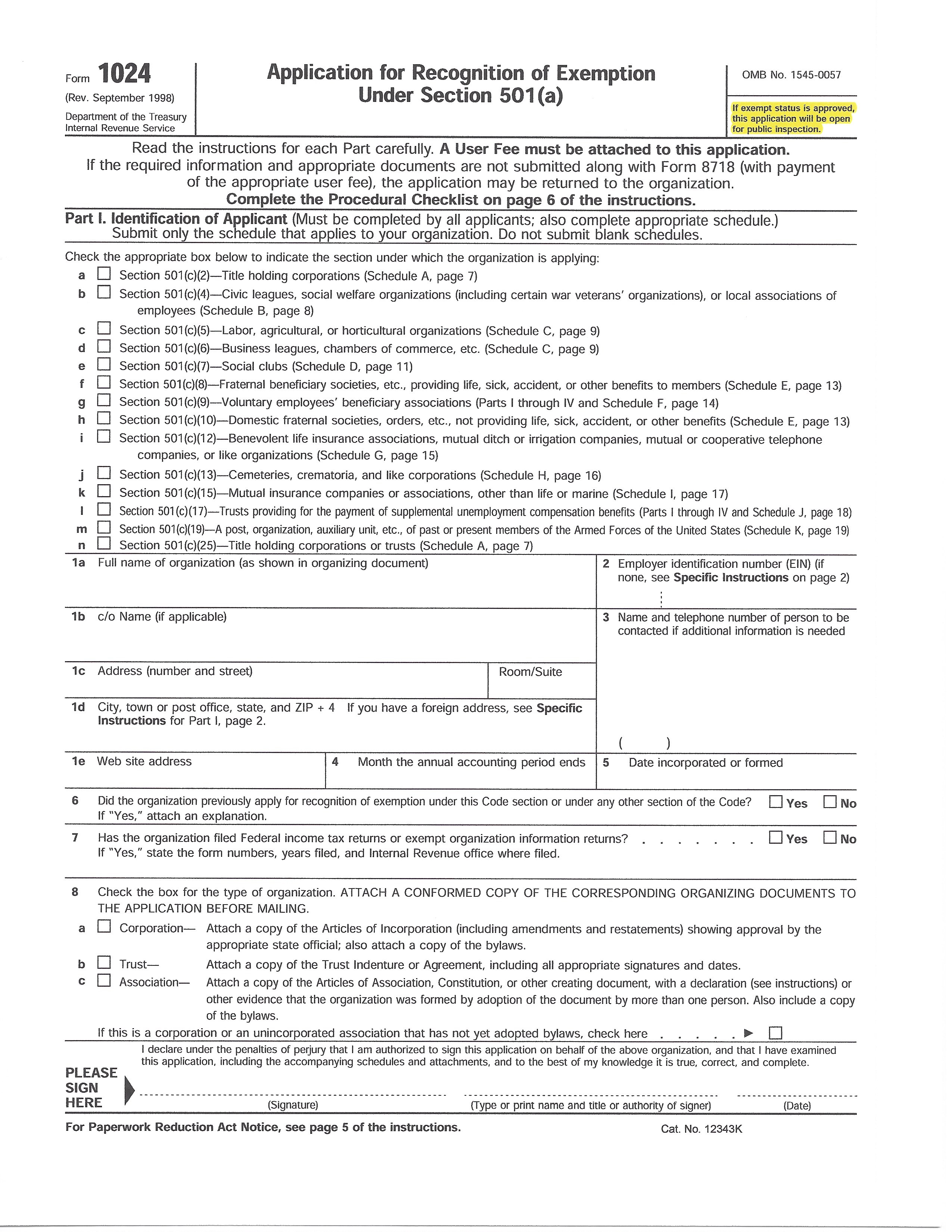

enlarge). An IRS form shows which IRS application forms are required

for a specific kind of organization to file as a tax-exempt organization (Click image 3rd right to enlarge).

The Internal Revenue Service explicitly states under what conditions an organization shall become a tax exempt organization (Click image near right to enlarge). There are some exceptions for filing for tax exempt

status, none of which apply in this case (Click image 2nd right to

enlarge). An IRS form shows which IRS application forms are required

for a specific kind of organization to file as a tax-exempt organization (Click image 3rd right to enlarge).

In

addition, the IRS provides specific procedures on how an organization

applies for tax exempt status (Click image far left to enlarge).

Federal law is emphatic: while an organization may be a "non-profit"

organization under state law, this does not qualify it to be a

"tax-exempt" organization under federal tax law. For an organization to

be considered tax-exempt it must satisfy federal tax regulations

granting tax exemption. If an organization does not satisfy these

regulations, it is not considered a tax-exempt organization under

federal tax law.

In

addition, the IRS provides specific procedures on how an organization

applies for tax exempt status (Click image far left to enlarge).

Federal law is emphatic: while an organization may be a "non-profit"

organization under state law, this does not qualify it to be a

"tax-exempt" organization under federal tax law. For an organization to

be considered tax-exempt it must satisfy federal tax regulations

granting tax exemption. If an organization does not satisfy these

regulations, it is not considered a tax-exempt organization under

federal tax law."To be recognized as exempt under section 501(a), most organizations must file an application for recognition of exemption with the IRS. Most organization applying for exemption under section 501(a) (other than section 501(c)(3) use Form 1024." (Click image near right to enlarge). As stated in the form, if such exemption is approved by the IRS, the form becomes a matter of public record.

The email of Mr. DeMoss states clearly 501(c)(3) tax-exempt status for Compact for America Educational Foundation Inc., was granted by the Internal Revenue Service on October 1, 2014. A confirmation letter from the IRS available on the CFA website confirms the date of approval for tax-exempt status for Compact for America as October 1, 2014. Another confirmation letter confirms that Compact for America(Action) received 501(c)(4) approval on October 25, 2013.

According to IRS regulations while Compact for America did not actually file for tax exempt status until 2013, on recognition by the IRS of tax exempt status, the status was extended back to the date the organization was created. Therefore, even though Compact for America had not yet filed for tax exempt status in 2012, the IRS regulations allowed them to use the 990 forms to report their taxes.

Page Last Updated: 6 AUGUST 2017